[ad_1]

- LDO’s value rallied by over 75% within the final week

- As buyers hunt down revenue, the bears may be preparing for a re-entry.

Lido Finance’s governance token LDO, noticed a big improve in value of 78% up to now week. This made LDO one of many top-performing cryptocurrency belongings by way of beneficial properties over the previous seven days, in accordance with knowledge from CoinMarketCap.

Nonetheless on an uptrend at press time, LDO’s value was up by 29% within the final 24 hours. In the identical time interval, LDO tokens value $274 million had been traded. This led to a big improve within the every day buying and selling quantity of over 500%

Learn Lido Finance’s [LDO] Price Prediction 2023-24

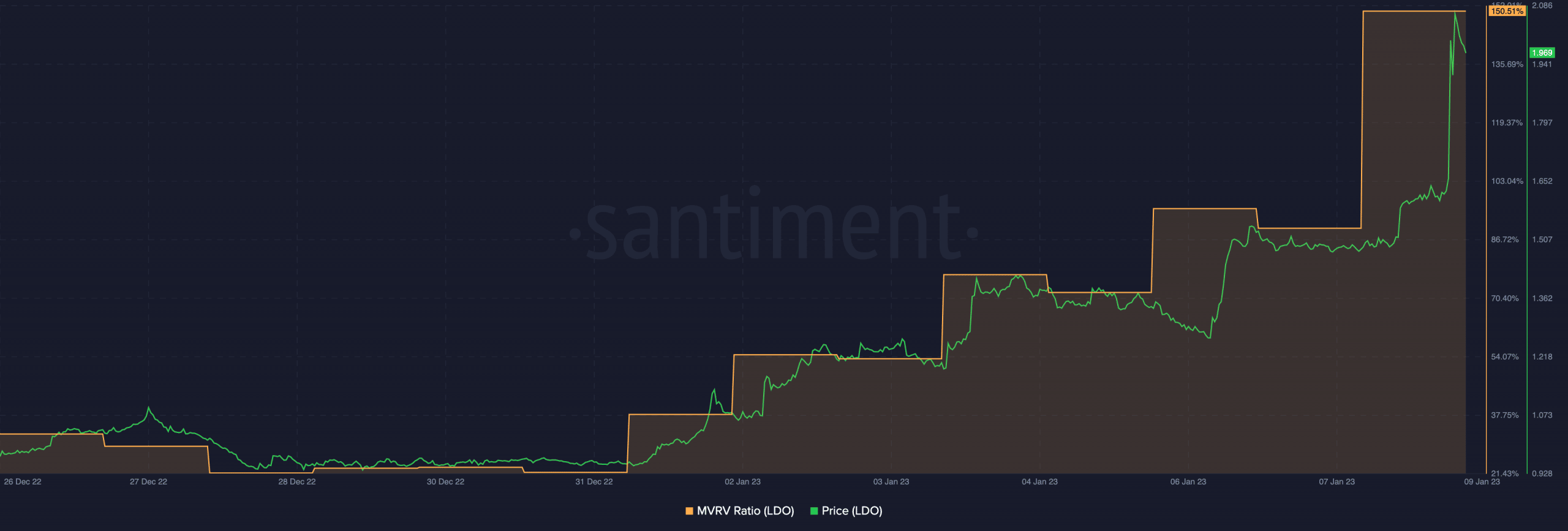

With the Market Worth to Realized Worth (MVRV) ratio of 150.51% at press time, LDO was overvalued. Its market worth (the present value which was $1.91) was considerably larger than the realized worth (the value at which the asset was just lately purchased and bought).

This indicated that buyers that distributed their LDO holdings for the reason that yr started realized double the revenue on their investments.

However for a way lengthy will this proceed?

A disadvantage within the works?

An evaluation of LDO’s efficiency on a every day chart confirmed that bears may be making ready to re-enter the market. This might result in a possible lower within the value of LDO.

