[ad_1]

- Gold and S&P 500 confirmed indicators of enchancment as BTC’s worth continues to wrestle

- Correlation hole at its highest because the FTX crash, with the identical contributed to by the Silvergate information

Over time, the diploma of correlation between the standard market and the crypto-market has shifted. Each open questions are how a lot the hole widened and what prompted the prevailing correlation.

Learn Bitcoin (BTC) Price Prediction 2023-24

The crypto-SPX correlation is the connection between the value of Bitcoin or Ethereum and the S&P 500 index – An ordinary measure of inventory market efficiency in the US. Gold’s worth change is added to that of the S&P 500 to get a greater perception into the divergence. The value traits of standard belongings and cryptocurrencies are in comparison with decide whether or not they observe an identical sample.

The current state of correlation

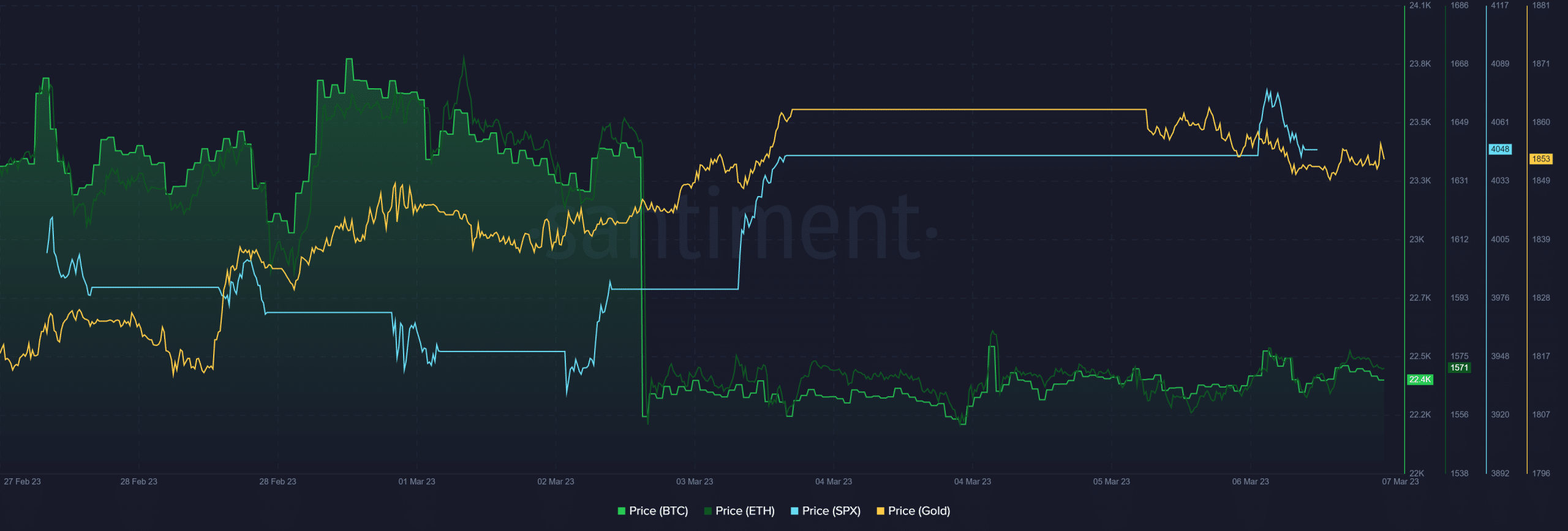

In response to a brand new report by Santiment, the S&P 500, Gold, and cryptocurrency costs are now not transferring in sync. Though cryptocurrencies like Bitcoin and Ethereum continued to wrestle on March 6, the research indicated that Gold and the inventory market noticed some enchancment.

