[ad_1]

Bitcoin on-chain information suggests a historic assist line could have helped the coin as soon as once more because the asset has recovered towards $28,000 as we speak.

Bitcoin Brief-Time period Holder Price Foundation Could Nonetheless Be Energetic As Help

In accordance with information from the on-chain analytics agency Glassnode, the BTC value approached the associated fee foundation of the short-term holders lately. The related indicator right here is the “realized price,” which is a metric derived from the “realized cap.”

The realized cap refers to a capitalization mannequin for Bitcoin that claims that the worth of every coin within the circulating provide will not be the present spot value, however the value at which it was final transacted on the blockchain.

On this manner, the mannequin accounts for the value at which every investor acquired their cash. That’s, their “value foundation.” When the realized cap is split by the variety of cash in circulation (to discover a form of common worth), the aforementioned realized value emerges.

Associated Studying: Bitcoin Exchange Inflows Mostly Coming From Loss Holders, Weak Hands Exiting?

This realized value signifies the typical worth at which every holder available in the market purchased their cash. The metric will also be outlined for under partial segments of the market, just like the “short-term holders” (STHs), by which case, the indicator will inform us in regards to the common value foundation amongst this group solely.

The STHs are all these traders who purchased their cash lower than 155 days in the past. The BTC holders outdoors this group are termed the “long-term holders” (LTHs).

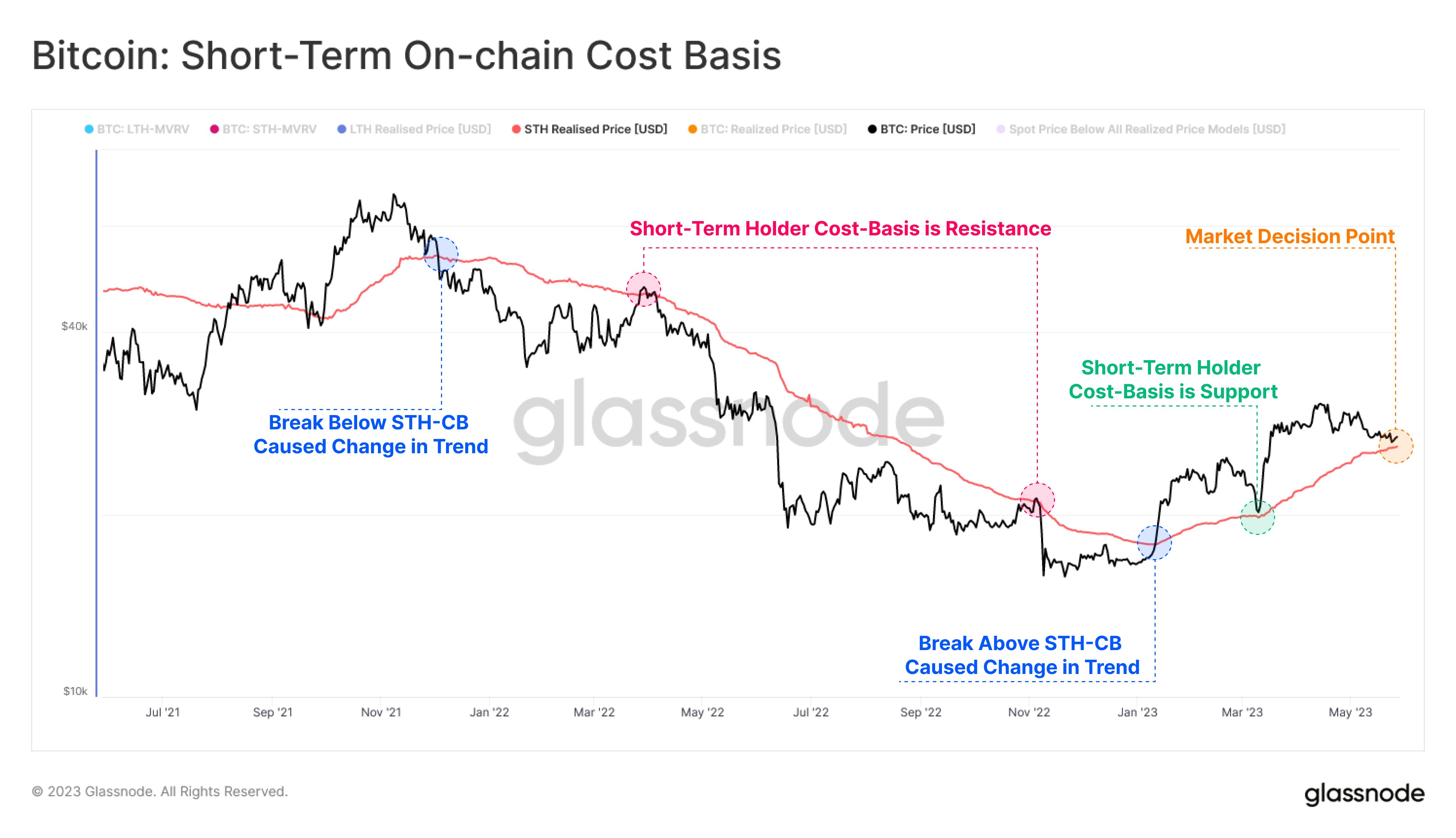

Now, here’s a chart that exhibits the pattern within the Bitcoin realized value for the STHs over the previous couple of years:

The worth of the metric appears to have been climbing in latest days | Supply: Glassnode on Twitter

Within the above graph, Glassnode has marked the assorted situations the place the Bitcoin STH realized value has apparently interacted with the spot value of the asset. Again when the 2021 bull run topped out in November, the cryptocurrency’s worth dropped under this indicator, signaling a change of pattern.

From this level on, because the bear market took over, the STH value foundation began offering resistance to the asset. Again in January of this 12 months, although, the value lastly managed to interrupt by means of this resistance because the rally started to happen.

Associated Studying: Bitcoin Bulls Push BTC Back Up To $28K Amid Surging Address Activity

This break result in one other change within the wider pattern, as the road seemingly became assist for the asset. Nonetheless, this isn’t an uncommon sample, as bullish durations have traditionally noticed the metric serving to the value.

Lately, Bitcoin discovered some wrestle, as the value plunged in the direction of the $26,000 degree. The consolidation close to this degree meant that the value was quick approaching the STH realized value, which was slowly going up.

When Glassnode posted the chart yesterday, it described this present state as a “choice level” for the market. In accordance with the analytics agency, a profitable retest right here could be an indication of energy within the bullish pattern, whereas failure would suggest weak spot.

Over the previous day, Bitcoin has loved a rebound, with the value briefly breaking above the $28,000 degree. However it might maybe not be a coincidence that the uplift has come proper as the value was nearing a retest of this historic degree.

Naturally, a sustained transfer away from the STH realized value now would affirm that the extent remains to be energetic as assist, an indication that might be optimistic for the rally’s sustainability.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $27,900, up 4% within the final week.

BTC has surged prior to now day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link