[ad_1]

- New evaluation instructed that BTC’s worth may decline within the coming days.

- On-chain metrics and some market indicators appeared bearish.

For the previous few days, the crypto market has been on a bullish streak, inflicting the costs of most cryptos to rise. Bitcoin [BTC], the market chief, additionally benefited from the scenario.

In accordance with CoinMarketCap, BTC’s worth was up by greater than 3% and 13% during the last 24 hours and the final seven days, respectively. On the time of writing, BTC was buying and selling at $24,482.41 with a market capitalization of greater than $472.4 billion. Nevertheless, the desk may flip quickly.

Learn Bitcoin’s [BTC] Price Prediction 2023-24

Hassle within the close to time period

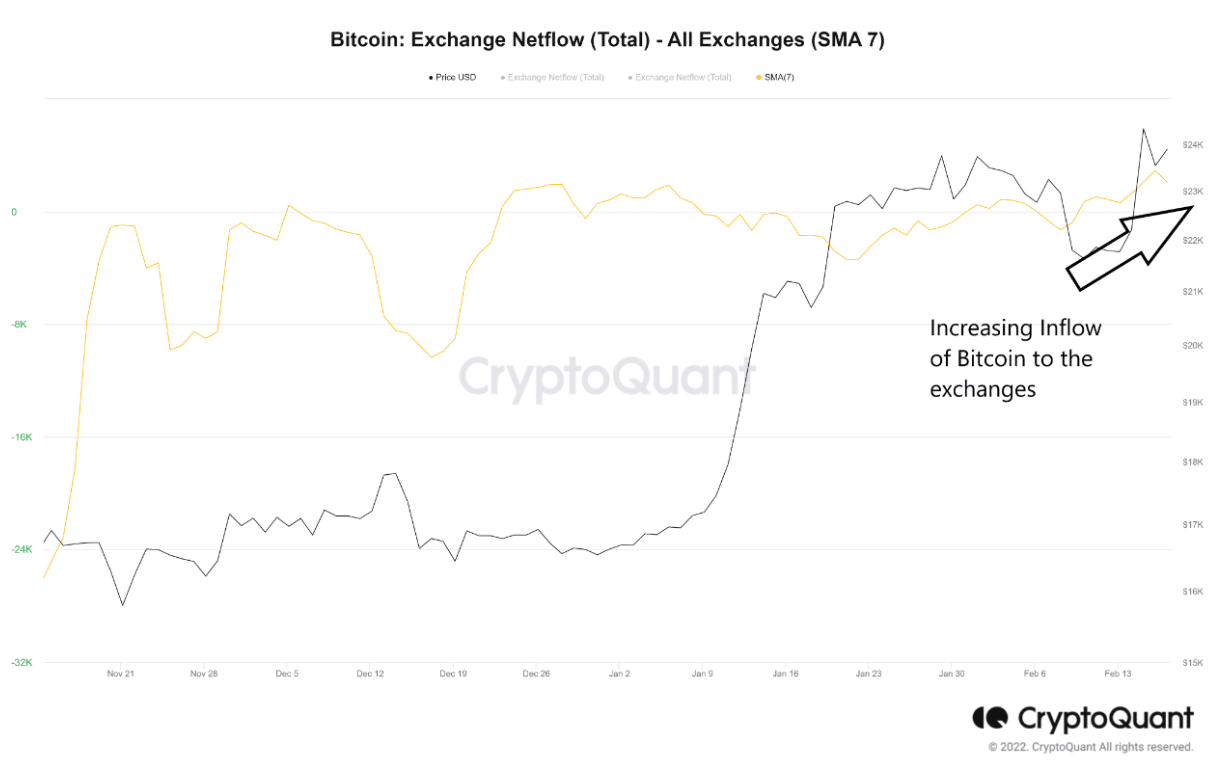

CryptoOnchain, an writer and analyst at CryptoQuant, posted an analysis on 17 February, which instructed BTC’s good days may quickly finish. As per the evaluation, there was a rise within the influx of Bitcoins to exchanges and the outflow of stablecoins from exchanges – a bearish sign.

