[ad_1]

- Ethereum’s SSV community unveils a brand new fund that helps additional decentralization.

- SSV bulls could also be headed for a cliff after the robust efficiency within the final two months.

Ethereum is pretty well-liked within the blockchain enviornment, with a lot of the consideration it will get going towards mainnet and layer 2 networks.

Its decentralization infrastructure has comparatively flown below the radar; there may be one specific phase that doesn’t obtain sufficient consideration and that’s decentralization infrastructure.

Ethereum’s shift to Proof of Stake opened the doorways to a wholly new construction of incentivized community participation. SSV Community, an open-source, decentralized Ethereum stake protocol goes the additional mile to assist decentralization.

Its DAO, dubbed the SSV community just lately unveiled a $50 million fund aimed toward supporting the creation of extra functions utilizing Distributed Validator Know-how (DVT).

The pursuit of extra decentralization

Current reviews counsel that the fund represents a path via which to facilitate extra decentralization and right here’s how- SSV Community goals to push for DVT as the primary Ethereum infrastructure.

This is similar know-how championed by Vitalik Buterin as the perfect path for making certain decentralization.

If profitable, its footprints will probably be evident within the type of extra assist for decentralized staking options. It may also assist a extra sturdy progress path for the SSV community and its native SSV token.

Extra worth for SSV?

SSV already boasts a number of use circumstances which embrace governance, voting, and operator funds. A broader influence on the general Ethereum ecosystem could enhance SSV’s demand.

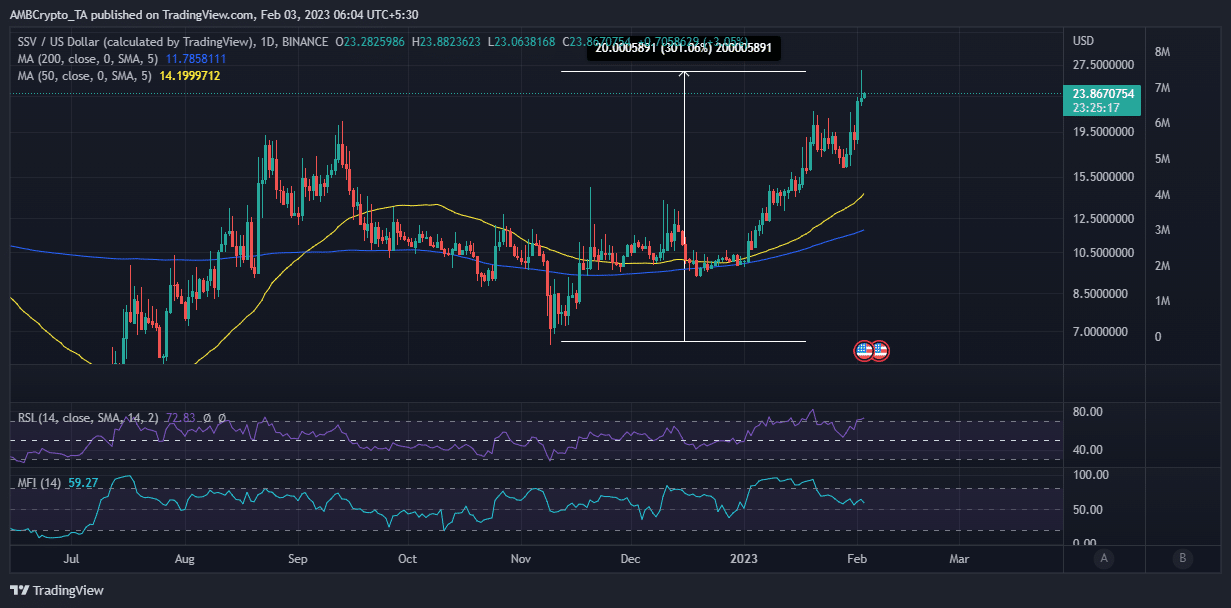

The latter has far pushed SSV into the record of the best-performing tokens. For perspective, it’s up by over 300% from its November lows. Additionally, it just lately managed to drag off a brand new 12-month excessive due to robust demand.

Can SSV keep the rally? Effectively, its MFI means that there have been a large quantity of outflows in the previous few days. As well as, the RSI is forming a price-RSI divergent sample which suggests {that a} retracement is within the works.

