[ad_1]

- Similar BTC transactions on 5 January may need kickstarted the present rally.

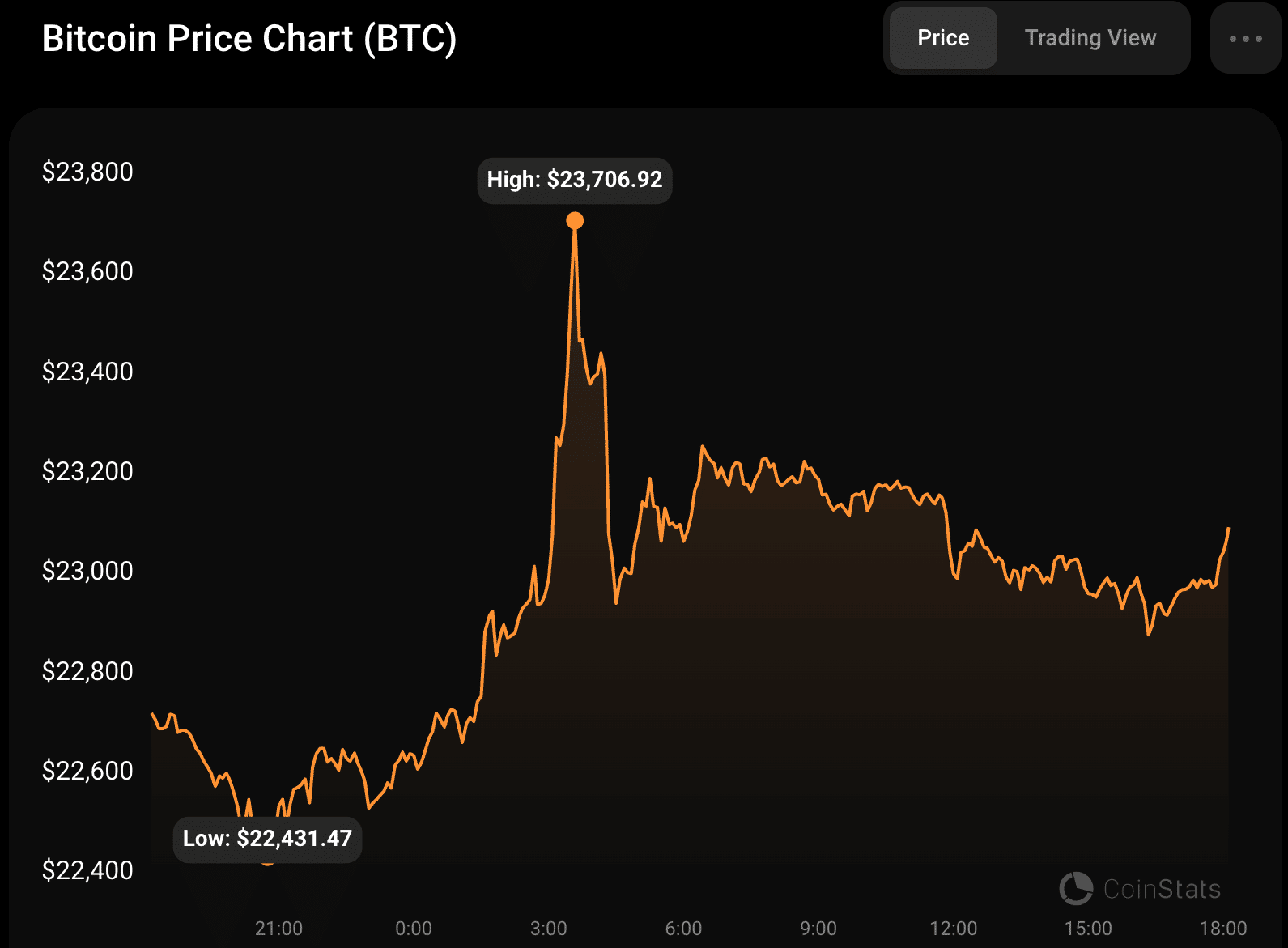

- BTC flirts with the $23,000 area because it makes an attempt to type a brand new help line.

