[ad_1]

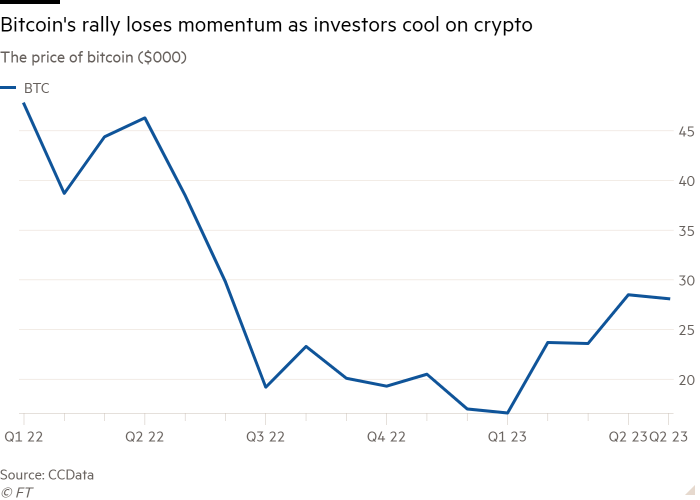

Cryptocurrency buying and selling exercise has dwindled whilst bitcoin enjoys its longest profitable streak in additional than two years, in an indication that many traders are more and more reluctant to purchase into the rebound after a string of collapses and scandals in 2022.

The worth of bitcoin, the most well-liked token, has risen 70 per cent this 12 months, serving to the market regain some momentum following the failure of corporations like change FTX.

Buyers have shrugged off lawsuits from US regulators in opposition to corporations corresponding to Binance, the business’s largest change, and the collapsed stablecoin operator Terraform Labs, as authorities have sought to clamp down on exercise they see as unlawful.

Nevertheless, the worth of bitcoin has since been caught in a rut for greater than a month, buying and selling in a slender vary round $28,000. That pause has been accompanied by thinning volumes, with small trades more and more in a position to transfer market costs.

“Whereas bitcoin’s latest efficiency is nice on the face of it, many in crypto are calling this 12 months an unloved rally,” stated Charles Storry, head of development at Phuture, a crypto index supplier.

“Sentiment hasn’t modified, and regulatory scrutiny is sidelining lots of new cash which may in any other case enter the area. Worth actions don’t imply a lot if the business isn’t making significant progress to regain belief and entice new traders,” he added.

A bruising 2022 has left traders nursing losses or funds trapped in limbo as failed cryptocurrency lenders and exchanges undergo chapter proceedings within the courts.

Crypto lovers additionally argued confidence has been renewed by the weak spot within the world banking sector, and the huge outflow of deposits from banks such because the US’s Silicon Valley Bank and Silvergate, and Credit score Suisse in Switzerland.

Digital property dashboard

Click on here for real-time knowledge on crypto costs and insights

“That rally we skilled after the banking disaster earlier this 12 months gave the impression to be straight associated to a flight for security and self-custody of funds away from the greenback,” stated Edmond Goh, head of buying and selling at crypto dealer B2C2.

However that sentiment has been undermined by a bunch of alerts coming from crypto markets. Analysts level out that the rally in cryptocurrency costs was already constructed on a thinly traded market.

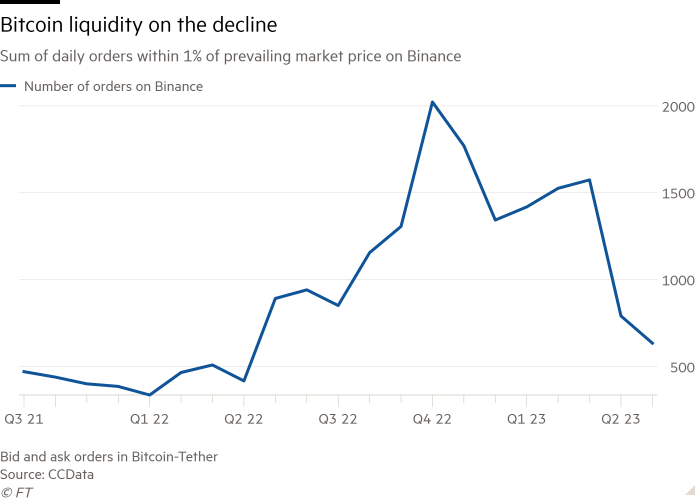

The diploma to which a market can take in massive orders with out main modifications to the worth of bitcoin has declined because the begin of the 12 months, based on knowledge supplier CCData.

In January it could have required the acquisition of greater than 1,400 bitcoins, roughly equal to $23mn on the time, to maneuver the worth of the token by greater than 1 per cent of its prevailing market worth, CCData stated.

In direction of the tip of final month it could have taken solely 462 bitcoins, price about $13mn, to maneuver market costs by 1 per cent, the bottom level of market depth for the bitcoin-tether buying and selling pair since Might 2022, when the business plunged into disaster.

“Costs are recovering, however liquidity has but to return. No change or market maker has but to fill the area that FTX and [its sister trading arm] Alameda as soon as encompassed,” stated Michael Safai, managing accomplice at crypto buying and selling agency Dexterity Capital.

Buyers who’ve purchased into bitcoin in latest months are actually holding on to their investments.

Glassnode, a crypto knowledge supplier, stated “there was remarkably little expenditure” by traders who purchased bitcoin when it hit a two-year low after FTX’s failure final November.

“The ‘FOMO’ that drove lots of first time institutional and retail traders final 12 months is clearly not taking place now, regardless of the very fact the crypto markets have rallied considerably this 12 months,” stated one crypto fund supervisor primarily based in Dubai, referring to a worry of lacking out.

Furthermore, there have been outflows of $72mn over the past two weeks in digital asset investments, ending a six-week run of consecutive inflows, based on CoinShares. The crypto funding group ascribed the development to the likeliness of additional rate of interest will increase by the US Federal Reserve.

Merchants are additionally apprehensive that the heavy clouds which have overshadowed the business for the previous 12 months haven’t absolutely gone away. Binance, the world’s largest crypto change, is prone to be pulled right into a drawn-out lawsuit with the Securities and Change Fee.

One other cloud is the destiny of Genesis, one of many greatest lenders within the crypto market, which filed for chapter in January owing greater than $3bn after the implosion of FTX.

Proprietor Digital Foreign money Group, one of many world’s largest proprietor of bitcoins through its asset administration arm, is trying to increase funds to pay again Genesis collectors. DCG stated last week some Genesis collectors had walked away from a beforehand agreed restructuring deal.

The market seems to be “in a holding sample pending the decision of DCG’s debt funds”, stated Ram Ahluwalia, chief government of funding adviser Lumida Wealth Administration.

The uncertainty, together with the disaster within the US regional banking business, has underscored for a lot of that the market continues to be working by way of its many points.

“There nonetheless isn’t lots of natural momentum behind cryptocurrencies,” stated Safai. “The headline occasions that propel cryptocurrency costs previous sticking factors . . are few and much between.”`

Click here to go to Digital Asset dashboard

[ad_2]

Source link