[ad_1]

That is an opinion editorial by Bitcoms, a Bitcoin-focused author and licensed accountant.

With mainstream monetary administration titans similar to BlackRock, Fidelity and Vanguard all legitimizing BTC as a monetary asset by way of their curiosity in providing associated merchandise to shoppers, the “massive cash” worldwide could be poised to extend its publicity to bitcoin. These vital traders might not but see the liberating, world-improving, hard-money features of the know-how that I see, however they’re prone to have an effect on bitcoin as a retailer of worth all the identical.

And, if something, I consider the possible worth impact of great quantities of capital being interested in bitcoin is underestimated by most Bitcoiners. It’s now widespread to explain bitcoin’s potential worth ceiling as “everything divided by 21 million” — a reference to all saved worth divided by the overall potential provide of bitcoin. However, for my part, an inexpensive heuristic for predicting bitcoin’s worth is “every thing divided by 7 million” (the place “every thing” is the overall reallocated of capital to bitcoin, nonetheless excessive which may be). This implies, for instance, that bitcoin may hit $1 million with solely one-third of the redirected capital generally considered wanted.

To indicate why this can be a extra useful yardstick, I’ll broaden on some present methods of estimating newly-allocated capital’s impact on bitcoin’s worth, adjusting the outcomes for what I see as three important however uncared for elements.

Present Instruments For Predicting Bitcoin’s Value

For an preliminary bitcoin worth projection, we’ll use two present instruments, each born of deep analysis and thorough evaluation: a framework proposed by Onramp COO Jesse Myers (also known as Croesus) and a mannequin produced by Swan CIO Alpha Zeta.

For our instance situation, we’ll presume $20 trillion of funding capital flowing out of conventional belongings and into bitcoin (the particular quantity isn’t too essential, as we’ll flex the numbers up and down later). For the sake of simplicity and comparability, our instance situation is timeframe agnostic (so, all figures are in right this moment’s {dollars}).

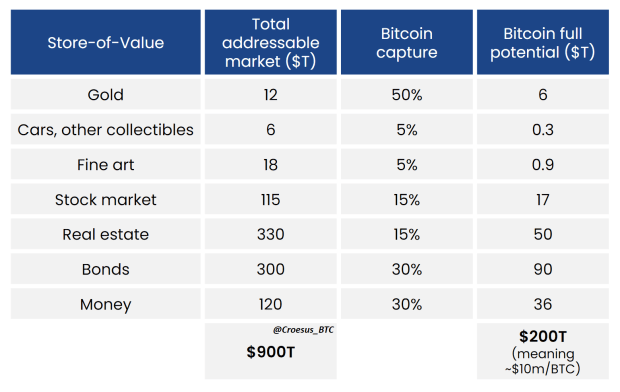

Myers’ framework, printed earlier this yr, posits a most potential bitcoin market capitalization of $200 trillion, estimated by capturing that quantity from his personal $900 trillion estimate of the overall of present store-of-value belongings and assuming bitcoin will seize some proportion of every class.

As indicated within the backside proper of the above desk, the framework suggests a most potential bitcoin seize of $200 trillion, resulting in an approximate bitcoin worth of $10 million ($200 trillion divided by about 20 million equals about $10 million per BTC.)

In his commentary, Myers means that “you’ll be able to run your personal numbers right here for the ‘Bitcoin seize’ column and see what you provide you with.” So, if we scale every thing down by an order of magnitude for our extra modest bitcoin seize of $20 trillion (roughly 2.2% of Myers’ $900 trillion “whole addressable market”), the identical arithmetic offers us an anticipated worth of about $1 million per BTC.

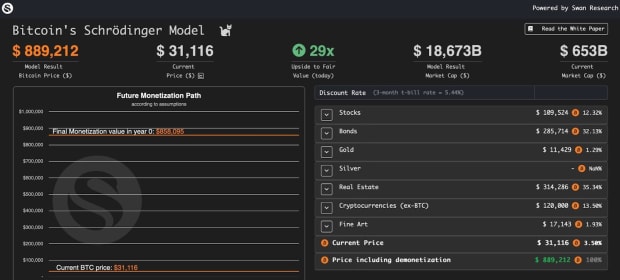

In the meantime, Alpha Zeta’s model is a complicated, interactive software with a configurable set of enter parameters, which (with apologies to its creator) I crudely manipulated to approximate the values we used with Myers’ framework. As a result of the software permits just for spherical percentages, I modeled Bitcoin’s asset seize at solely 2% (not the roughly 2.2% used with Myers’ mannequin) of $900 trillion. This leads to precisely what I might have anticipated: the same, however barely decrease, BTC worth projection of round $900,000 per coin.

For the sake of coping with spherical numbers, let’s say that in capturing about $20 trillion in international funding capital, each instruments would recommend an anticipated bitcoin greenback worth of about $1 million. These instruments are usually not solely logical, but in addition in keeping with one another. So, what may they miss?

Missed Issue One: Misplaced Bitcoin

Each instruments appear to base their worth predictions on a reallocated greenback worth divided by a tough whole variety of bitcoin in concern (about 20 million). Nonetheless, this ignores the truth that some issued bitcoins are unavailable.

