[ad_1]

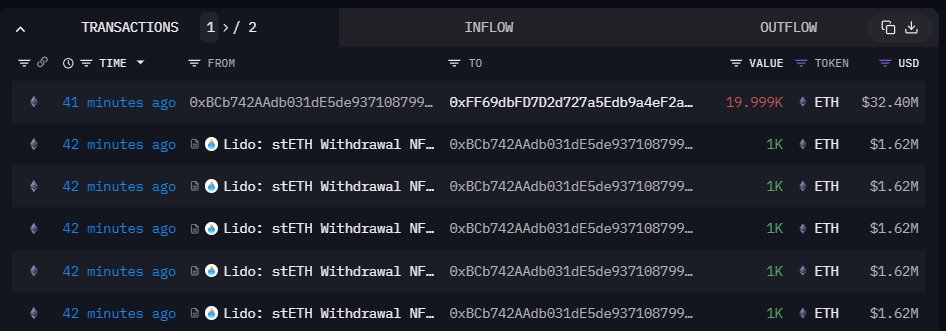

A crypto pockets related to Justin Solar, the co-founder of Tron, a wise contract platform, has moved 20,000 Ethereum (ETH) value roughly $32.4 million from Lido Finance, a liquidity staking platform. Funds have been transferred to Binance, the world’s largest crypto trade, buying and selling quantity and shopper depend.

The transaction, executed in a single batch, was captured by The Information Nerd, an evaluation platform, and shared on X on October 5. As it’s, Ethereum (ETH) is below strain, trying on the efficiency within the every day chart.

Ethereum Drops 4%, Are Bears Flowing Again?

Trackers present that the coin is down roughly 4% in three days, confirming sellers of October 2. Notably, the every day chart has a double bar formation with the bear candlestick of October 2, fully reversing consumers of October 1.

This association means that bears may very well be in management, particularly contemplating the draw-down of the previous few buying and selling days and the extent of participation on October 2 when the coin slipped.

In technical evaluation, losses behind growing volumes typically level to excessive participation. If costs are rising, then the coin in query may rally. Conversely, a sell-off may worsen if the bar had excessive buying and selling volumes.

It is usually unclear whether or not Justin Solar plans to promote ETH after transferring cash to exchanges. Crypto transfers to centralized exchanges, which assist many stablecoins like USDT and others, are sometimes related to sell-offs.

Market contributors could interpret such actions as bearish, fueling the sell-off, subsequently heaping extra strain on costs. ETH is now at a one-week low.

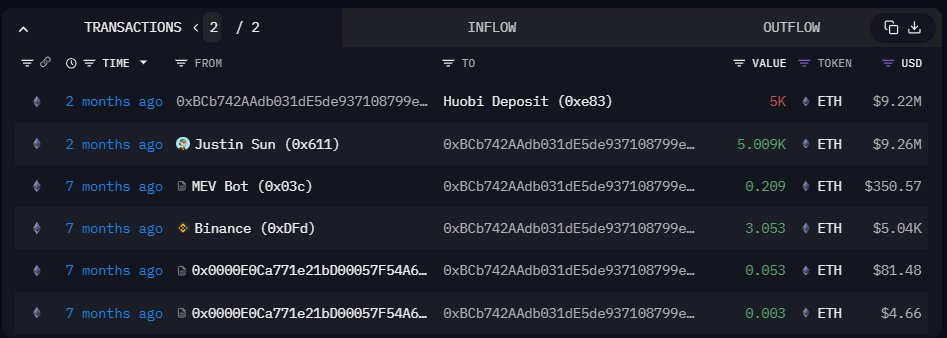

Justin Solar Shuffling ETH In 2023

The Information Nerd observes that costs fell the final time the pockets moved ETH to Huobi, which has since rebranded to HTX. In August, the pockets moved 5,000 ETH to HTX. The deposit got here every week earlier than ETH costs crashed 12%.

Bitcoin and Ethereum costs fell sharply in mid-August, inflicting a “cascade liquidation” that spooked buyers. ETH bulls have since did not reverse these losses. Contemplating the comparatively low buying and selling volumes within the final two months, costs are nonetheless boxed throughout the August 17 commerce vary, a bearish sign.

In late February 2023, Justin Solar staked 150,000 ETH, value roughly $240 million, to Lido Finance. The switch stays the biggest single-stay transaction, forcing the liquidity staking supplier to activate the Staking Charge Restrict function, capping the quantity of cash one can stake at 150,000 ETH.

Lido Finance mentioned the function is extra of a “security valve” that “addresses potential side-effects corresponding to rewards dilution, while not having to pause stake deposits explicitly.”

Characteristic picture from Canva, chart from TradingView

[ad_2]

Source link