Lately, the worth of Bitcoin (BTC) rose, affecting your complete crypto market. The bulls’ swing began the present run that the coin is now seeing. In response to current studies of tracked transactions, there are indications that some bulls might have taken the initiative for the present surge with vital trades.

Supply: Coinstats

How a lot was transferred, and the way has BTC carried out to date for the reason that surge began?

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

Whales load up BTC

When the 12 months turned, Bitcoin (BTC), which had beforehand been in a downtrend, unexpectedly skilled a resurgence that sparked a rally. In response to the BTC value chart, the rally began round 5 January and has been going up.

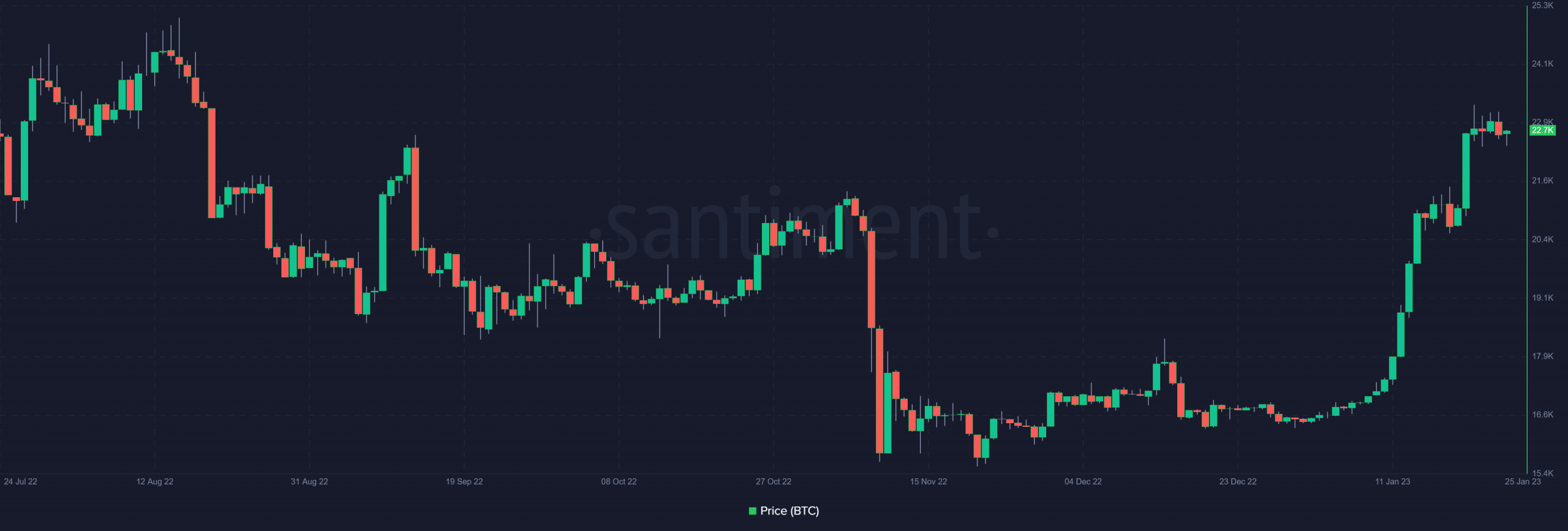

A better examination of BTC transactions on 5 January might reveal extra details about what brought about the resurgence, in response to current studies from Santiment.

There had been whale motion within the BTC market earlier than the surge, in response to the transaction information from Santiment. Nonetheless, a number of equivalent transactions have been made, which is a key issue within the surge.

There have been two transactions on 5 January, every totaling 15,477.92 BTC. That will have been an enormous coincidence, however the value of BTC then started to rise.