First, take into account misplaced cash. The variety of bitcoin which were misplaced is inconceivable to quantify with precision, but it surely has been estimated at practically 4 million in a 2020 report by Chainalysis. Cane Island Digital’s 2020 report “There Will Never Be More Than 14 Million Bitcoins” suggests a better variety of about 5.4 million misplaced cash. I sought a 3rd opinion from main on-chain analyst Checkmate for this text, who kindly shared an preliminary estimate of “round 3.942 million BTC.”

Utilizing a median of those three information factors, we are able to justifiably posit that, of the 19.4 million bitcoin issued up to now, round 4.4 million are misplaced, leaving 15 million accessible by their homeowners. That is considerably lower than the roughly 20 million usually utilized in bitcoin pricing fashions.

Missed Issue Two: Hardcore HODLers

Second, take into account what quantity of this accessible 15 million bitcoin may by no means be offered for fiat. The obvious existence of “hardcore HODLers” — true believers who’re unwilling to sell at any price — implies that the final aphorism that “everybody has their worth” might not essentially apply to Bitcoin.

Probably-useful analysis on this missed issue is a Glassnode report from 2020, which concluded that “14.5 million BTC may be labeled as being illiquid.” This was constructed upon by Rational Root in his 2023 “HODL Model,” which hypothesizes that by “2024, the illiquid provide… might be… 14.3 million bitcoin.” Subtracting our earlier estimate of 4.4 million misplaced cash from this whole illiquid provide determine (which incorporates misplaced bitcoin), these sources recommend that about 10 million of the roughly 15 million accessible bitcoin are on this “illiquid” class, i.e., their HODLers are unwilling to promote.

However quantifying what number of of these 10 million illiquid cash might be “hardcore HODL’d” by the diamond handed within the face of unprecedented bitcoin worth appreciation is absolutely past the bounds of research and firmly within the realms of conjecture. It appears completely rational to me to count on many present HODLers to half with no less than a portion of their stack if the fiat worth rises to new all-time highs. Recognizing that any “guesstimate” is extra smart than ignoring this phenomenon altogether, I’m going to suppose simply half of these 10 million illiquid bitcoin might be “hardcore HODL’d” as the worth goes up.

The Value Impact Of Unavailable Cash

So, as soon as we’ve allowed for 4.4 million misplaced and 5 million “hardcore HODL’d” bitcoin, that leaves round 10 million cash accessible for the $20 trillion of captured worth in our instance situation. $20 trillion divided by 10 million offers us a $2 million imply worth paid per BTC.

That imply of $2 million is double the valuation instruments’ unadjusted worth estimate of $1 million. So, for me, at this level an inexpensive heuristic for gauging the imply bitcoin worth is: “every thing divided by 10 million” (the place “every thing” is the overall fiat newly allotted to bitcoin, nonetheless a lot which may be).

Missed Issue Three: Volatility

However $2 million is the imply worth in our instance situation, and the worth at any given time throughout bitcoin’s absorption of the $20 trillion might be considerably greater or decrease. So, we additionally have to predict the vary inside which the worth may transfer.

Utilizing historical past as a information, we see that the dollar-BTC worth has develop into much less risky as bitcoin has grown up from toddler to a young person, with the ratio of the major USD price tops to subsequent bottoms shrinking as follows:

Presuming that this development towards decrease volatility continues, over the subsequent few years we’d plausibly count on a high-to-low ratio of round three. Towards our instance situation’s longer-term shifting common worth of $2 million, that may translate to short-term lows of about $1 million and short-lived highs of about $3 million.

That top of $3 million is triple the valuation instruments’ unadjusted worth estimate of $1 million. So, for me, an inexpensive present heuristic for gauging the most worth is: “every thing divided by 7 million” (the place “every thing” is the overall fiat newly allotted to bitcoin, nonetheless a lot which may be).

Scaling The Instance Situation

Subsequent, we’ll alter the quantity of latest capital being reallocated to bitcoin to create various eventualities, as follows:

Primarily based on this, for bitcoin’s worth to hit $1 million, slightly than requiring the roughly $20 trillion reallocation of world funding capital advised by the uncooked instruments, solely round one third of that quantity could be wanted.

Though modest-sounding within the context of world wealth, such a reallocation would nonetheless contain vital participation by giant, slow-moving and conservative swimming pools of capital. For my part, whereas that is potential over the medium- or long run, this appears inconceivable inside the subsequent few years with out seismic disruption in monetary markets (similar to a significant sovereign debt disaster, banking system collapse or persistently vertiginous inflation) accelerating the required paradigm shift away from “fiat considering.”

Within the absence of such an occasion inside that point, I see one thing like the primary and most modest situation within the desk as extra possible, with momentary highs within the low a whole bunch of hundreds of {dollars} as “massive capital” slowly reallocates to bitcoin.

Chances are you’ll after all have your own opinion on an applicable heuristic. However, having thought-about the function of volatility and accounted for unavailable bitcoin (each misplaced and “hardcore HODL’d”), I believe “every thing divided by 7 million” is an inexpensive gauge for the probably peak worth affect of capital redirected to bitcoin. Whereas “every thing” right here is the overall of that capital — which may theoretically be as a lot as all of the saved worth on the planet — any credible guess at a future worth must be primarily based on a practical stage of reallocation to bitcoin.

It is a visitor publish by Bitcoms. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link