[ad_1]

Knowledge from Glassnode reveals that Bitcoin’s newest rejection across the $23,800 degree coincided with the price foundation of a selected whale group.

Whales Who Purchased Following December 2018 Have Their Value Foundation At $23,800

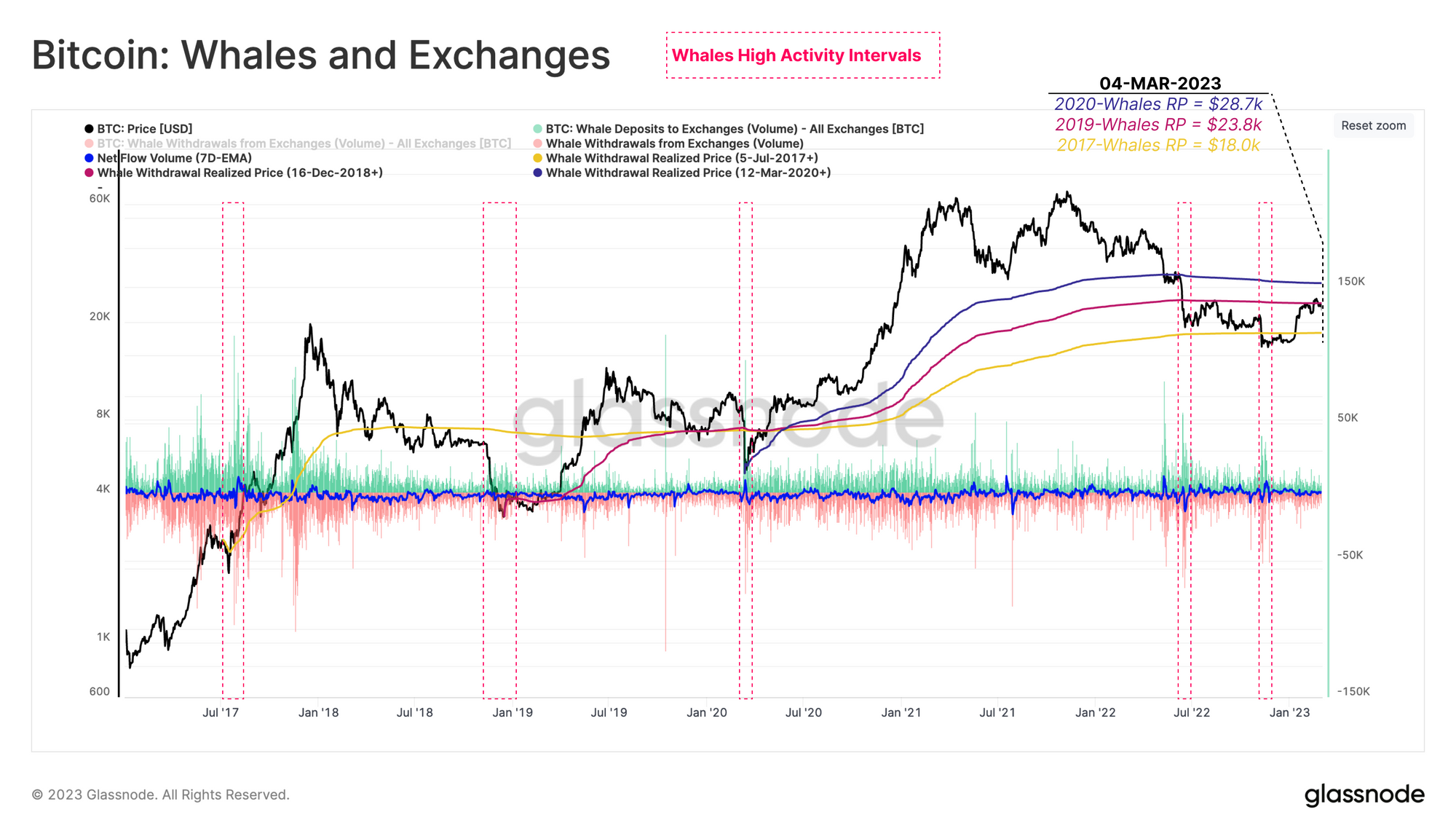

Based on the most recent weekly report from Glassnode, all three whale teams being thought-about right here went underwater for some time after the FTX crash occurred final yr.

