[ad_1]

- BTC commenced 2023 with an especially low realized volatility.

- On-chain exercise revealed weak point on the BTC community

In keeping with a brand new report by on-chain knowledge supplier Glassnode, main coin Bitcoin [BTC] kicked off the 2023 buying and selling yr with an especially low realized volatility.

Realized volatility is a measure of the volatility of a cryptocurrency asset based mostly on historic costs. The metric is deployed towards figuring out the extent to which the worth of an asset has fluctuated over a specified interval.

Are your BTC holdings flashing inexperienced? Test the Profit Calculator

Low realized volatility suggests a comparatively steady market and will be a sign that traders have the next diploma of certainty in regards to the worth of an asset.

In keeping with Glassnode, in earlier cycles, extraordinarily low realized volatility of BTC’s worth triggered explosive actions in each bullish and bearish instructions.

For instance, in November 2018, the extreme decline in BTC’s realized volatility instantly preceded a 50% worth drawdown in below 30 days. Whereas, in April 2019, the low realized volatility led to “a rally from $4.2k to a peak of $14k in July 2019,” Glassnode discovered.

BTC is unwell, on-chain knowledge suggests

Within the wake of FTX’s collapse final November, BTC noticed a surge in new addresses as many took benefit of the worth decline to “purchase the dip.” Nonetheless, Glassnode discovered that the depend of BTC new addresses has “since cooled off noticeably.”

“The month-to-month common of New Addresses is returning towards the yearly common baseline, indicating that community utilization is but to ascertain a convincing and sustained restoration,” Glassnode said.

Glassnode noticed that through the bull market cycles of 2019 and 2021, there was a sustained improve within the variety of new consumers for BTC. This contributed to the cryptocurrency’s appreciation in worth throughout these occasions.

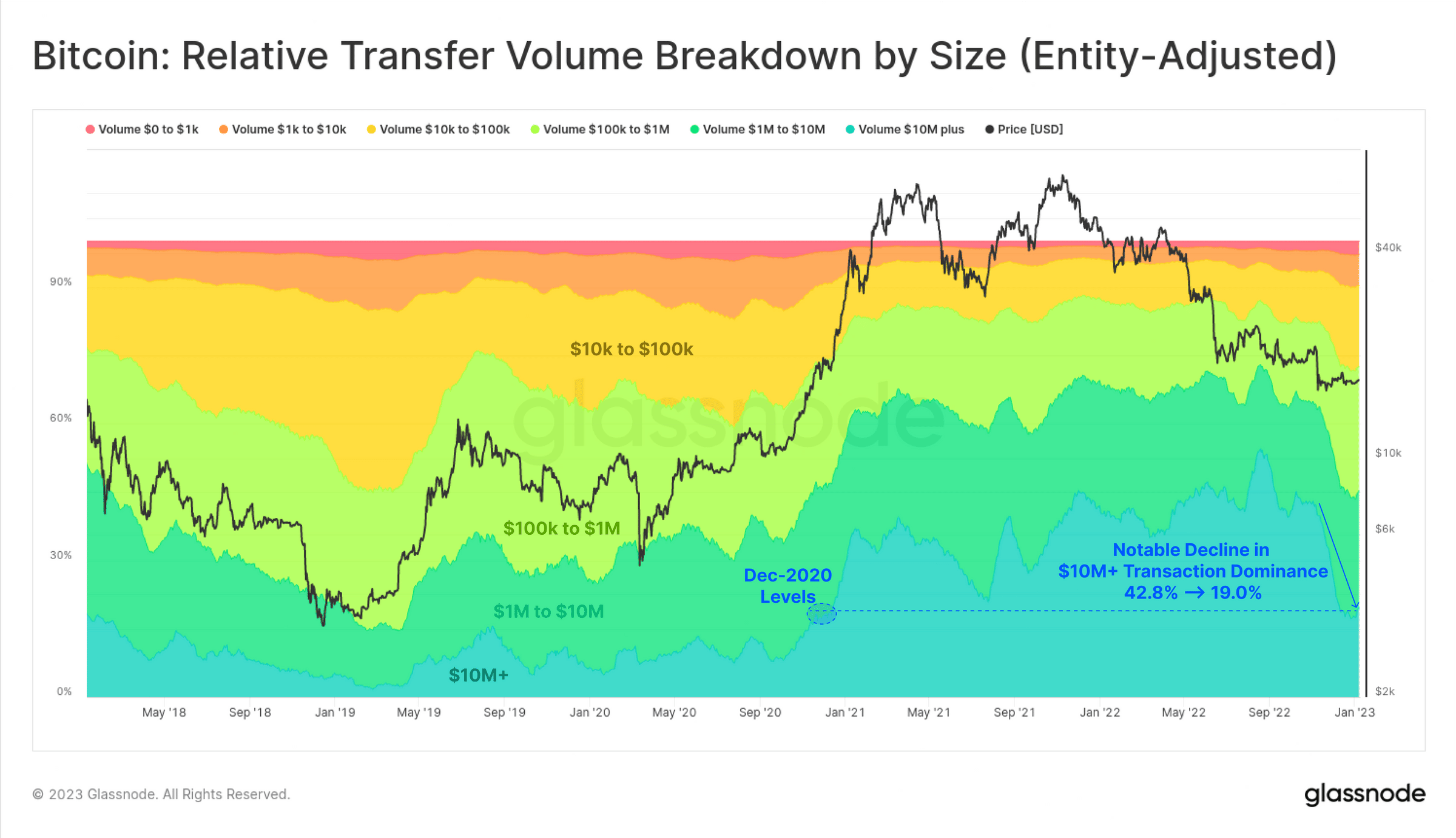

Along with a decline in deal with exercise on the BTC community, Glassnode famous that the whole USD worth processed by the Bitcoin community “has been in free-fall.” The extreme drop decline in every day switch quantity may very well be attributable to the exit of institutional-sized capital from the BTC market following FTX’s collapse.