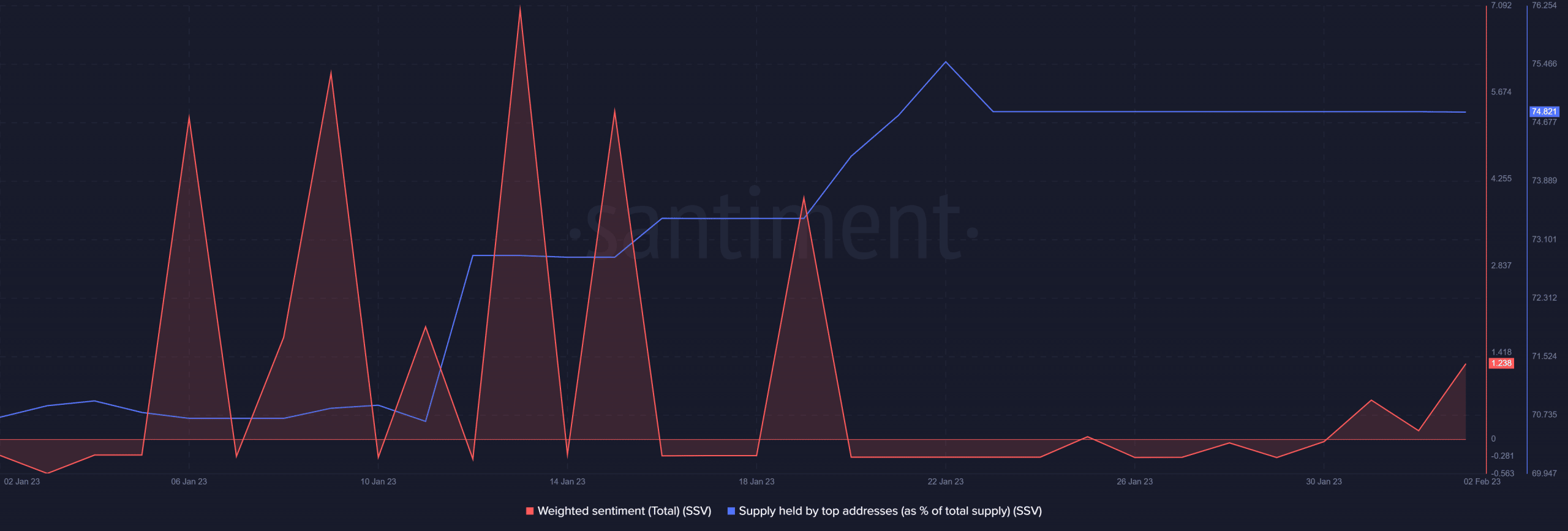

SSV’s on-chain metrics are additionally flashing fascinating alerts. That won’t essentially align with the bearish expectations. For instance, the availability of SSV held by prime addresses has remained unchanged for nearly two weeks, which means whales aren’t contributing to promoting stress.

What number of are 1,10,100 SSVs worth today?

Moreover, the weighted sentiment has barely improved in favor of the bulls because the finish of January.

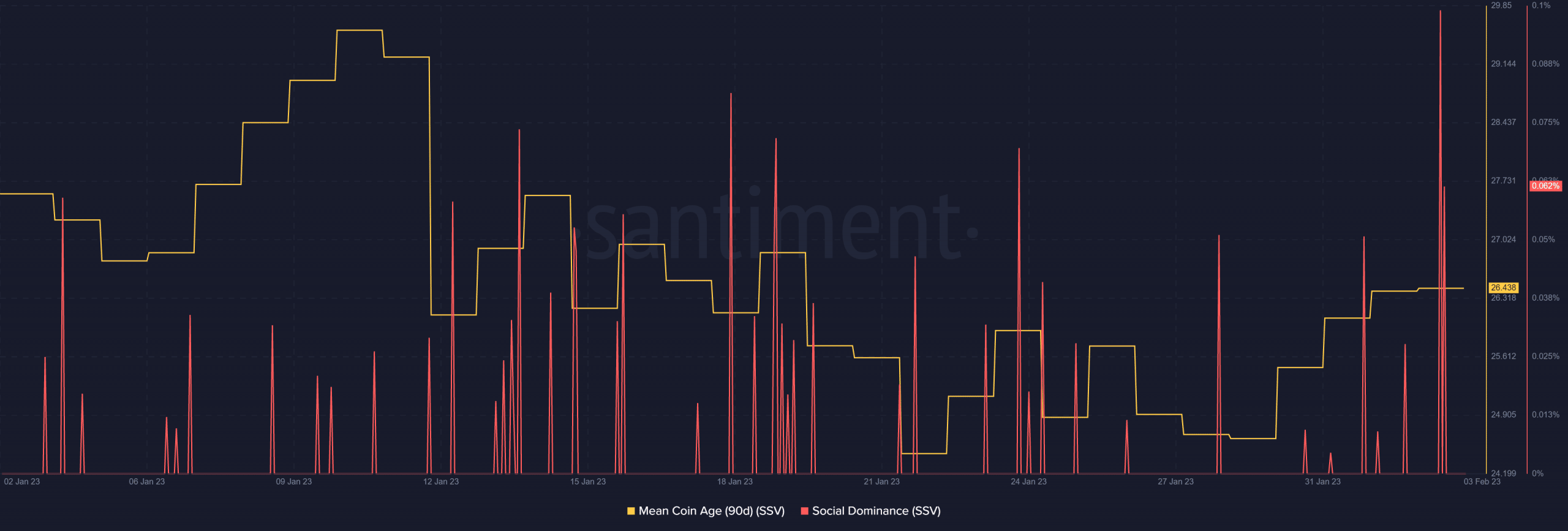

This can be a affirmation that traders’ sentiment is bettering. The 90-day imply coin age metric did register some upside confirming a rise within the stage of patrons bearing the present highs.

This was backed by a current surge in social dominance to a brand new month-to-month excessive.

If something, these indicators are bullish, however that is opposite to the worth sample that means a better chance of a reversal.

[ad_2]

Source link