The related indicator right here is the “realized price,” which is a worth derived from the realized cap. This capitalization mannequin for Bitcoin assumes that the precise worth of every coin within the circulating provide isn’t the present BTC worth (because the market cap says), however the worth at which it was final moved.

When this cover is split by the entire variety of cash in circulation, the realized worth is obtained. The importance of this metric is that it represents the common acquisition worth within the BTC market.

Which means when the conventional worth of Bitcoin sinks beneath this realized worth, the common holder goes right into a state of loss. This realized worth is the common value foundation of the complete market, however the indicator will also be outlined for particular parts of the market.

An essential cohort for any cryptocurrency is the “whale” group, which, within the case of BTC, contains all traders which are holding no less than 1,000 cash of their wallets. As this group is massive and various, Glassnode has divided it into three subgroups to review essentially the most favorable realized costs throughout completely different eras.

The analytics agency has divided these teams through the use of completely different acquisition begin factors for every. For the primary group, the cutoff is July 2017, which was the launch of the cryptocurrency trade Binance.

For the second, it’s December 2018 (the bear market lows of the earlier cycle), and for the final one, it’s the COVID backside in March 2020. Additionally, with the intention to discover at what actual costs these whales have been shopping for their cash, Glassnode has solely thought-about trade transactions right here (as this cohort often makes use of these platforms for purchasing and promoting).

Here’s a chart that reveals how the price bases of those Bitcoin whale subgroups have modified over time:

The realized costs of the completely different whale subgroups available in the market | Supply: Glassnode's The Week Onchain - Week 10, 2023

As displayed within the above graph, the 2017+ period whales have their realized worth at round $18,000 proper now, suggesting that the common whale that has acquired their cash between right this moment and 2017 is in a state of revenue proper now.

The 2018+ and 2020+ whales, nevertheless, appear to be in losses at the moment as their realized costs are $23,800 and $28,700, respectively. Curiously, the resistance that Bitcoin has been dealing with lately is roughly the identical degree as the price foundation of the previous group of whales.

That is clearly seen within the chart, the place the most recent rally could be seen to have come to a halt because the cryptocurrency’s worth has encountered this degree. Previously, value foundation ranges like these have often provided resistance to the worth due to the truth that traders, who had beforehand been in loss, see such ranges as very best promoting home windows.

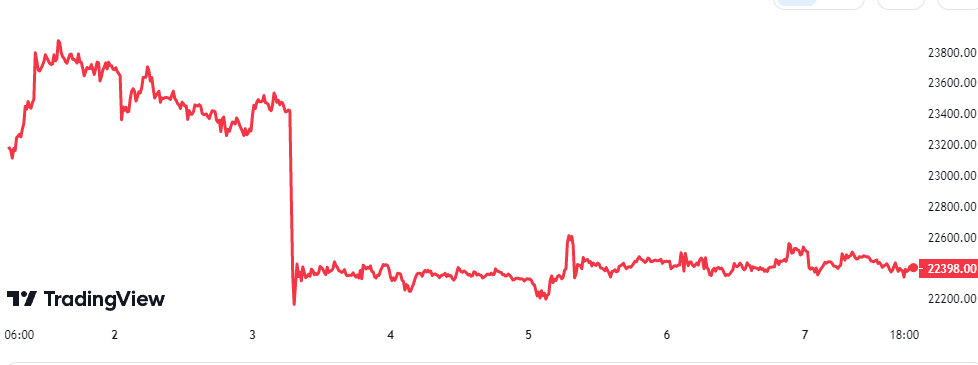

BTC Worth

On the time of writing, Bitcoin is buying and selling round $22,400, down 4% within the final week.

Seems to be like BTC remains to be shifting flat | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link