[ad_1]

An analyst has defined that the absence of miners on the Ethereum community may very well be bullish for the ETHBTC ratio.

Miners Present A Persistent Promoting Stress On Bitcoin

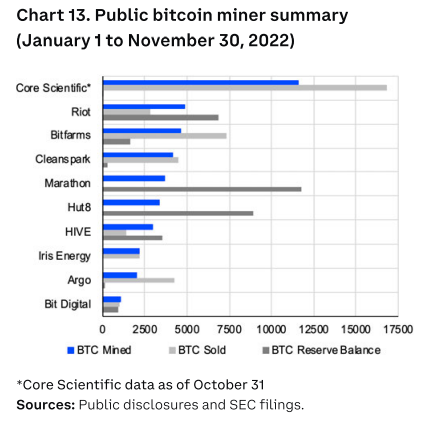

As defined in a tweet by Tom Dunleavy, a Messari analysis analyst, BTC miners promote nearly all of the cash they mine. The under chart comprises information concerning the high ten public Bitcoin mining corporations, displaying data reminiscent of how a lot every of them mined this 12 months, the quantities that they offered, and the dimensions of their present holdings:

Appears to be like like Marathon is holding the biggest reserve proper now | Supply: Tom Dunleavy on Twitter

In whole, the ten largest mining corporations within the area mined a collective 40.7 BTC this 12 months and offered 40.3 BTC. Which means they roughly dumped the complete provide that they mined in 2022 and within the course of, utilized fixed promoting strain on the community.

Earlier within the 12 months, Ethereum efficiently transitioned to a Proof-of-Stake (PoS) consensus mechanism, which suggests the blockchain now not makes use of miners for dealing with transactions, and slightly makes use of stakers (buyers which have locked 32 ETH within the PoS contract) to behave as validating nodes.

In a Proof-of-Work (PoW) system, miners compete with one another utilizing giant quantities of computing energy. Subsequently, many bills are concerned in getting up their services, however one value, particularly, stays with them so long as they proceed to function: the electrical energy payments. It’s due to these electrical energy payments that miners must constantly promote what they mine to maintain their enterprise sustainable.

Some miners attempt to maintain onto their reserves for so long as potential, like Marathon, and Hut8 could be seen doing within the chart. Nonetheless, in a market like proper now, the place electrical energy costs have shot up whereas the BTC value has plummeted because of the bear, margins are effective for the already debt-ridden public miners, and thus most of them can’t afford to build up.

Within the case of a PoS chain, nevertheless, stakers don’t incur such bills and thus don’t have any explicit have to promote the rewards they earn whereas staking. This suggests that the kind of promoting strain that miners placed on Bitcoin isn’t current on the Ethereum blockchain.

The analyst believes that this reality supplies a very good thesis to be bullish on the ETHBTC ratio.

Ethereum Worth

On the time of writing, ETH is buying and selling round $1,200, down 1% within the final week.

The worth of the crypto does not appear to have moved a lot throughout the previous few days | Supply: ETHUSD on TradingView

Featured picture from Pierre Borthiry – Peiobty on Unsplash.com, chart from TradingView.com

[ad_2]

Source link