[ad_1]

- Bitcoin’s volatility hits all time low as per head of analysis at CoinShares

- BTC Whale Ratio managed to point out some restoration

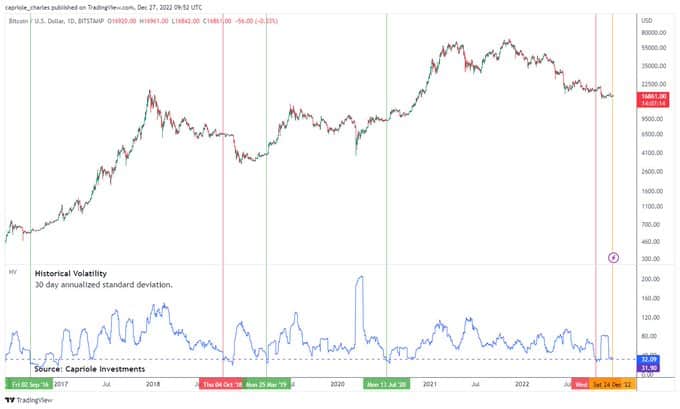

Bitcoin [BTC] continued to disappoint each the bulls and bears as its volatility hit contemporary lows as of seven January. As per a tweet posted by James Butterfill, the top of analysis at CoinShares, BTC’ 30-day volatility fell to an all time low of 18.7, within the vary of in style fairness indices like Nasdaq and S&P 500.

This might be taken as a exceptional departure from the coin’s unpredictable conduct exhibited within the final decade.

1/ Bitcoin 30d volatility is the bottom on report at 18.7, a real milestone and decrease than the Nasdaq at 25.7! pic.twitter.com/Em1HLqtfX8

— James Butterfill (@jbutterfill) January 6, 2023

What number of BTCs can you get for $1?

