[ad_1]

- Yearn Finance ( YFI) launched a brand new DeFi characteristic to permit customers to earn by varied commerce methods

- YFI continued rising even after a 7% improve in worth over the previous week

The launch of the Yearn Finance [YFI] Permissionless Vault Manufacturing facility coincided with the rise within the worth of the YFI token. Because the begin of the 12 months, Yearn Finance skilled a incredible worth run. The DeFi coin has been on the rise, and a current protocol improvement would possibly improve the worth of buyers’ holdings.

Learn Yearn Finance’s [YFI] price prediction 2023-2024

Making Permissionless extra Permissionless

On 9 January, Yearn Finance notified its subscribers {that a} new addition was being made to the Decentralized Finance platform.

The protocol’s newest replace, referred to as the Permissionless Vault Manufacturing facility, would let anybody arrange a vault, basically a secure haven the place crypto belongings will be saved to earn curiosity by varied investing strategies.

At first, customers can solely create vaults for Curve Finance LP tokens and deposits within the decentralized market maker (AMM). Manufacturing facility vaults may have preconfigured techniques developed by the Yearn staff.

Moreover, the methods make the most of Yearn’s stockpile of veCRV tokens. This improves protocol yields and, by extension, boosts returns for any Curve liquidity supplier.

What Yearn’s TVL is saying

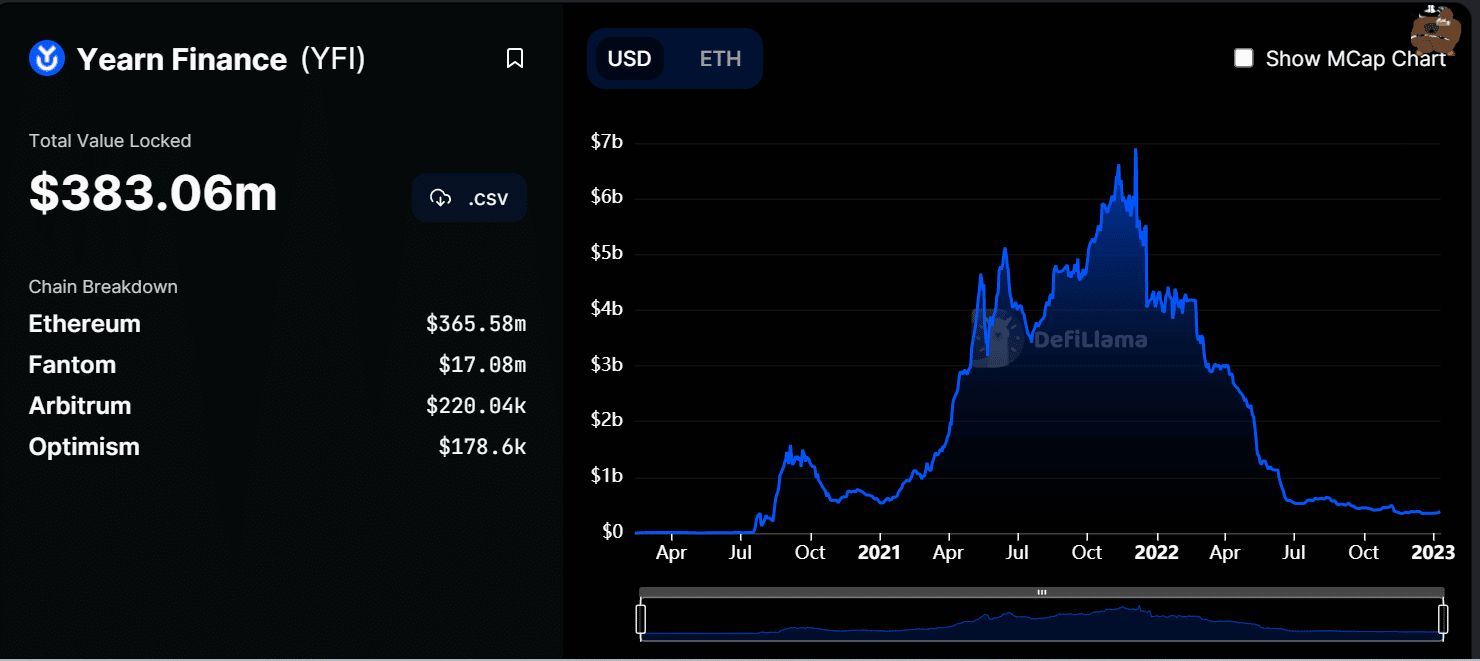

In keeping with information from DeFiLlama, Yearn Finance had a Whole Worth Locked (TVL) at $383.06 million on the time of this writing. Nonetheless, no current surge within the TVL might be seen, however there was a fall. The present state of the market would be the trigger, as was seen within the bigger DeFi market.

Moreover, the YFI token’s worth steadily elevated during the last a number of days. On the time of writing, a cumulative 7% improve in worth had been seen. The present worth sample confirmed a rally from the realm the place costs had fallen in December 2022.

What number of YFIs can you get for $1?

The asset was now buying and selling at about $5,700 in a each day on the time of writing. Moreover, the resistance stage was close to $7,000 and was represented by the lengthy transferring common (blue line).

In keeping with the Relative Energy Index, the asset had successfully been pulled right into a bullish pattern by the current worth motion. A bull pattern was indicated when the RSI line was proven to be above the 50 line.

Moreover, the Shifting Common Convergence Divergence (MACD) indicator additionally indicated an upward flip. Moreover, a mix of the RSI and MACD indicators additional supported the current pattern revealed by the YFI token.

[ad_2]

Source link