[ad_1]

The Moonbirds NFT assortment had a unstable weekend. Their flooring continued its regular downtrend and hit a low proper round 4 eth on Saturday. So what occurred with Moonbirds that brought about this value motion?

What occurred with the Moonbirds flooring?

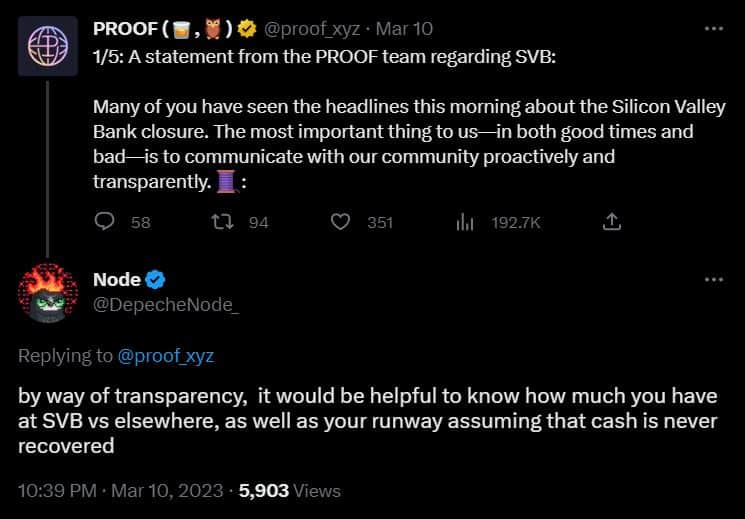

Proof, the father or mother assortment of Moonbirds, tweeted that their ecosystem holds a portion of their treasury on the now-defunct Silicon Valley Financial institution. They claimed to have diversified their funds throughout completely different locations, nonetheless, didn’t disclose actual quantities at first. The Proof Twitter account said, “Proof holds money at SVB, nonetheless… We’ve fortunately diversified our property throughout ETH, stablecoins, in addition to fiat—so financially and operationally, we’re going to be OK.”

The neighborhood response was rapid and extreme. Many distinguished holders requested for extra clarification on simply how a lot of the venture’s treasury had doubtlessly been misplaced. Given the sum of money the venture had raised from the Moonbirds mint, royalties, and VC funding, there was an actual worry that the losses could possibly be catastrophic.

Picture Credit score: Twitter.com

Kevin Rose, CEO of Proof, even tweeted that he was seeing Moonbird patrons get bullied on the Twitter timeline. Whereas presumably true, the concept that individuals had been getting shamed for purchasing into the venture didn’t precisely lend itself to any constructive consideration in a market that primarily capabilities as an consideration financial system.

How did Blur farming contribute to the panic?

To make issues worse, the information got here at unlucky timing for Moonbirds due to uncommon market exercise brought on by Blur farming. One whale had been mass-bidding on Moonbirds final week to farm the upcoming Blur airdrop. This particular person artificially inflated the worth of the gathering over 6 eth by accumulating 499 Moonbirds.

After the SVB announcement, the dealer started dumping their total assortment to bids as little as 3.94 weth on Saturday. By the top of the weekend, the Blur farmer had offered their final Moonbird and suffered about 700 eth in buying and selling losses within the course of.

Why did the Moonbirds flooring value rebound?

Kevin Rose, the CEO of Proof, disclosed on Sunday that lower than 50% of their treasury is held in SVB. This announcement got here after the Division of Treasury, FDIC, and the Federal Reserve launched a joint statement promising to guard depositors’ property. By guaranteeing these funds, the federal government ensured that the Moonbirds staff will be capable to execute their roadmap.

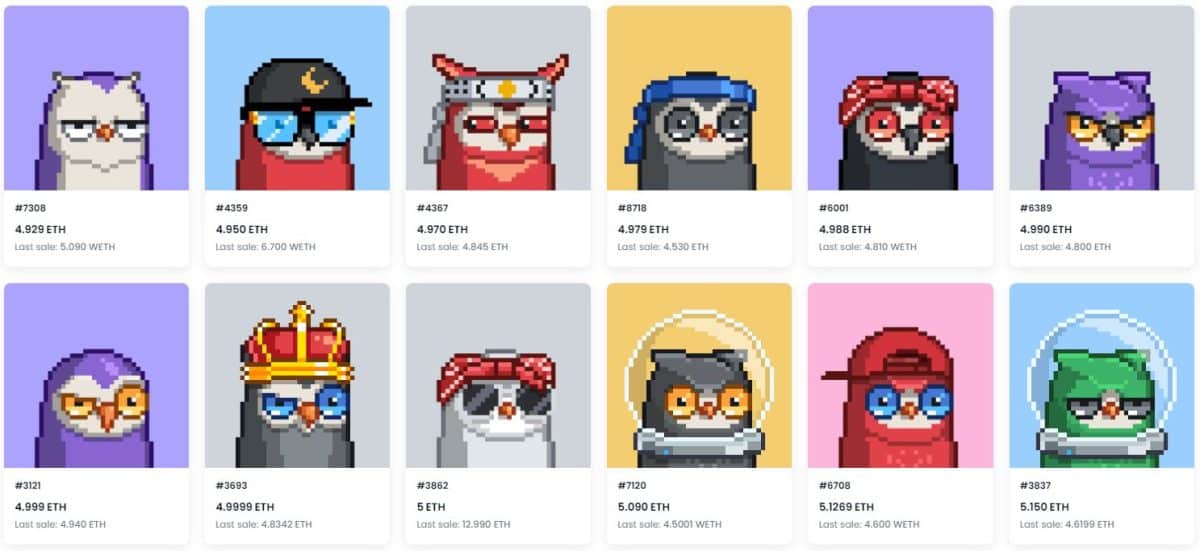

Picture Credit score: Twitter.com

The neighborhood rallied behind the venture and took benefit of discounted flooring value following the information. The ground value at the moment sits at 4.80 eth, up about 20% off the lows on Saturday.

What’s the future for Moonbirds?

Undertaking leaders Kevin Rose and Justin Mezzell held a Q1 update just lately. They promised to give attention to artwork at their “north star” transferring ahead. To that finish, they scrapped their metaverse artwork gallery venture Highrise and introduced the cancellation of nesting rewards, a longtime venture hallmark that rewards holders for not itemizing their Moonbirds on the market, after their subsequent reward.

Picture Credit score: OpenSea.io

Will the Proof staff be capable to return the Moonbirds assortment to its earlier place as a top-3 NFT assortment? We are going to quickly discover out, however now that their funds held in Silicon Valley Financial institution are protected, they may a minimum of have the funding to take a shot at it.

All funding/monetary opinions expressed by NFTevening.com will not be suggestions.

This text is instructional materials.

As at all times, make your personal analysis prior to creating any type of funding.

[ad_2]

Source link