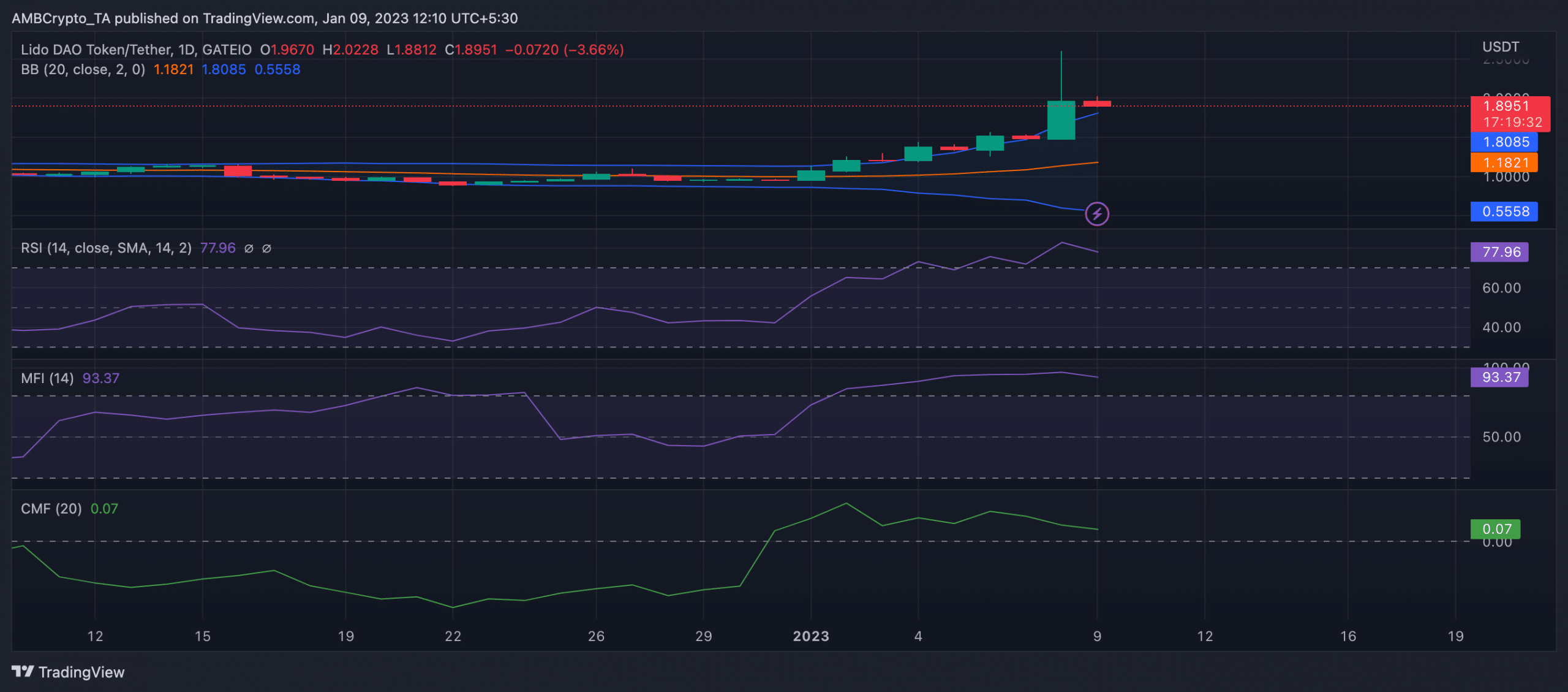

Over the past 9 days, key momentum indicators rose steadily to relaxation at overbought highs at press time. LDO’s Relative Energy Index (RSI) and Cash Circulate Index (MFI) had been noticed at 77.96 and 93.37 at press time.

When an asset’s RSI and MFI lie within the overbought area, the asset’s value has been rising for an prolonged time frame. Consequently, it might be overextended, probably indicating {that a} value correction or reversal is imminent.

At overbought highs, patrons available in the market are sometimes exhausted and are unable to provoke any additional value rally. Therefore, a disadvantage in LDO’s value may be on the horizon within the coming days.

Additional, regardless of the value rally within the final week, LDO’s Chaikin Cash Circulate (CMF) was seen on a downtrend since 6 January. This might thus, create a bearish divergence.

What number of LDOs can you get for $1?

If an asset’s value rises however the CMF drops, it might point out a bearish divergence between the asset’s value and the underlying shopping for and promoting strain. This divergence signifies that the asset’s value is probably not sustained, and a value reversal or correction might be imminent.

Lastly, LDO’s value was considerably risky at press time. The narrowness of the hole between the higher and decrease bands of alt’s Bollinger Bands revealed this.

When the value of a cryptocurrency is very risky, it signifies that it’s vulnerable to speedy and important value fluctuations. Therefore, warning is suggested.

[ad_2]

Source link