[ad_1]

“Progressively, then immediately,” goes the Hemingway trope about going bankrupt that Bitcoiners have so enthusiastically adopted. When crypto exchanges, stablecoins and banks are collapsing left and proper, it seems suspiciously like we’re already within the “immediately” portion. And it’s immediately that currencies of the previous have moved from the pocketbooks to the historical past books.

Hyperinflation is a common improve in costs by 50% or extra in a single month. Alternatively, generally economists and journalists use a decrease price of month-to-month inflation sustained over a 12 months (however that also quantities to 100%, 500% or 1,000%). The imprecision results in some confusion in what does or doesn’t represent a hyperinflation.

Definitional quibbles apart, the primary level is as an example the last word demise of a fiat foreign money. Hyperinflation of whichever caliber is a state of affairs the place cash holders rush for the exits, like depositors in a financial institution run rush for his or her funds. Actually something is best to carry on to than the melting ice dice that may be a hyperinflating foreign money.

A hyperinflating foreign money is usually accompanied by collapsing economies, lawlessness and widespread poverty; and is normally preceded by extraordinarily giant cash printing in service of protecting equally huge authorities deficits. Double- or triple-digit will increase usually costs can not occur with out a large enlargement of the cash provide; and that typically doesn’t happen until a rustic’s fiscal authority has issue financing itself and leans on the financial authority to run the printing presses.

BACKGROUND: What Hyperinflation is and the way it occurs

In 1956, the economist Phillip Cagan wished to review excessive circumstances of financial dysfunction. As we’ve realized over the previous few years, every time costs go berserk there’s a huge kerfuffle about who’s accountable — grasping capitalists, obscure provide chain bottlenecks, unprecedented cash printing by the Fed and monetary deficits by the Treasury or that evil-looking dictator midway world wide.

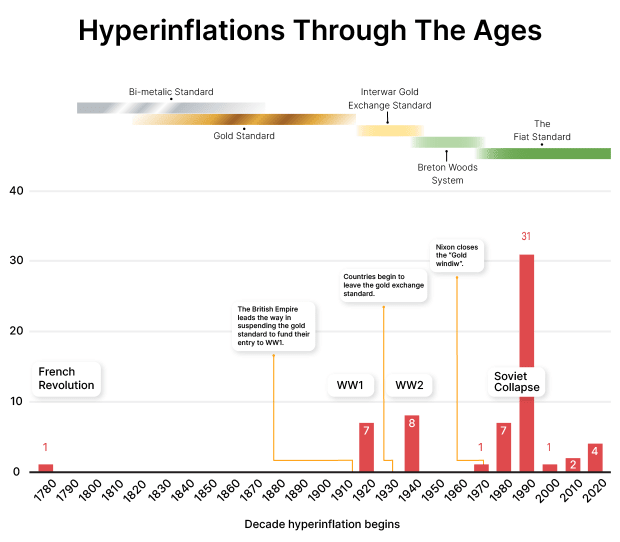

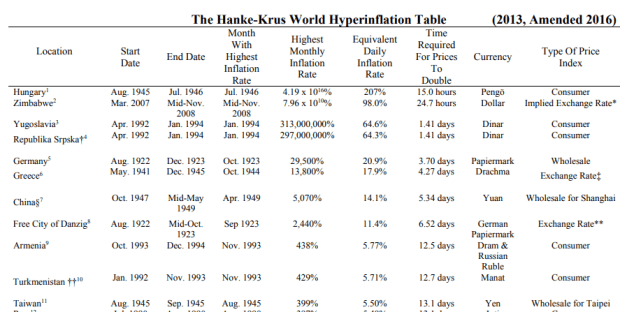

Cagan wished to summary away from any modifications in “actual” incomes and costs, and due to this fact positioned his threshold at 50% worth rises in a single month; any offsetting or competing modifications in actual components, mentioned Cagan, can then be safely disregarded. The brink caught, though 50% a month makes for astronomically excessive charges of inflation (equal to about 13,000% yearly). The excellent news is that such an excessive collapse and mismanagement of fiat cash is uncommon — so uncommon, in truth, that the Hanke-Krus World Hyperinflation Desk, usually thought of the official checklist of all documented hyperinflation, comprises “solely” 57 entries. (Up to date for the previous few years, its authors now claim 62.)

The unhealthy information is that inflation charges properly under that very demanding threshold have destroyed many extra societies and wreaked simply as a lot havoc of their financial lives. Inflation “bites” at a lot, a lot decrease charges than that required for going into “hyper.”

No one does inflation like us moderns. Even probably the most disastrous financial collapses in centuries past have been slightly gentle in comparison with the inflations and hyperinflations of the fiat age.

What Hyperinflation Seems like

“Hyperinflation very hardly ever happens swiftly, with none early warning indicators,” writes He Liping in his Hyperinflation: A World History. Fairly, they stem from earlier episodes of excessive inflation that escalate into the hyper selection.

But it surely’s not significantly predictive, since most episodes of high inflation do not descend into hyperinflation. So what causes common intervals of excessive inflation within the tens or twenties of % that the majority Western nations skilled within the aftermath of Covid-19 pandemic in 2021-22 is totally different from what causes a few of these episodes to devolve into hyperinflation.

The checklist of culprits for excessive inflation regimes embrace

- Excessive provide shocks that trigger costs of key commodities to rise quickly for a sustained time.

