[ad_1]

- Bitcoin and ETH derivatives register wholesome restoration alongside spot demand.

- Nonetheless, demand continues to be comparatively low as merchants proceed cautiously.

The crypto market’s efficiency on a YTD foundation has been completely different from the bearish efficiency final yr. We’ve seen sturdy demand restoration, particularly from the spot market.

A current evaluation revealed how Bitcoin and ETH derivatives demand faired throughout the identical interval.

Real looking or not, right here’s ETH market cap in BTC’s terms

Analysis carried out by Deribit Insights highlighted some attention-grabbing observations about derivatives demand for BTC and ETH.

The evaluation seems to be into a number of aspects of the derivatives market. It notes that whereas bullish demand has returned for the reason that begin of 2023, the derivatives demand has been a bit restrained. However, each BTC and ETH achieved substantial demand particularly segments.

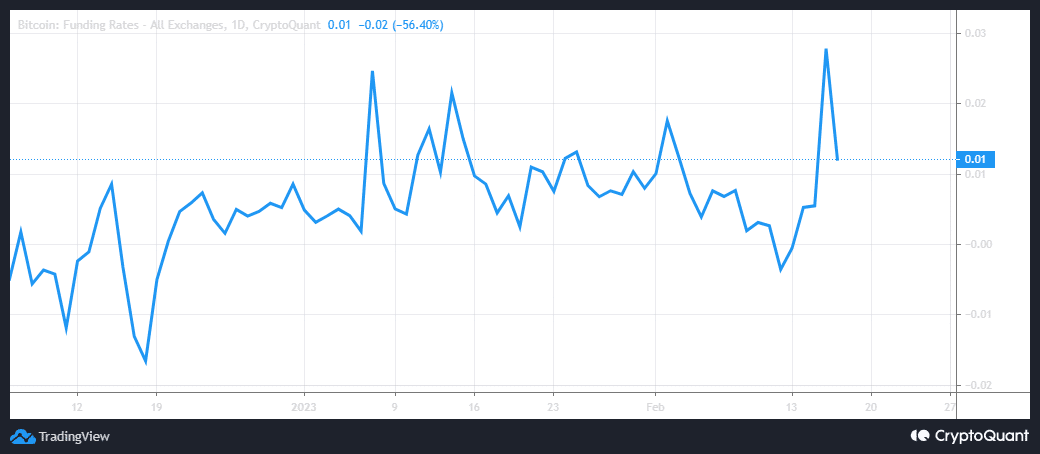

The Bitcoin and ETH funding charges

BTC’s funding fee registered some exercise in January and even much less within the first half of February. Nonetheless, the newest rally triggered a big spike in Bitcoin funding charges to greater ranges than spot demand.

The newest spike which peaked on 16 February marks the very best degree of BTC funding fee seen to this point on a YTD foundation.

Issues are a bit completely different on ETH’s side. It rapidly surged from zero firstly of the yr to 0.03 by mid-January. It fell to zero as soon as once more by mid-February adopted by one other spike within the final two days.

Regardless of one other spike, ETH’s funding fee didn’t handle to push to earlier highs, thus indicating decrease demand.

