[ad_1]

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

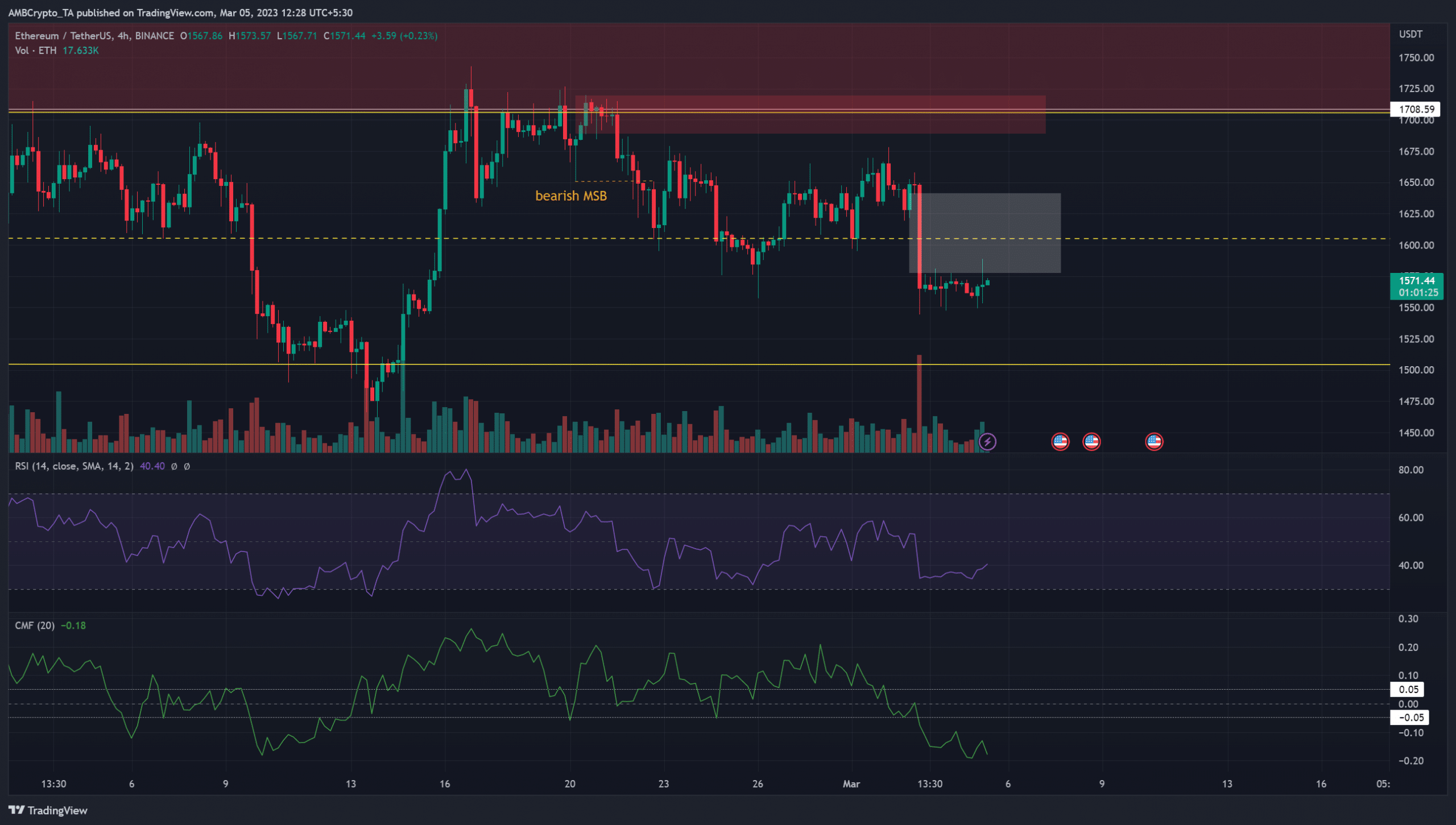

- The market construction was bearish on the 4-hour chart and strongly hinted at additional losses.

- An imbalance above Ethereum costs meant a small bounce might arrive quickly.

Ethereum costs noticed a rejection on the $1715 stage and the development has been bearish since then. Nevertheless, the asset has traded inside a variety since mid-January. May ETH descend to $1500 from right here?

How a lot are 1, 10, and 100 Ethereum worth right this moment?

A recent report highlighted that Ethereum trade provides had fallen, which instructed promoting strain won’t spike. Then again, the worth motion confirmed that the decrease timeframe was bearish. How a lot decrease will the costs go?

The $1600 space may very well be retested earlier than one other transfer down

The aforementioned vary was highlighted in yellow. It prolonged from $1505 to $1708, with the mid-range at $1606. All three ranges have been important prior to now six weeks. Particularly, the mid-range was revered a number of occasions, which underlined the credibility of the vary.

On 22 February the market construction flipped to bearish and was marked in orange. Since then, the worth continued to make a sequence of decrease highs and decrease lows.