The report said additional that the massive transfers of $10 million or extra have considerably decreased and are now not dominating the switch quantity of Bitcoin. For instance, earlier than the collapse of FTX, 42.8% of the amount got here from massive transfers, however this quantity dropped to 19.0% as of 10 January.

What number of BTCs can you get for $1?

This pattern indicated a slowdown in institutional funding and a lack of confidence amongst this group of traders. Moreover, it may point out the departure of capital related to the controversial FTX and Alameda entities, Glassnode opined.

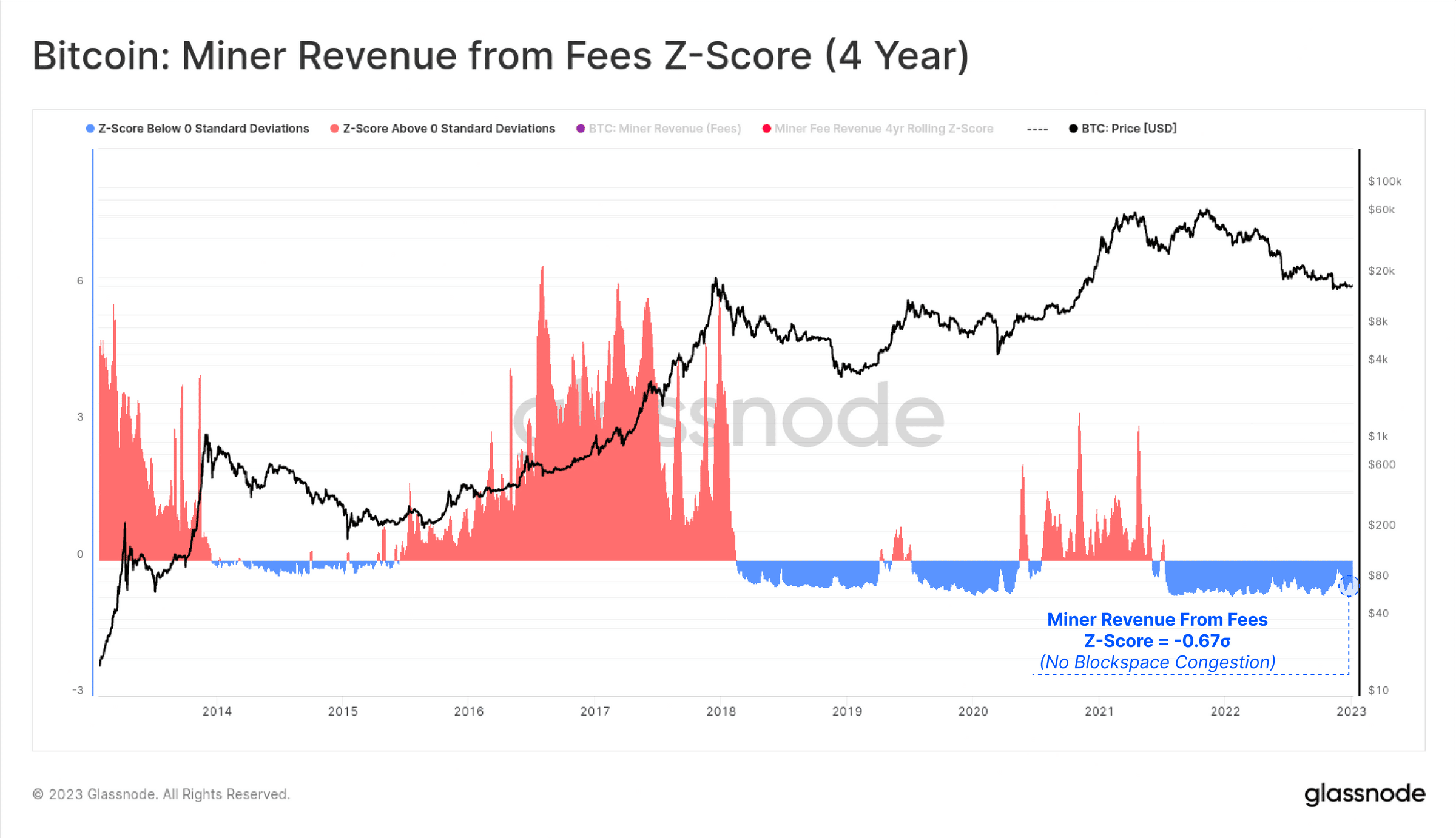

Almost about mining on the BTC community, Glassnode stated,

“Demand for Bitcoin blockspace continues to stay weak, with negligible upwards stress on the Bitcoin charge market. The 4-yr Z-Rating of miner revenues is but to make any noteworthy progress again in direction of optimistic territory, and stays -0.67 customary deviations beneath the imply.”

[ad_2]

Source link