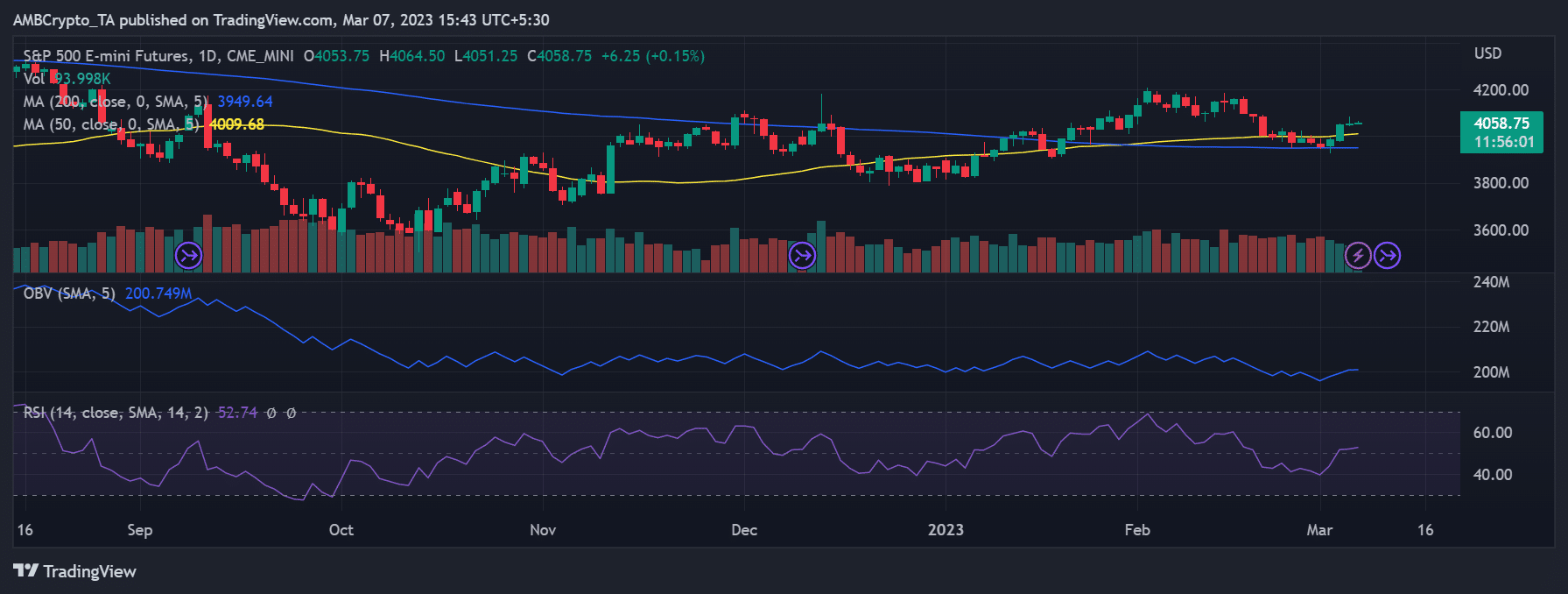

The S&P 500 had began to rebound as of March 2 on the day by day timeframe chart. The restoration got here after a number of weeks of a downward development, additionally seen on the chart.

The graph demonstrated that since its restoration began on March 2, it hiked by over 3%. It was promoting at $4,059, up about 0.16% at press time. A weak bull development was additionally indicated by its Relative Energy Index line because it crossed the impartial line to the upside.

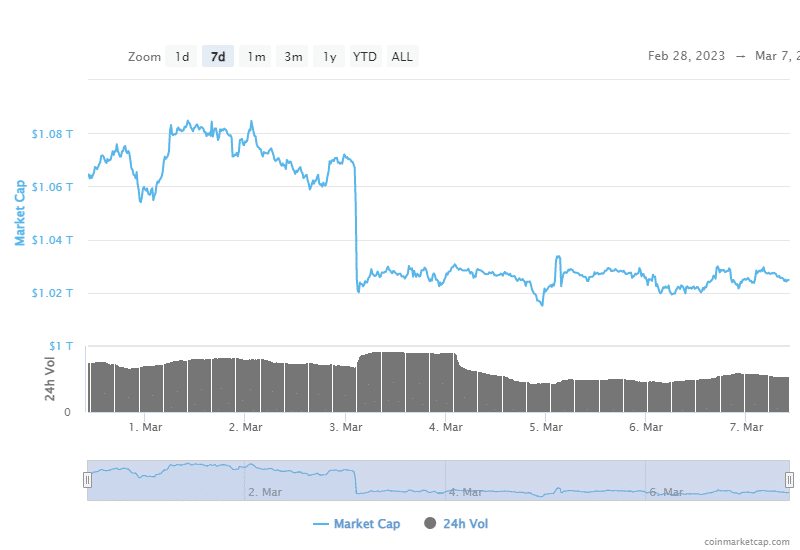

And but, over the identical interval, a have a look at BTC’s charts revealed that it has been battling to bounce again after its almost 5% loss on March 3. It quickly gained marginally, with the crypto buying and selling at about $22,500.

The Relative Energy Index (RSI) line was beneath the impartial line, indicating that it has continued to wrestle.

What the charts imply for crypto-market correlation

The present worth distinction between the 2 asset courses is what these two charts on the identical timeframe have been in a position to present. Moreover, it demonstrated that the distinction intensified following BTC’s drop on March 3. Usually, a drop within the worth of BTC normally impacts the value of virtually most cryptocurrencies.

The Silvergate episode

Silvergate, a crypto-friendly financial institution, has been within the highlight this previous week because of its failing well being. There have been stories that the financial institution has modified its stance on cryptocurrencies. The change was in response to the rising scrutiny and hazy guidelines surrounding digital belongings. Because of the information, a number of related tasks and exchanges severed their ties with the financial institution. It fueled widespread panic because it underlined the departure of a significant institutional participant.

The broader crypto-market’s cap took a big knock as a result of concern, uncertainty, and doubt (FUD) that adopted the Silvergate incident.

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

The current correlation breach between conventional belongings and the crypto-market is the biggest because the FTX collapse. The identical is evidenced by Santiment and the aforementioned charts.

Alalthough buyers in digital belongings are crossing their fingers for higher occasions, those that personal each asset varieties seem to have a extra diversified portfolio proper now.

[ad_2]

Source link

![Bitcoin [BTC], Gold, S&P 500 and a case of the widening correlation](https://cryptowizz.net/wp-content/uploads/2023/03/chart-1905225_1920-1000x600-750x375.jpg)