[ad_1]

Avalanche price evaluation for December 25, 2022, reveals that the market is bearish right now as the worth is at the moment buying and selling beneath $11.67. The value for the AVAX/USD pair has remained unfavourable for the previous 24 hours and is ready to proceed. The value of AVAXUSD has decreased by nearly 1.09% from the final substantial barrier at $11.67, difficult the numerous current resistance at $11.80. The 24-hour buying and selling quantity for AVAX has additionally decreased to $59,161,831 with a market cap of $3,627,786,192.

Avalanche worth evaluation 1-day worth chart

The one-day Avalanche worth evaluation confirms that the market development has been dropping. The market’s volatility is growing in response to a motion, which signifies that Avalanche’s worth is more and more prone to bear a variable shift on both excessive.

The strongest resistance is represented by the higher Bollinger band’s worth of $20.9653; the strongest help is proven by the decrease Bollinger band’s worth of $13.2759.The relative energy index (RSI) is buying and selling at 52.50, which signifies that the market is neither overbought nor oversold, signifying a secure cryptocurrency. The value is buying and selling inside the SMA 200 and 100 curves, which reveals that the development route is bearish.

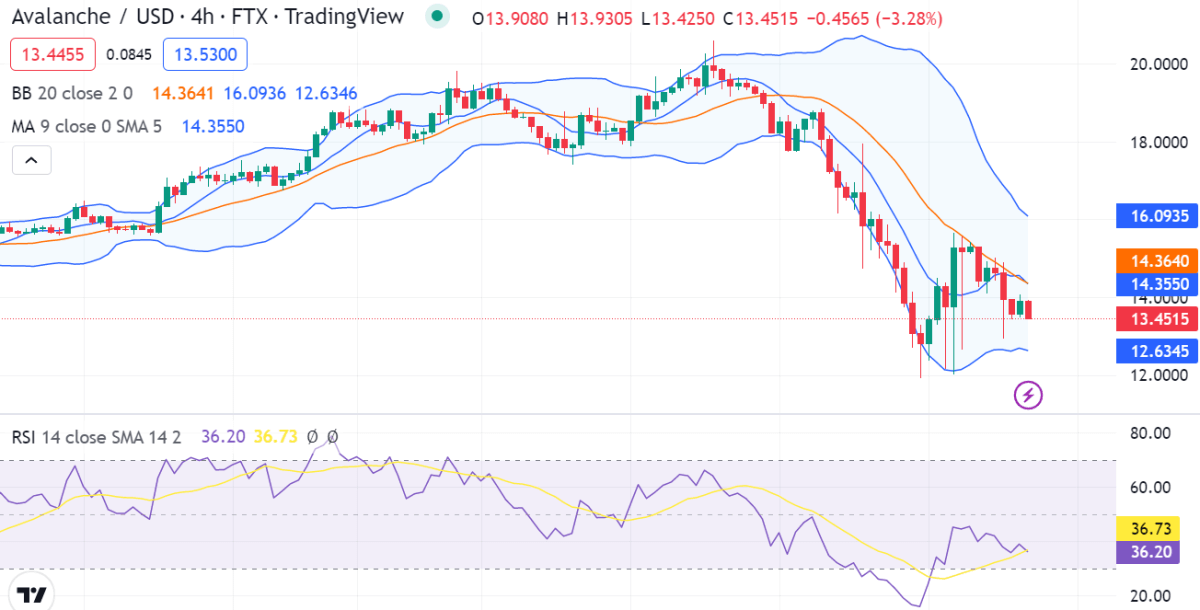

AVAX/USD 4-hour worth chart: Costs proceed to say no

The 4-hour Avalanche worth evaluation signifies a pessimistic market as the costs proceed with downward momentum. Avalanche worth evaluation reveals that the bears have been answerable for the marketplace for the previous a number of hours; the worth is at the moment buying and selling beneath the $11.67 degree and is anticipated to maintain sliding. This implies that the bearish period can final for a really very long time.

The AVAX/USD worth seems to be crossing underneath the curve of the shifting common, signifying a bearish motion. The volatility is growing, which implies that the bearish wave is prone to increase within the upcoming days. Relating to the higher and decrease Bollinger bands’ indicators’ values, the higher band reveals $16.0936 figures, whereas the decrease band reveals a $12.6346 worth. The relative energy index (RSI) curve is buying and selling at 36.73, indicating that the bears are answerable for the market.

Avalanche worth evaluation conclusion

The market is anticipated to expertise consolidation within the close to future, in keeping with the Avalanche worth evaluation. Costs are anticipated to maintain falling, although, because the bearish development continues to be very robust. The market indicators are indicating further near-term draw back momentum because the bears take over the market. Involved in regards to the state of the economic system, buyers are nonetheless being cautious. Costs are anticipated to maintain falling, although, because the bearish development continues to be very robust.

[ad_2]

Source link