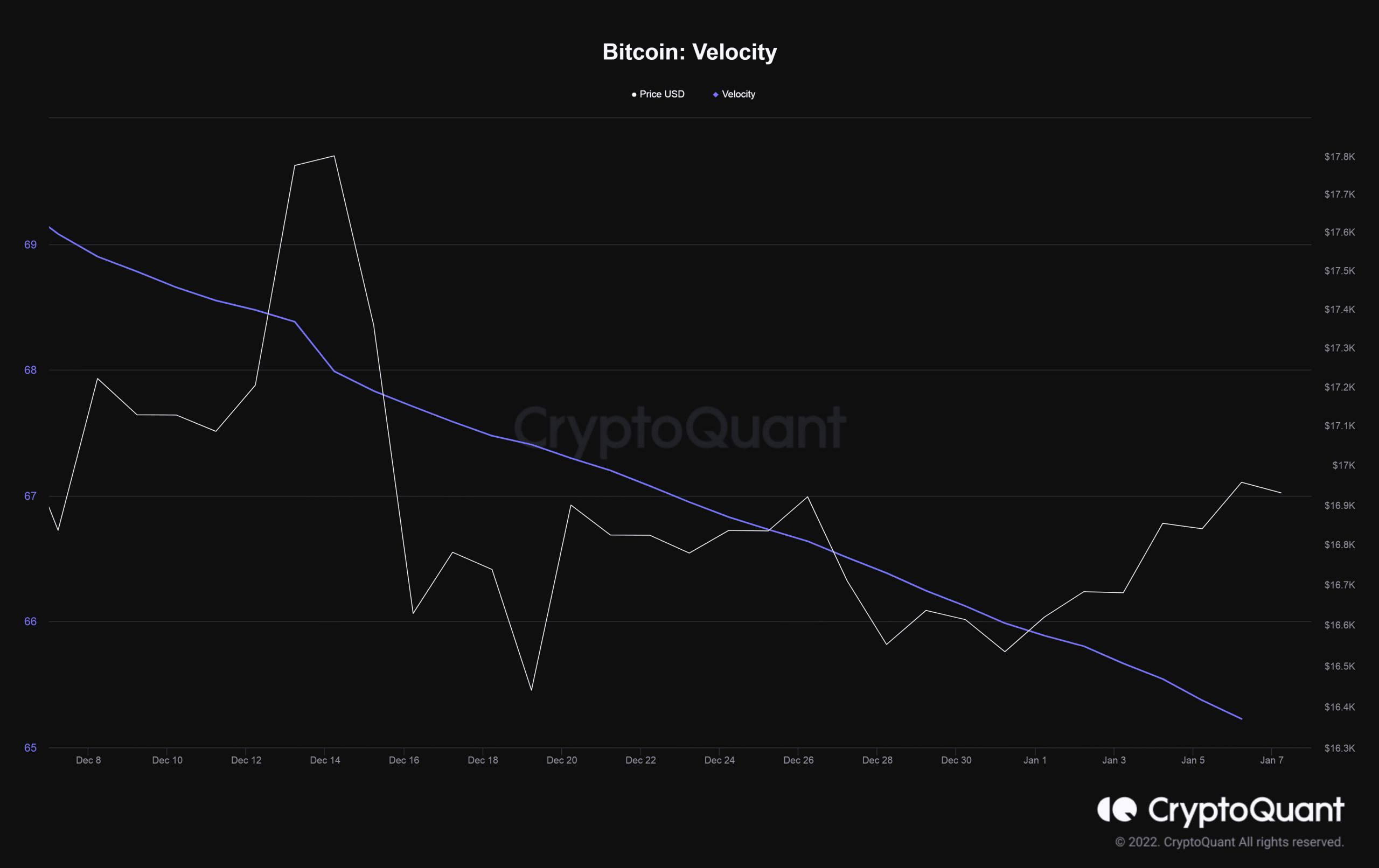

The identical was mirrored within the buying and selling volumes of BTC which has diminished step by step for the reason that FTX-induced market volatility section in mid-November. At press time, the quantity dipped by nearly 3% since 6 January, per information from CoinMarketCap.

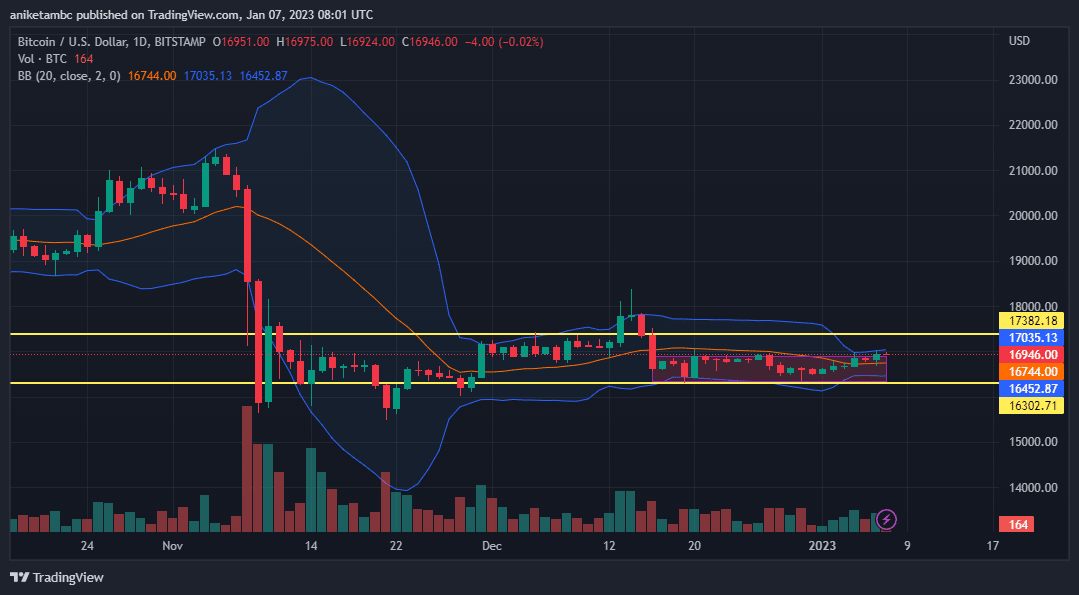

Moreover, upon contemplating BTC’s worth chart on a each day timeframe the king coin oscillated inside a decent vary between $16,302 and $17,382. The converging Bollinger Bands (BB) alongside the talked about vary strengthened the notion of low volatility.

The place does BTC go from right here?

Analyst Charles Edwards, founding father of Capriole Investments predicted an enormous transfer for BTC however solely when it breaks out of low volatility. He shared a chart which correlated Bitcoin’s volatility with historic worth information and prompt that the brand new development after the low volatility section tends to last more.

“Bitcoin is at the moment buying and selling at a serious low in volatility. Usually, when Bitcoin breaks out of extraordinarily low volatility, the following development tends to final. Don’t battle the development on the following main transfer.”

Moreover, crypto analyst ‘Crypto Rover’ stated that this low volatility section will proceed for an extended time frame.

The volatility of #Bitcoin is so low…

That is the last word sign of a bear market.

Be ready for a lot of extra days with low volatility this 12 months.

— Crypto Rover (@rovercrc) January 6, 2023

Has on-chain exercise tapered down?

The speed at which cash moved on the community progressively dropped within the final month. This aligned with the drop in buying and selling quantity seen earlier.

