[ad_1]

- As per an analyst, BTC’s LTH SOPR had been trending beneath one since late Might 2022.

- Mining exercise on the BTC community was considerably impacted by the king coin’s value.

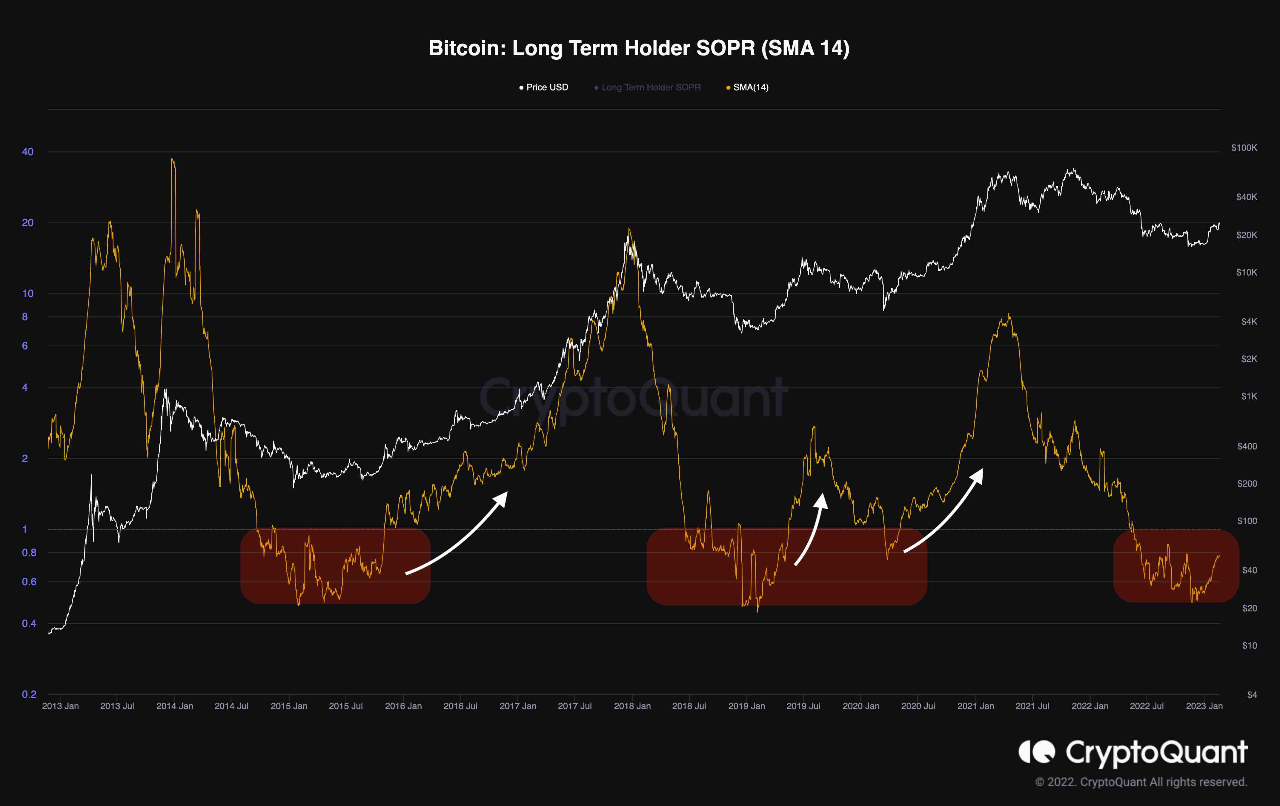

On-chain evaluation of the main coin’s efficiency revealed that the year-to-date (YTD) rally in Bitcoin’s [BTC] value has prompted its long-term spent Output Revenue Ratio (LTH SOPR) metric to develop.

In accordance with Glassnode Academy, the SOPR metric is used to grasp the general market sentiment and analyze profitability and losses incurred throughout a selected interval for a selected crypto asset.

As well as, the indicator tracks the quantity of revenue realized for all on-chain coin transactions.

Learn BTC’s Value Prediction 2023-2024

So far as BTC is worried, the LTH SOPR provides insights into the psychology of long-term holders throughout a bear market. When the metric is beneath one, it means that long-term holders are realizing losses and could possibly be motivated to promote.

