[ad_1]

Lodz-founded/London-HQ’d Cryptiony has raised €500,000 in a pre-seed funding spherical. The startup gives a crypto tax automation platform for people, merchants, and tax professionals, and with the pre-seed cash is focusing on a market enlargement into Europe’s largest crypto market with over 4.2 million customers, the UK.

Alongside the market enlargement, Cryptiony plans to increase its growth crew, introducing new options, and new trade and blockchain integrations.

Cryptiony’s pre-seed spherical was led by New York-based ff Enterprise Capital with Pointer.Capital and web3-focused angel investor Marcin Wenus collaborating.

Crypto and taxes. In case you’ve ever bought, traded, or hodld, you’re legally obligated to report and pay tax on these 1’s and 0’s. And but, whereas crypto merchants may be forward of the curve (in some respects, we’ll depart FTX out of this dialogue. For now.) technically talking, the accountants they/we/you have interaction are oft to be barely much less behind in relation to the necessities of reporting these losses/earnings(?).

And with each the IRS within the US and HMRC within the UK beginning to put strain on crypto asset holders, an rising quantity people have gotten conscious of the necessity to file crypto positive factors, losses, and staking (a notoriously troublesome calculation as a consequence of the truth that funds are sometimes made each day, creating tons of of knowledge factors for every asset) funds as a part of annual tax reporting.

And with each the IRS within the US and HMRC within the UK beginning to put strain on crypto asset holders, an rising quantity people have gotten conscious of the necessity to file crypto positive factors, losses, and staking (a notoriously troublesome calculation as a consequence of the truth that funds are sometimes made each day, creating tons of of knowledge factors for every asset) funds as a part of annual tax reporting.

Within the UK, for instance, exchanges are legally required to inform HMRC when a person’s complete holdings attain a comparatively modest £3,000, and even exchanging one sort of crypto asset for one more or for items incurs tax liabilities.

As for residents of the EU, don’t assume you’re out of the woods, because the European Union proposed new guidelines that can require all digital asset service suppliers to report transactions involving prospects residing within the bloc.

Proper now, reporting can work to taxpayers’ benefit. With most crypto belongings closely down in worth because the finish of 2021, it’s probably that many purchasers have losses that, if recognised and reported, might offset future capital positive factors tax.

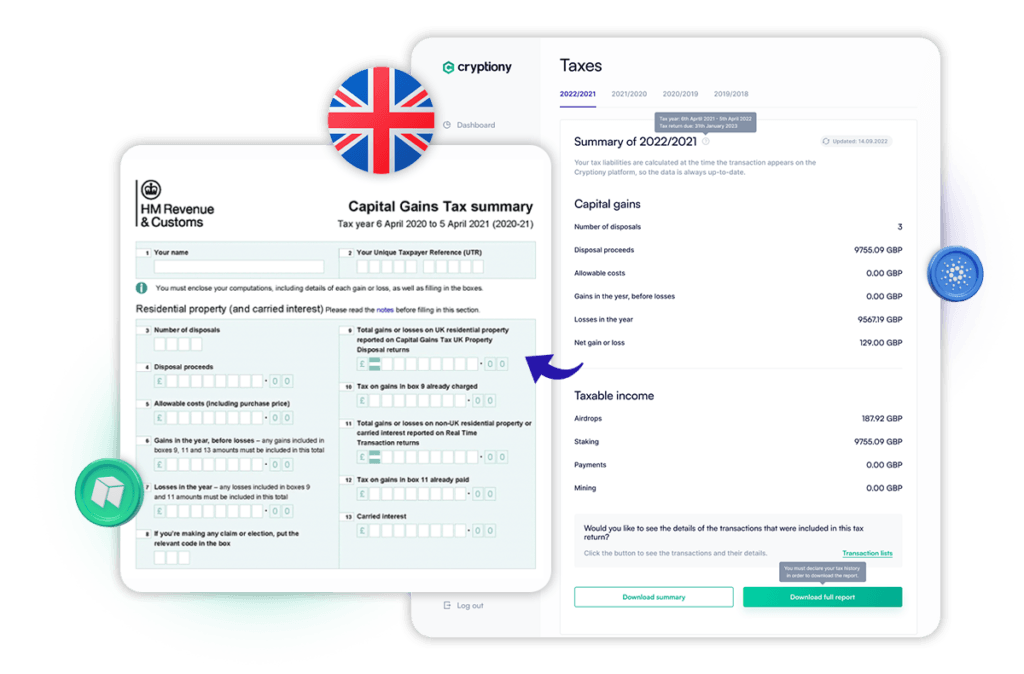

Stepping in and aiding in conserving all the pieces above board is Cryptiony. By offering a cryptocurrency tax calculation that’s reportedly simple, quick, and reasonably priced for inexperienced persons, but in addition scales upwards to assist skilled merchants and accountants.

In linking on to exchanges by way of APIs and extracting related information, the platform can mechanically create a full tax legal responsibility report compliant with advanced tax legal guidelines, such because the UK’s share pooling guidelines.

“If crypto ever was a part of a separate universe, it isn’t now. Tax authorities are treating buying and selling income identical to every other capital acquire and taxpayers are waking as much as the dangers of non-compliance,” commented co-founder and CEO Bartosz Milczarek. “It’s an enormous market already and, as web3 turns into mainstream, goes to get even larger. The UK is our most essential alternative proper now and the brand new pre-seed funding permits us to seize that opening with a pricing mannequin that’s going to be arduous to disregard.”

Lead picture: Anna Mizerska

[ad_2]

Source link