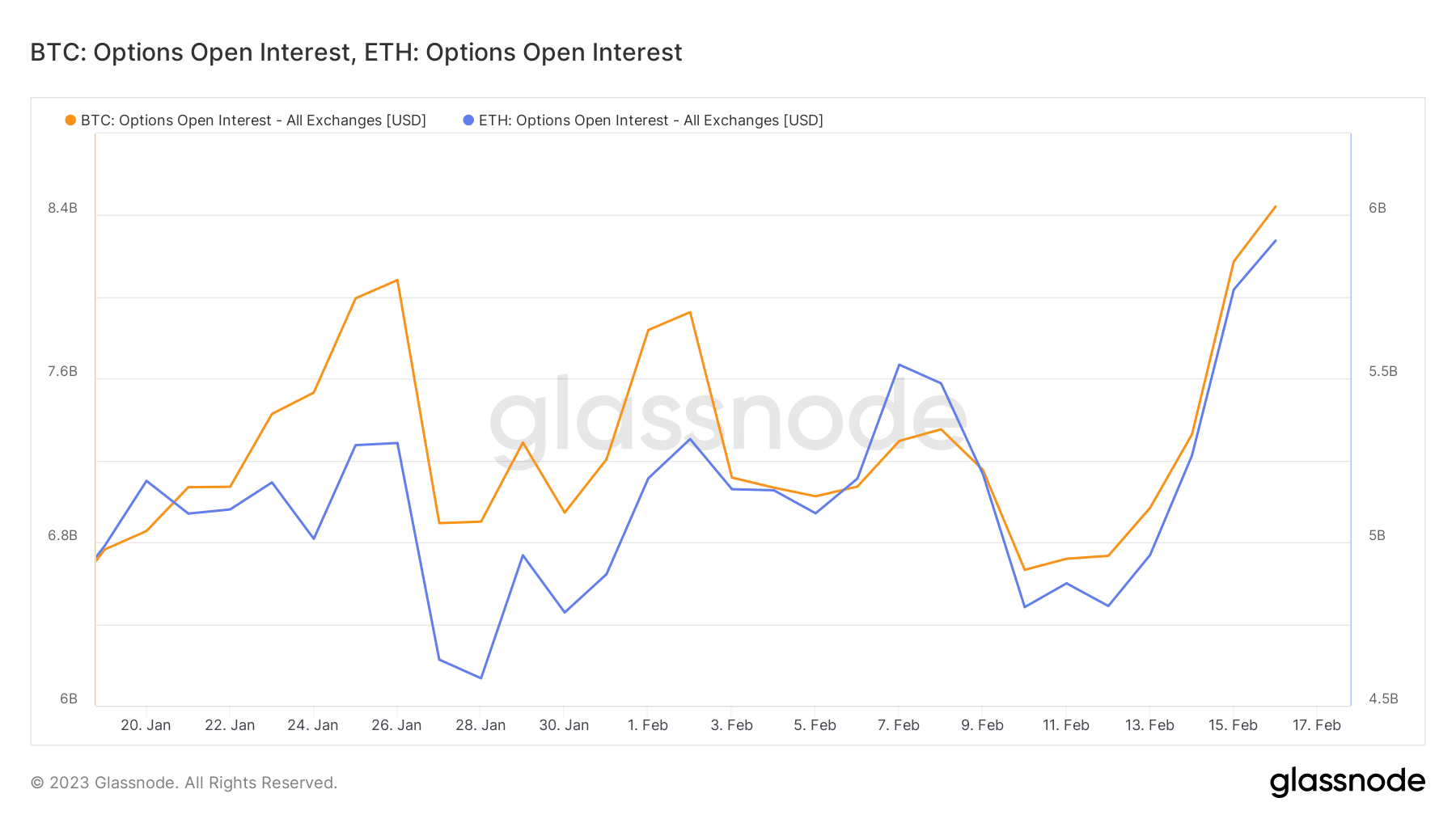

BTC and ETH Choices open curiosity comparability

Bitcoin and ETH’s open curiosity metrics have been up and down for the final 4 weeks. Extra noteworthy is that BTC outperformed ETH on this regard no less than for the second half of January. Nonetheless, ETH’s open curiosity has been greater in February to this point.

As well as, each the BTC and ETH choices open curiosity metrics are presently at a brand new YTD peak. Maybe a sign of elevated confidence available in the market.

The Deribit report confirms that ETH and BTC annualized yields have recovered considerably in step with spot demand.

Conclusion

The frequent theme with the above findings is that derivatives demand for BTC and ETH are in restoration mode. Nonetheless, there’s nonetheless some restraint available in the market.

The explanation for that is that buyers took on heavy losses and this has pressured many to take a extra conservative stance. We could, nonetheless, see a better urge for food for threat if the market goes via a state of euphoria as seen in 2021.

[ad_2]

Source link