[ad_1]

- BTC’s MVRV rests above 1, indicating that the market may need entered a bullish mid-term stage.

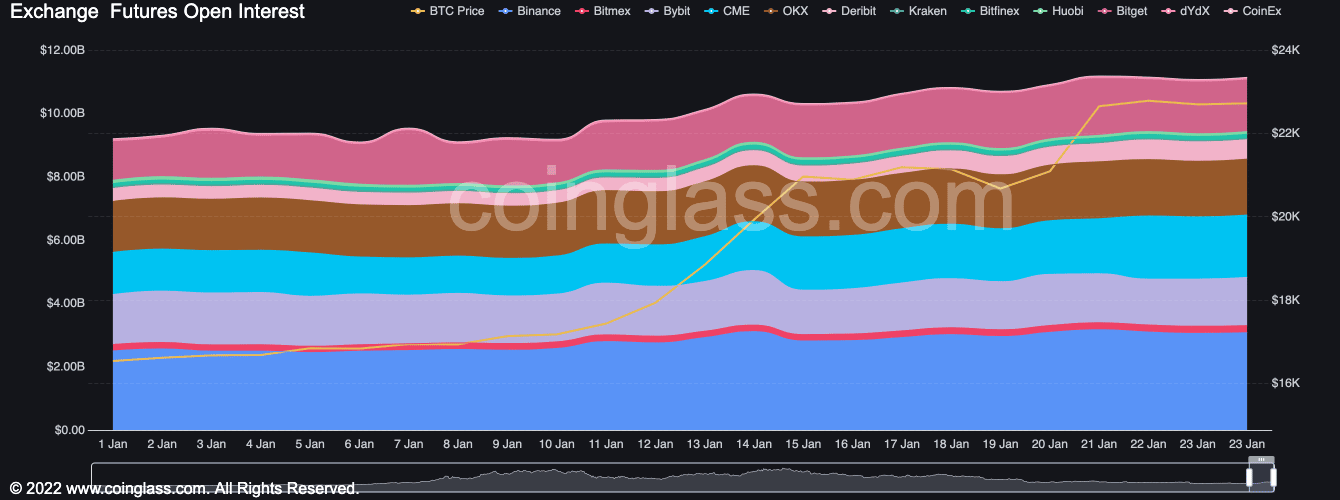

- Open Curiosity has been on a gentle improve for the reason that 12 months began.

The latest rally in Bitcoin’s [BTC] value in the previous couple of weeks led to a pointy improve within the coin’s market-value-to-realized-value ratio (MVRV), which in keeping with CryptoQuant pseudonymous analyst Greatest Trader, implied that the market may need entered a bullish mid-term stage.

How a lot are 1,10,100 BTCs worth today?

Best Dealer assessed BTC’s value historic efficiency within the final 4 cycles and located that the king coin’s MVRV fell beneath one throughout the bearish market phases, signifying that the coin was undervalued and a bear market backside was in formation. Every time the MVRV was pushed above one, “Bitcoin skilled a surge, and the bull market began,” Best Dealer discovered.

A bull run was underway within the present market with the MVRV above one. However, in keeping with Best Dealer, the latest rally in value is perhaps adopted by “sudden strikes and excessive volatility.”

What to anticipate within the quick time period?

