[ad_1]

TL;DR Breakdown

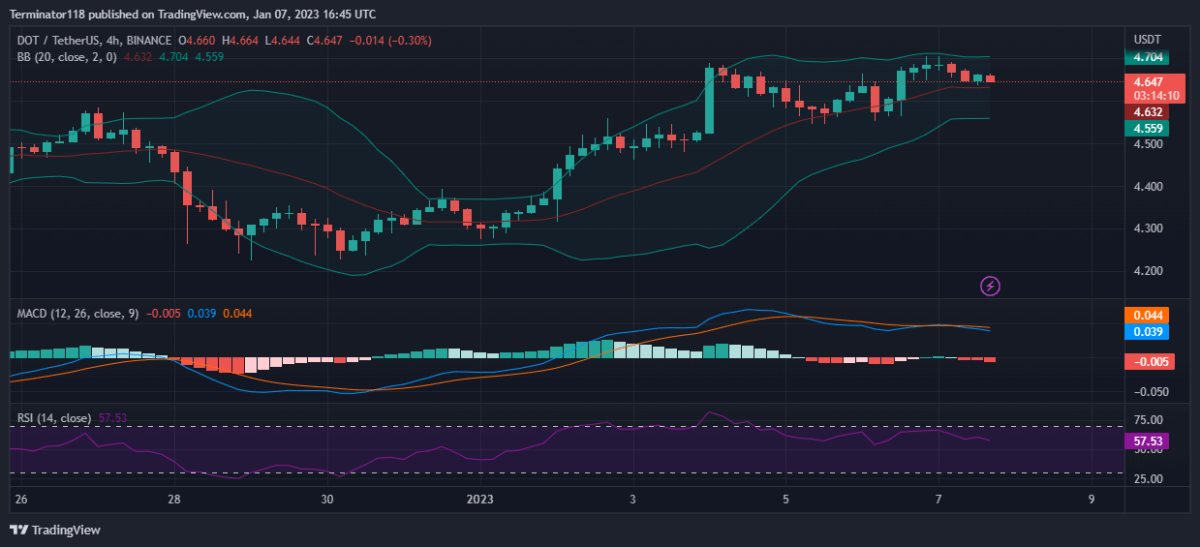

- Polkadot worth evaluation suggests downward motion to $4.600

- The closest help degree lies at $4.632

- DOT faces resistance on the $6.700 mark

The Polkadot worth evaluation exhibits that the DOT worth motion has been rejected on the $4.700 mark and strikes again in direction of the $4.600 level.

The broader cryptocurrency market noticed a bullish market sentiment during the last 24 hours as most main cryptocurrencies recorded constructive worth actions with low volatility. Main gamers embrace BTG and ETC, recording a 9.69 p.c and a 8.07 p.c incline, respectively.

Polkadot worth evaluation: DOT rejected at $4.700

The MACD is presently bearish, as expressed within the purple color of the histogram. Nevertheless, the indicator exhibits low momentum because the indicator has solely just lately exhibited a bearish crossover. However, the darker shade of the histogram suggests an rising bearish momentum as the worth falls in direction of the $4.600.

The EMAs are presently buying and selling excessive above to the imply place as web worth motion during the last ten days stays constructive. Furthermore, the 2 EMAs buying and selling intently present low momentum. Moreover, the diverging indicators counsel an rising bearish momentum throughout the 4-hour charts.

The RSI briefly rose to the overbought area however has since moved again into the impartial zone as the worth motion was rejected at $4.70. At the moment, the index is buying and selling on the 57.53 unit degree with a slight downwards slope. The indicator doesn’t concern a sign in the intervening time however the slope suggests bearish strain on the time.

The Bollinger Bands are presently slim as the worth volatility decreases close to the $4.600 mark and present convergence as the worth motion returns to the indicator’s imply line. The indicator’s backside line offers help at $4.559 mark whereas the higher restrict presents a resistance degree on the $4.704 mark.

Technical analyses for DOT/USDT

General, the 4-hour Polkadot price evaluation points a purchase sign, with 12 of the 26 main technical indicators supporting the bears . However, solely 4 of the indications help the bears displaying low bullish presence in current hours. On the similar time, ten indicators sit on the fence and help neither aspect of the market.

The 24-hour Polkadot worth evaluation shares this sentiment and in addition concern a promote sign with 11 indicators suggesting an upwards motion in opposition to solely seven suggesting downwards motion for the asset throughout the timeframe. The evaluation exhibits bearish dominance throughout the day by day body with sugnificant bullish presence nonetheless present. In the meantime, eight indicators stay impartial and don’t concern any indicators at press time.

What to anticipate from Polkadot worth evaluation?

The Polkadot worth evaluation exhibits that after rising to the $4.700 mark, the worth motion did not climb any additional and was rejected on the degree because the bulls have been overextended. At press time, the worth has fallen under $4.650 because the bears proceed pushing.

Merchants ought to anticipate DOT to maneuver downwards to the $4.600 mark as the worth motion observes a correction for the steep bullish motion. Because the 4-hour evaluation exhibits bullish presence, the worth could be anticipated to cease at $4.600 mark, nevertheless, in case of a downwards breakdown, the following help degree lies at $4.500 mark.

[ad_2]

Source link