BTC flirts with $23,000 and stays bullish

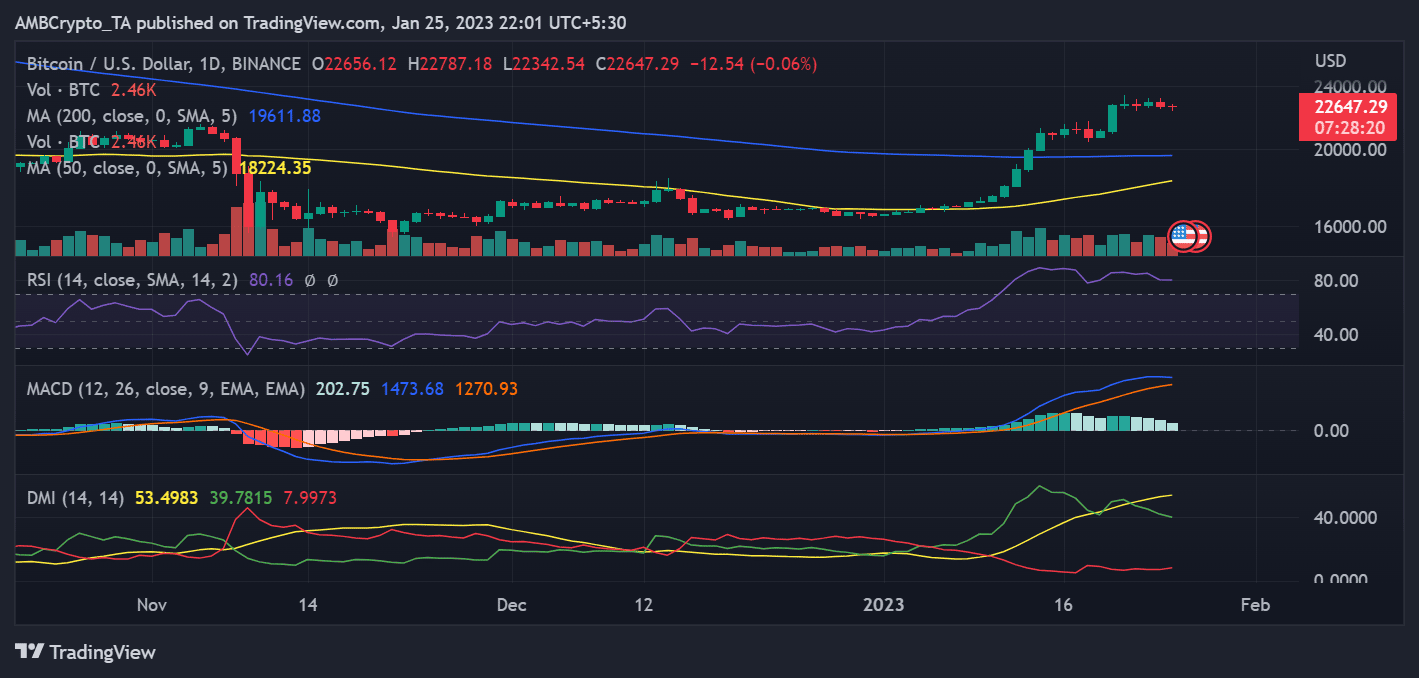

Bitcoin (BTC) circled the $23,000 space between 21 and 24 January. It’s but to essentially have the ability to break by means of the $22,000 space because it began its rally.

It was buying and selling at a loss on the time of this writing, seemingly persevering with the earlier buying and selling interval’s sample and bringing the loss to about 1.5%. BTC is making an attempt to create a help stage close to the $22,000 space regardless of the loss, which was little nonetheless.

One other indication of a market correction is the place of BTC on the RSI. BTC continued strongly trending upward on the Relative Energy Index (RSI). The RSI’s place additionally demonstrated that it was firmly positioned within the oversold space. Nonetheless, if a downturn have been to begin, the lengthy Shifting Common (blue line) is perhaps its help.