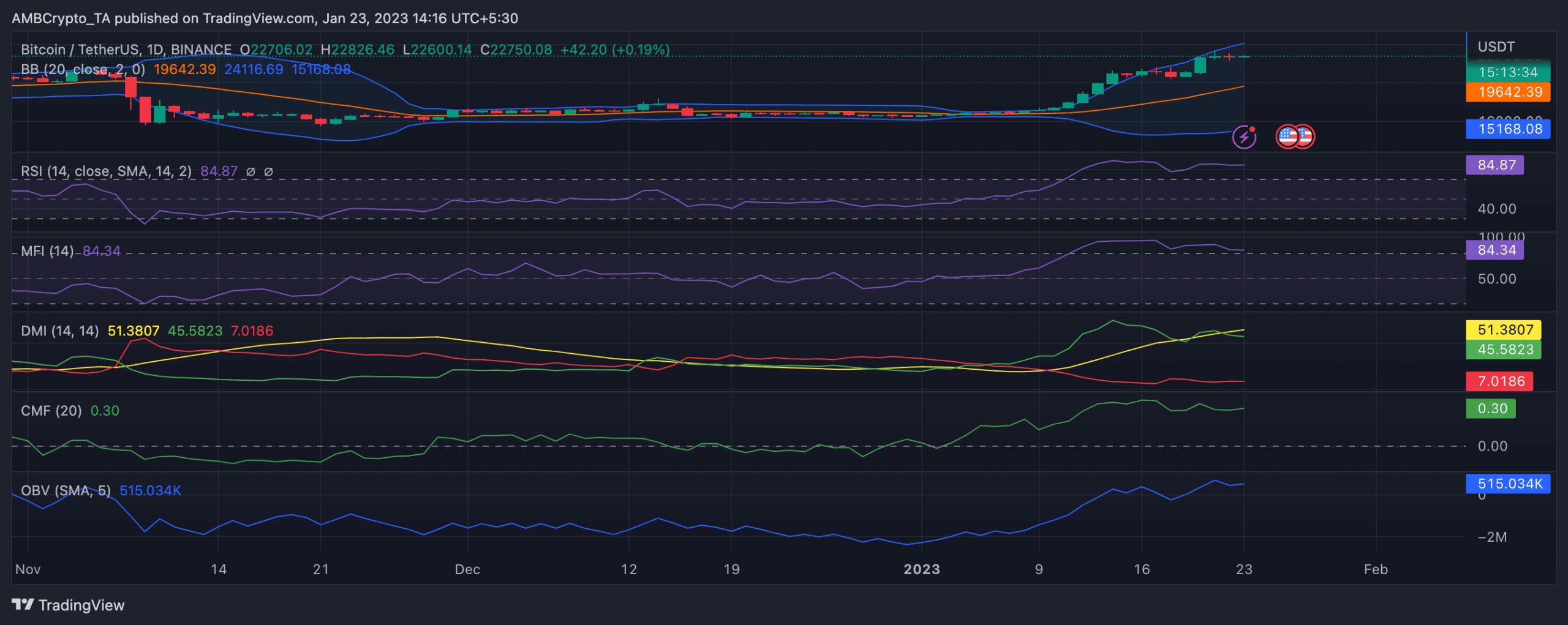

Every day chart evaluation revealed bullish sentiment lingered within the BTC market and has so been for the reason that 12 months began. With elevated coin accumulation up to now few weeks, BTC’s Relative Power Index (RSI) and Cash Stream Index (MFI) had been each pegged at 84 at press time. At this spot, BTC was presently overbought.

Moreover, the coin’s on-balance quantity has risen persistently for the reason that 12 months started. At press time, this was 515,034. An upward pattern in OBV means that the amount of shopping for is bigger than the amount of promoting, which is often a bullish sign for the asset’s value.

Additional, the dynamic line (inexperienced) of the main coin’s Chaikin Cash Stream (CMF) rested above the middle line at a optimistic 0.30 at press time. A rising optimistic CMF above the zero line is an indication of energy out there.

The energy of the bullish pattern within the BTC present market was confirmed by the place of the Common Directional Index (ADX). As of this writing, the ADX (yellow) was 51.

When an asset’s ADX is above 25, this means that the present market pattern is robust. With an ADX of 51, the consumers’ energy would possibly turn out to be irrevocable by BTC sellers within the quick time period.

Lastly, BTC’s Open Curiosity has been on a rally for the reason that 12 months began, knowledge from CoinGlass revealed. At $11.13 billion at press time, BTC’s Open Curiosity has risen by 21% since 1 January. A rising Open Curiosity is a sign of rising bullish sentiment, which additional drives the expansion of an asset’s value.

[ad_2]

Source link