A number of different metrics additionally appeared bearish for BTC. As an illustration, Glassnode Alerts revealed that Bitcoin’s steadiness on exchanges reached a one-month excessive of two,267,202.721 BTC.

📈 #Bitcoin $BTC Steadiness on Exchanges simply reached a 1-month excessive of two,267,202.721 BTC

Earlier 1-month excessive of two,266,916.823 BTC was noticed on 19 January 2023

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/h8ytX0U6f6

— glassnode alerts (@glassnodealerts) February 18, 2023

As per CryptoQuant’s data, BTC’s alternate reserve was additionally on the rise, suggesting increased promoting stress. On prime of that, the aSORP was additionally within the crimson, so extra buyers had been promoting at a revenue, indicating a attainable market prime.

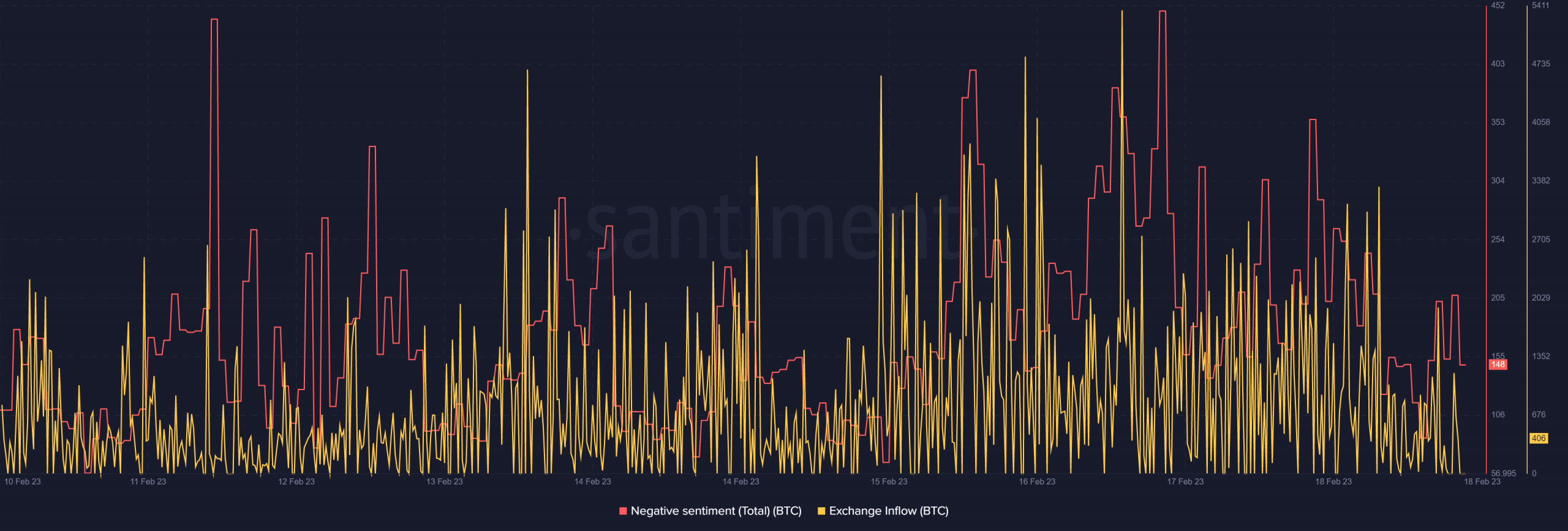

Demand from the derivatives market additionally appeared to dwindle, as BTC’s taker purchase promote ratio instructed that promoting sentiment was dominant within the futures market. In accordance with Santiment’s chart, BTC’s alternate influx spiked in the previous few days. Furthermore, damaging sentiments round BTC additionally went up, reflecting much less belief amongst buyers.

