[ad_1]

- The depend of BTC whale transactions above $1 million clinched a two-year low

- Unfavorable sentiment round BTC nonetheless lingers out there

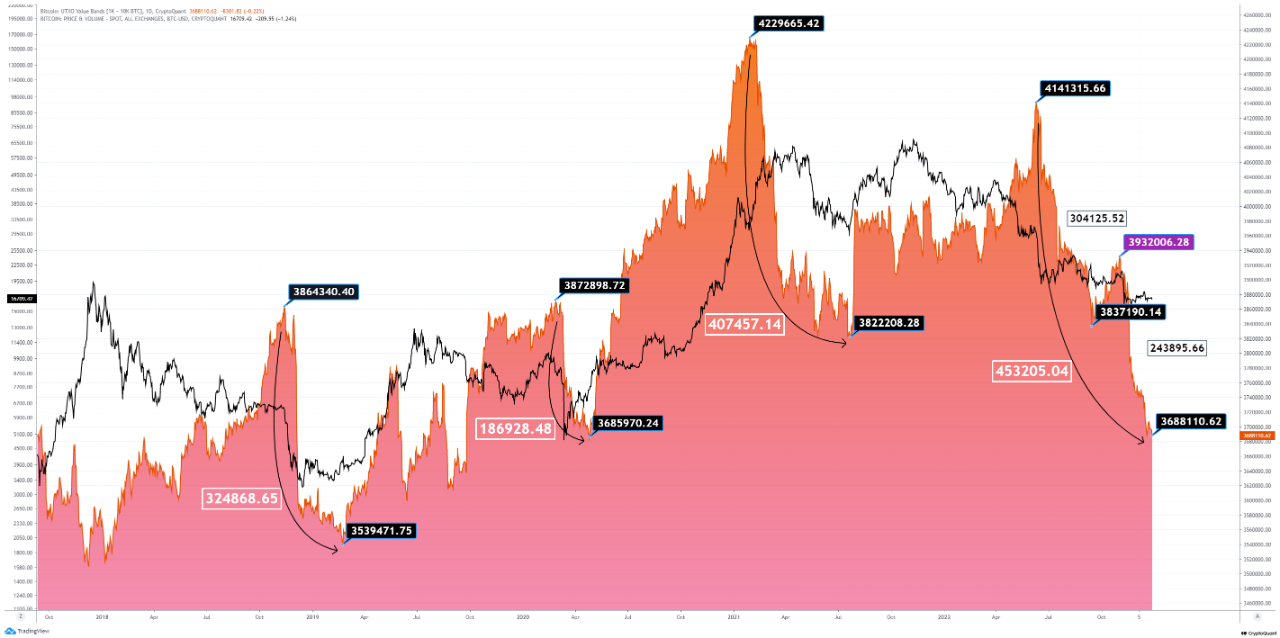

Pegged at 4331 at press time, the depend of Bitcoin [BTC] whale transactions that exceed $1 million marked its lowest spot since December 2020, knowledge from Santiment revealed.

There’s a robust correlation between BTC’s value and whale transactions that exceed $1 million. It is because the unwillingness of whales to build up or distribute can result in a constant decline in BTC’s value.

🐳 #Bitcoin‘s ranging costs have loads to do with declining whale curiosity. This chart illustrates how carefully $BTC and $1M+ valued whale transactions correlate. If costs proceed sliding and a spike happens, this might be a traditionally #bullish sign. https://t.co/nDZj3eicRD pic.twitter.com/t7GFIKNpax

— Santiment (@santimentfeed) December 28, 2022

Equally, for BTC transactions that exceed $100,000, at 31,300 transactions as of this writing, the bottom spot since 2019 was recorded.

A 0.45X lower if BTC falls to Ethereum’s market cap?

Moreover, CryptoQuant analyst BinhDang discovered a major drop within the BTC from Unspent Transaction Outputs (UTxOs) held by the cohort of BTC buyers that maintain between 1000 to 10,000 cash.

BinhDang assessed BTC’s historic efficiency and located that compared with earlier bear cycles. The present bear cycle has been remarkably affected by a decline in UTXOs held by buyers with pockets balances of 1000 to 10,000 cash.

With FUD lingering out there, BinhDang concluded,

“Usually, the market can solely recuperate when this cohort has sufficient confidence to build up once more. And in the mean time, we nonetheless not get any constructive indicators from this cohort.”

Along with decreased whale exercise on the BTC community, short-term holders proceed to promote regardless of going through losses, CryptoQuant analyst Phi Deltalytics discovered.

Based on Phi, an evaluation of BTC’s Quick-Time period Output Revenue Ratio confirmed that these members have prioritized liquidity over holding onto their property, even when it means incurring losses.

Supply: CryptoQuant

Within the interim…

On a each day chart, BTC’s On-balance quantity (OBV) was noticed at – 2.127 million. A detrimental OBV indicated that the amount of an asset bought is larger than the amount purchased, furthering the worth decline.

This place was confirmed by the truth that BTC’s Relative Energy Index (RSI) and Cash Move Index (MFI) rested beneath their impartial zones at press time. Each in downtrends, the RSI was 43.75, whereas the MFI was 40.17.

Learn Bitcoin’s [BTC] Price Prediction 2023-2024

A persistent decline in an asset’s RSI and MFI signifies a extreme downturn in shopping for momentum, which could trigger such an asset to be oversold. For a reversal to happen, a change in buyers’ conviction is important.

[ad_2]

Source link