The RSI was additionally beneath impartial 50 to point out bearish momentum at press time. The CMF stood properly under -0.05 to point out heavy capital circulate out of the market.

Is your portfolio inexperienced? Examine the Ethereum Profit Calculator

After the sharp fall in costs on Friday, the market has moved sideways. An necessary factor to notice was the massive imbalance left on the charts, highlighted in white. It was doubtless that this honest worth hole will get stuffed partially or fully within the coming days.

This imbalance has confluence with the mid-range mark as properly. Subsequently brief sellers can watch for a retest of $1600-$1610 earlier than on the lookout for promoting alternatives.

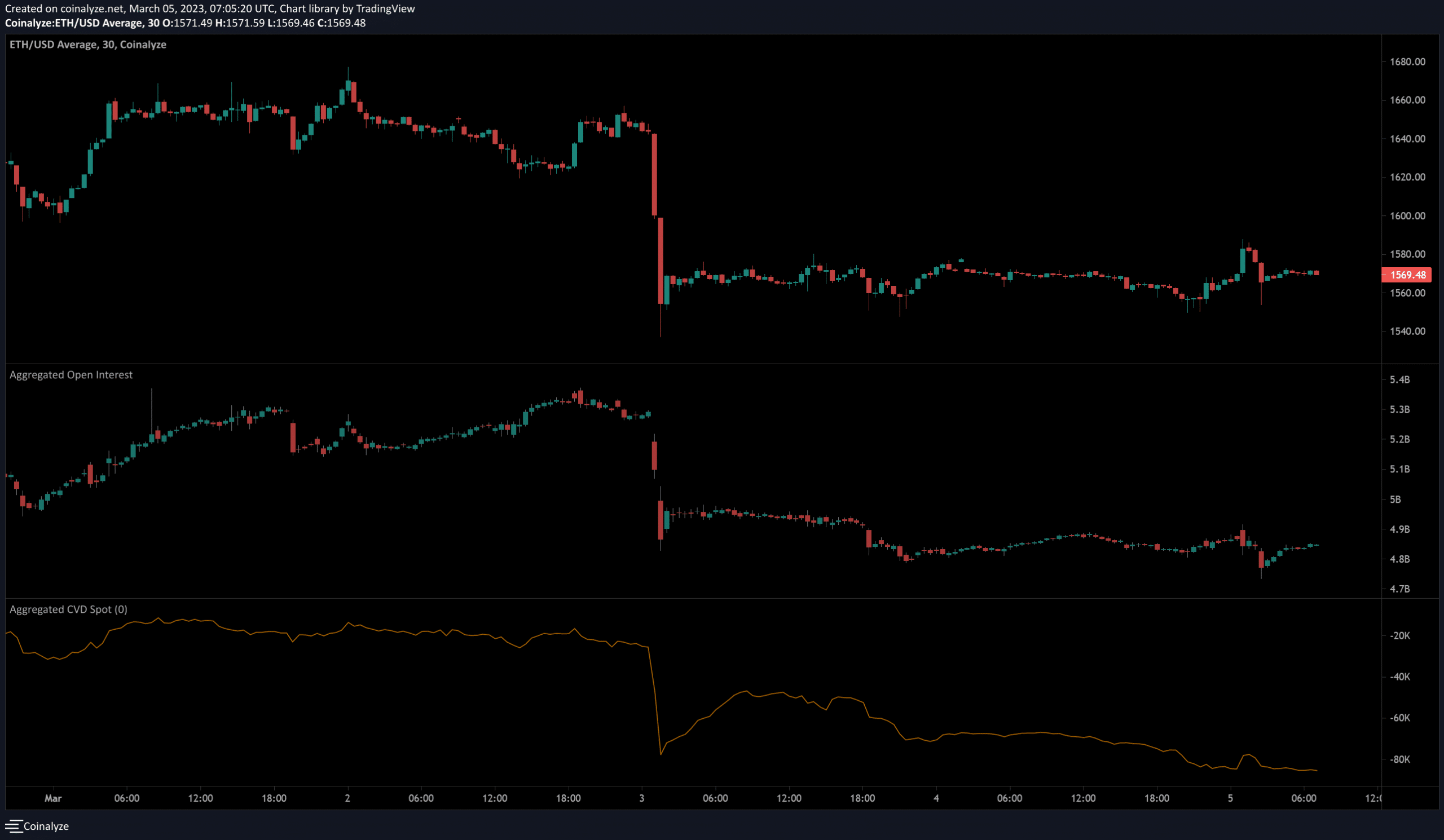

Flat Open Curiosity confirmed sidelined market individuals

Supply: Coinalyze

After the autumn on 3 March, the Open Curiosity didn’t budge by a big margin. The small transfer up from $1550 to $1588 was accompanied by a commensurate rise within the Open Curiosity.

The shortage of volatility meant OI didn’t rise and fall sharply, which instructed many ETH futures merchants remained sidelined.

In the meantime, the spot CVD continued to sink decrease and decrease. This indicated robust, persistent promoting strain prior to now three days, and supported the notion that Ethereum would sink to $1500 quickly.

[ad_2]

Source link