How a lot are 1,10,100 BTCs worth today

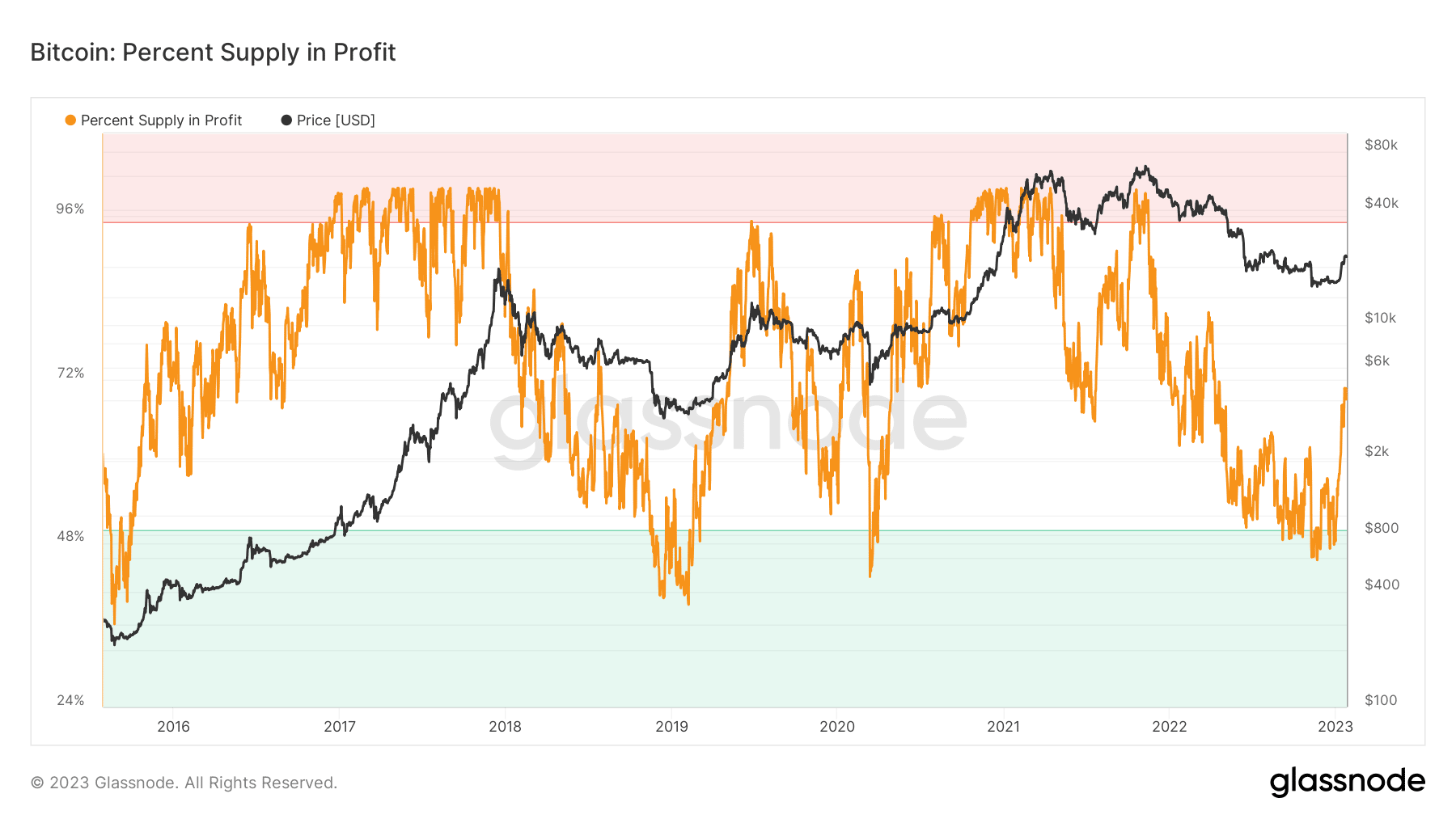

% provide in revenue at 7-month excessive

The rise in BTC’s value has additionally affected the p.c provide in revenue. The Glassnode graph confirmed that the share of BTC provide that was in revenue was over 70%. Upon a more in-depth examination of the indicator, the present provide within the revenue stage is the best it has been in additional than seven months.

[ad_2]

Source link

![Decoding key reasons behind Bitcoin’s [BTC] January price rally](https://cryptowizz.net/wp-content/uploads/2023/01/kanchanara-rhm7H8X5J98-unsplash-1000x600-750x375.jpg)