Conversely, when the metric is above one, long-term holders are realizing income and could also be inspired to carry or accumulate extra BTC.

CryptoQuant pseudonymous analyst Greatest Trader famous that the bearishness that plagued the 2022 buying and selling 12 months resulted in important losses for market members, together with long-term traders per the LTH SOPR.

In accordance with Best Dealer, the LTH SOPR had been trending beneath one since late Might 2022, indicating that long-term holders consistently misplaced cash.

Nevertheless, with the final uptrend within the crypto market for the reason that 12 months started, “the metric began recovering and barely elevated as a result of uptrend in Bitcoin’s value,” Best Dealer discovered.

Whereas this is likely to be taken as conclusive proof {that a} bull market was underway, Best Dealer opined that:

“But, it’s nonetheless too early to call the $15.5K stage the bear market’s backside, because the current impulsive rally might simply be a bull entice.”

The analyst warned additional that it was pertinent for merchants and traders to intently monitor the SOPR metric within the quick time period to anticipate potential value course and market sentiment.

Maintain your eyes on the miners

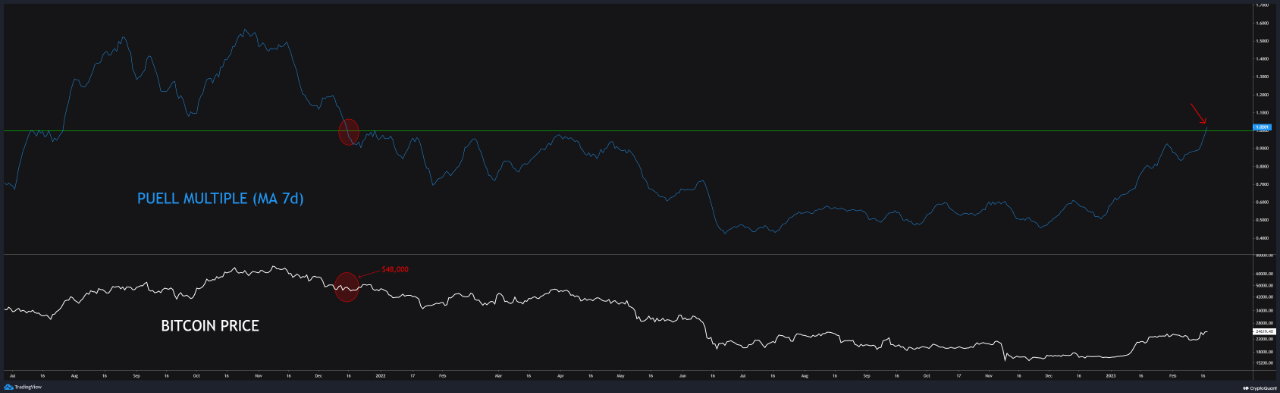

Mining exercise on the BTC community is considerably impacted by the king coin’s value and vice versa. In accordance with CryptoQuant analyst Gaah, miners are the one entity that requires an ongoing price, equivalent to working electrical energy, so their behaviors are all the time tied to BTC’s value.

Due to this fact, the research of metrics equivalent to Puell A number of, which compares the estimated 365-day common income to miners’ short-term income, turns into essential for figuring out the long run course of BTC’s value because it provides insights into miner habits.

How a lot are 1,10,100 BTC worth today?

Gaah discovered that for the reason that final native value fund in November 2022, the typical miners’ income has doubled in comparison with the earlier 12 months.

This improve in common income could cowl the mining prices, decreasing the necessity for miners to promote their BTC and, in flip, reducing the promoting strain available on the market.

In accordance with Gaah, within the quick time period, Puell a number of values above 1.00 are important to measuring the attainable future habits of miners.

If the typical income continues to extend, miners could not have to promote their BTC to cowl their prices. Therefore, it stays a key metric to concentrate to.

[ad_2]

Source link

![Bitcoin [BTC]: The two metrics that are crucial to your holdings this week](https://cryptowizz.net/wp-content/uploads/2023/02/aleksi-raisa-DCCt1CQT8Os-unsplash-1-2-1000x600-750x375.jpg)