[ad_1]

The full market cap of the NFT collections deployed on Ethereum (ETH) recorded a 59.6% drop in 2022, in keeping with a DappRadar report.

The combination market cap of the ETH-based NFT tasks began the 12 months 2022 at $9.3 billion and ended at $3.7 billion, in keeping with the report. Nevertheless, numbers from January point out that the NFT market began to flourish, which incorporates ETH-based NFTs.

Yuga Labs

ETH has 81 NFT collections deployed on its chain. The numbers point out that Yuga Labs NFTs account for 67% of the entire NFT market cap on the ETH chain.

Yuga Labs embrace widespread NFT collections like CryptoPunks, Bored Ape Yacht Membership (BAYC), Bored Ape Kennel Clum (BAKC), Mutant Ape Yacht Membership (MAYC), Meebits, and Otherdeeds for Otherside.

Collectively, CryptoPunks and BAYC account for 46.7% of the entire ETH NFT market cap. BAYC, with a flooring worth of $98,438, recorded a $49 million buying and selling quantity in January.

NFTs in January

In January, the NFT buying and selling quantity recorded a 38% progress from about $700 million in December 2022, in keeping with one other report by DappRadar. The present buying and selling quantity, $946 million, marks an all-time excessive since June 2022. NFT gross sales rely additionally elevated from 6.7 million in December to 9.2 million in January, reflecting a 42% progress.

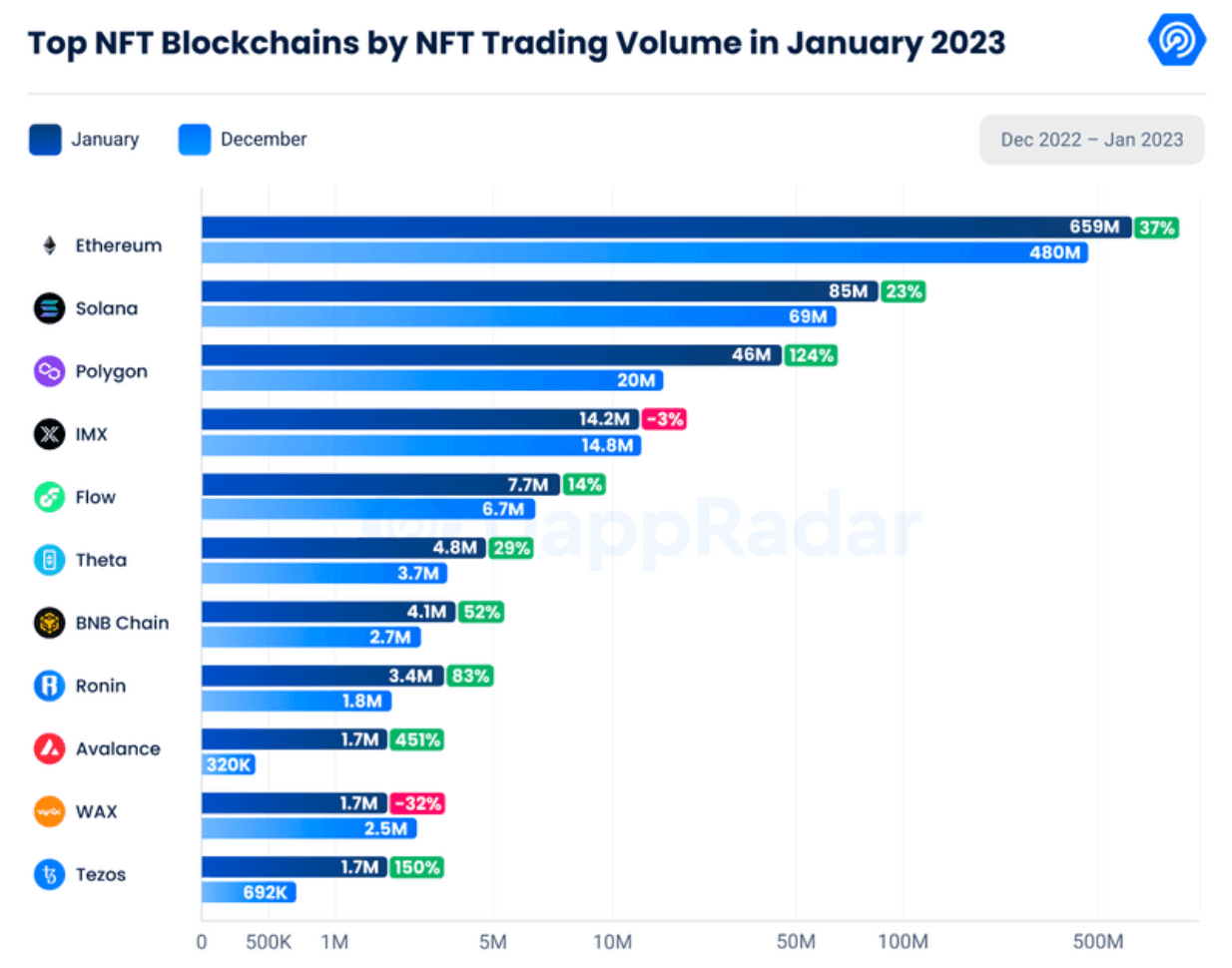

ETH additionally ranks first within the highest NFT buying and selling quantity. The chain’s buying and selling quantity recorded a 37% enhance from $480 million in December 2022 to $659 million in January.

Solana (SOL) and Polygon (MATIC) adopted ETH because the second and third with $85 million, and $46 million, respectively. Whereas SOL recorded a 23% enhance from December’s $69 million, MATIC stood out by recording the third-highest progress price of the month with 124%.

Avalanche (AVAX) and Tezos (XTZ) recorded the primary and second-largest month-to-month progress charges, with 451% and 150%, respectively. Immutable X (IMX) and WAX (WAXP) blockchains, alternatively, recorded -3% and -32% decreases in January, respectively.

[ad_2]

Source link