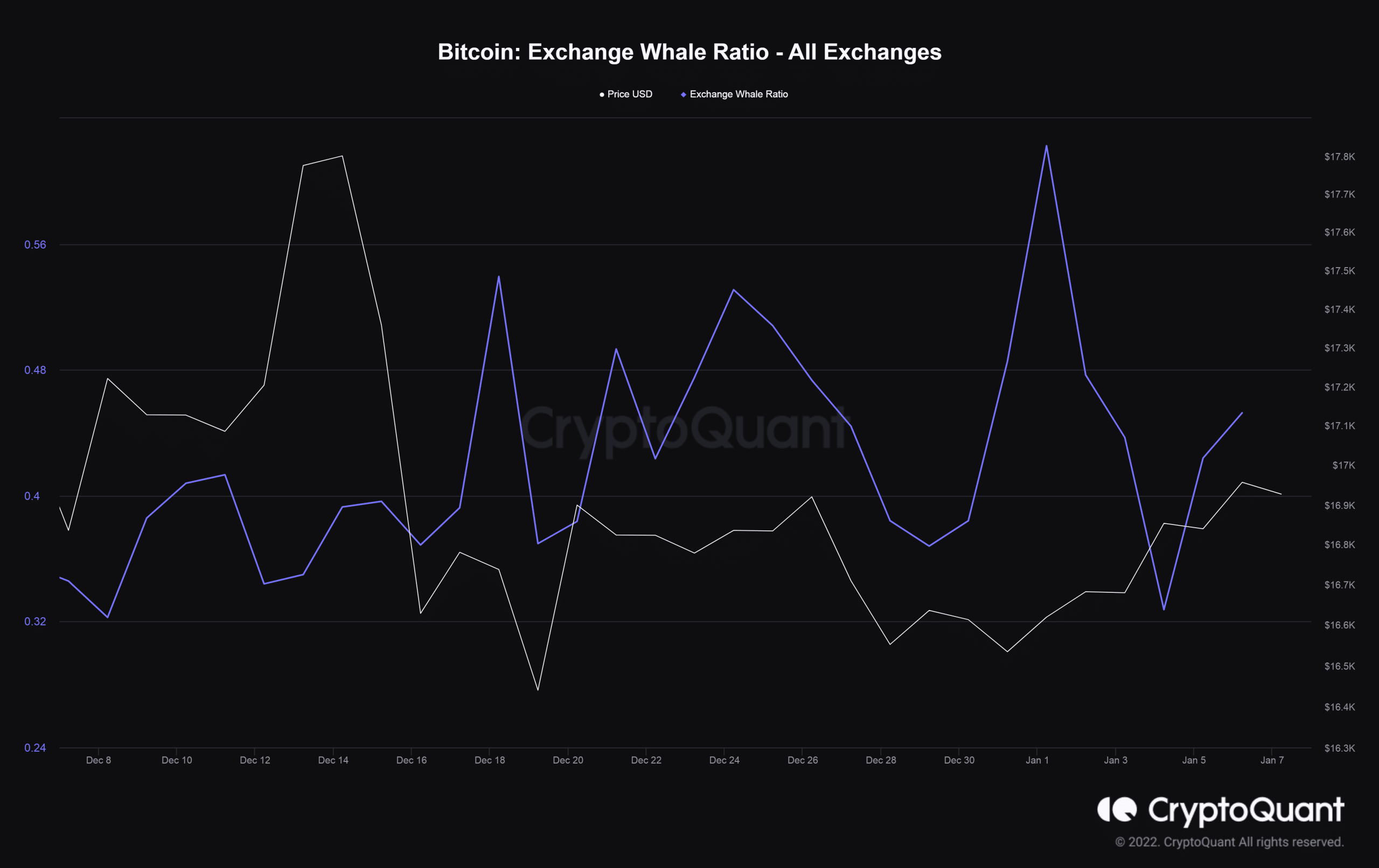

Moreover, the Alternate Whale Ratio which dipped beneath 0.4 within the first week of January confirmed indicators of restoration. The studying from the metric, which measures the highest 10 inflows to an change, prompt that whales performed the wait-and-watch recreation owing to an absence of clear purchase and promote alerts from the market.

The variety of open positions remained constant over the previous week which lent credence to the low volatility section.

Are your BTC holdings flashing inexperienced? Examine the Profit Calculator

Bitcoin has earned the fame of being some of the unstable currencies available in the market. Buzzwords like ‘Crypto Wild West’ turned in style for describing the untamed worth swings within the temporary historical past of the coin.

Nevertheless, its volatility now has began to reflect the extra conventional monetary devices available in the market. Will this strengthen Bitcoin’s thought as a respectable, safe, and steady forex sooner or later? 2023 might have all of the solutions.

[ad_2]

Source link