Is your portfolio inexperienced? Examine the Bitcoin Profit Calculator

Bitcoin: What the metrics should say

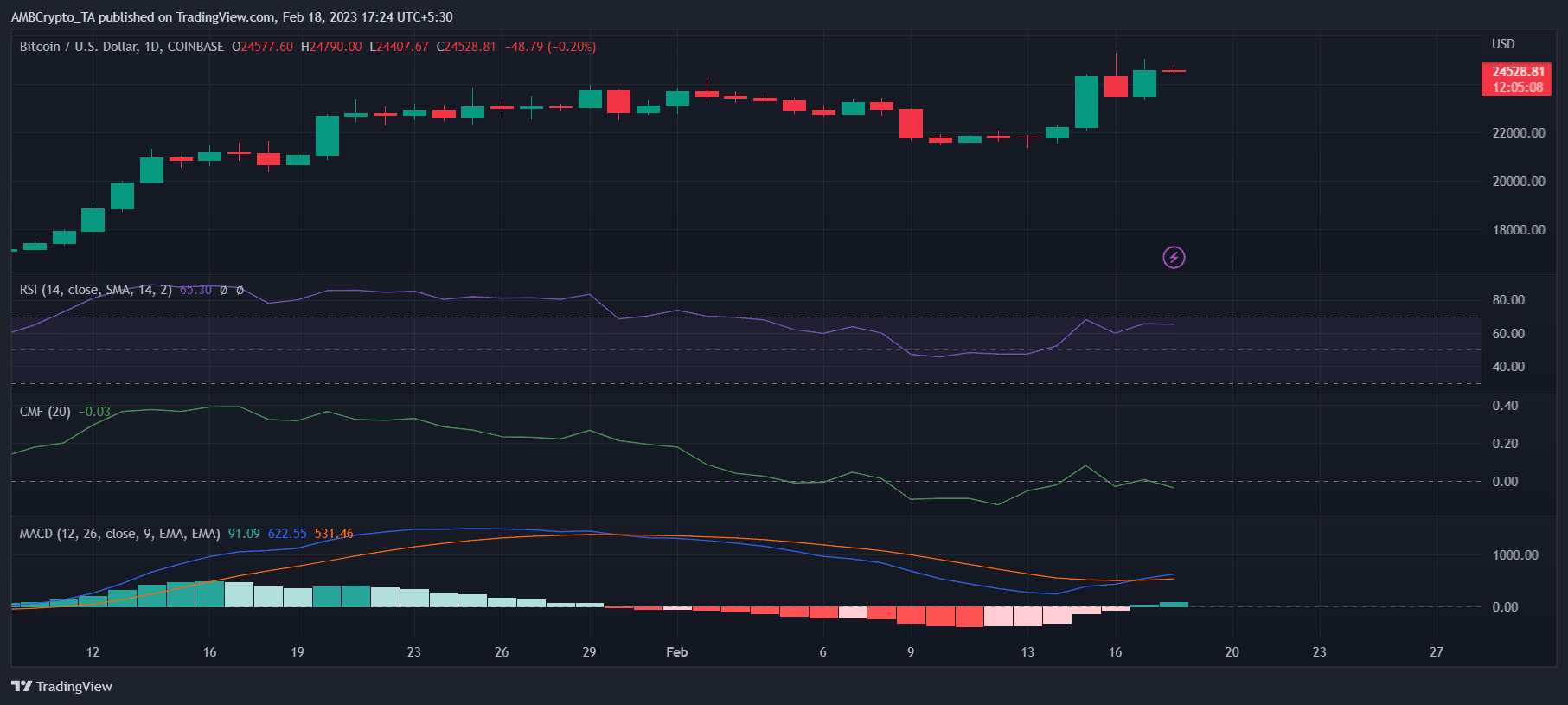

Persevering with with the bearish pattern, BTC’s Relative Power Index (RSI) was hovering close to the overbought zone, which could improve promoting stress. Furthermore, the king coin’s Chaikin Cash Stream (CMF) registered a downtick and was headed additional under the impartial mark.

Regardless, the MACD displayed a bullish crossover, giving hope for a continued uptrend within the quick time period.

[ad_2]

Source link

![Bitcoin [BTC]: Trend reversal on the horizon? Analysts say…](https://cryptowizz.net/wp-content/uploads/2023/02/BTC-1-1000x600-750x375.jpg)