- Expansionary financial coverage {that a}) includes central financial institution printing a number of new cash, and/or b) industrial banks lending freely, with out restraint.

- Fiscal authorities run fiscal deficits and be certain that combination demand runs sizzling (above development or above the financial system’s capability).

For top inflations to show into hyperinflations, extra excessive occasions should happen. Normally, the nation-state itself is in danger reminiscent of throughout or after wars, a dominant nationwide business collapses or the general public loses belief within the authorities completely. Extra excessive variations of the above are normally contain

- A fiscal authority operating extraordinarily giant deficits in response to nation-wide or dependent business shocks (pandemics, warfare, systemic financial institution failures).

- The debt is monetized by the central financial institution and compelled upon the inhabitants, usually by way of using legal guidelines that mandate funds within the nation’s foreign money or bans using foreign exchange.

- Full institutional decay; efforts to stabilize the cash provide or the fiscal deficits fail.

In a hyperinflation occasion, holding money or money balances turns into probably the most irrational of financial actions, but the one factor a authorities wants its residents to do.

There’s solely a lot printing you may — or would — do if there weren’t underlying issues or fiscal authorities respiratory down your neck; there are solely a lot further cash the general public needs to carry, and while you begin up the presses, the seigniorage revenue you may extract turns into smaller and smaller after they ditch your foreign money for actually anything. (“Persons are exchanging their {dollars} for dog money.”)

Everyone needs to transact, usually making an attempt to get their wages paid a number of occasions a day and head to the shop to buy something. Everyone needs to borrow or devour on credit score — since one’s debt will disappear in actual phrases — but no one needs to lend: banks normally curtail lending, and credit score runs dry. Prior money owed are fully worn out, as they had been mounted in nominal phrases. A hyperinflation occasion carefully resembles a “clear slate,” a means for collapsed nation-states to restart, monetarily talking. They reshuffle the online possession of onerous belongings like property, equipment, valuable metals or international foreign money. Nothing of monetary consequence stays: all credit score ties are inflated into nothingness. Monetary ties not exist. It’s the last word weapon of mass monetary destruction.

Historical past of hyperinflations

Although the primary cited occasion is normally revolutionary France, the trendy occasions include 4 clusters of hyperinflations. First, the Twenties when the losers of WWI printed away their money owed and wartime reparations. That is the place we get the wheelbarrow imagery and which Adam Fergusson’s traditional When Cash Dies so expertly chronicles.

Second, after the top of World Struggle II, we’ve one other bout of war-related regime collapses main rulers to print away their unsustainable obligations — Greece, Philippines, Hungary, China, and Taiwan.

Third, across the 12 months 1990 when the Soviet sphere of affect imploded, the Russian ruble in addition to a number of Central Asian and Japanese European nations noticed their defunct currencies inflate away into nothingness. Soviet-connected Angola adopted go well with, and, within the years earlier than Argentina, Brazil, Peru and Peru once more.

Fourth, the newer financial basket circumstances of Zimbabwe, Venezuela and Lebanon. All of them current tales of obscene mismanagement and state failure that whereas not precisely mirroring the earlier clusters of hyperinflations, at the very least share their core options.

Egypt, Turkey and Sri Lanka are different nations whose foreign money debasements in 2022 had been so stunningly unhealthy as to advantage a dishonorable point out. Although disastrous for these nations’ economies and tragic for the holders of their currencies — with head-spinning excessive inflation charges of 80% (Turkey), 50%-ish (Sri Lanka) or over 100% (Argentina) — it’s scant aid that their runaway financial programs are lengthy methods off to formally qualify as hyperinflations. You get horrible outcomes means earlier than runaway inflation crosses the “hyper” threshold.

Excessive inflation episodes (double digits or extra) are not stable. The printing by authorities and financial flight by customers both speed up or decelerate; there isn’t a such factor as a “steady” 20% inflation 12 months after 12 months.

What’s clear from the historic report is that hyperinflations “are a contemporary phenomenon associated to the necessity to print paper cash to finance giant fiscal deficits attributable to wars, revolutions, the top of empires, and the institution of latest states.”

They finish in two methods:

- Cash turns into so nugatory and dysfunctional that each one its customers have moved to a different foreign money. Even viable governments that maintain forcing their hyperinflating currencies onto the citizenry by way of authorized tender and public receivability legal guidelines, obtain solely minor advantages from printing. Foreign money holders have left for tougher monies or international money; there’s valuable little seigniorage left to extract. Instance: Zimbabwe 2007-2008, or Venezuela 2017-18.

- Hyperinflation ends by fiscal and financial reform of some kind. A brand new foreign money, usually new rulers or structure, in addition to help from worldwide organizations. In some circumstances, rulers seeing the writing on the wall purposefully hyperinflate their collapsing foreign money whereas getting ready to leap to a brand new, steady one. Instance: Brazil within the Nineties or Hungary within the Forties.

Whereas foreign money collapses are a most painful reminder of financial excesses, their final causes are virtually at all times fiscal problems and political disarray — a continual weak point, a flailing dominant business, a runaway fiscal spending regime.

The three fundamental features of cash — medium of change, unit of account, retailer of worth — are impacted otherwise by situations of very excessive inflation or hyperinflation. Retailer of worth is the first to go, as evidenced by photos of wheelbarrow inflation; the cash turns into too unusable a car by way of which to maneuver worth throughout time. The unit of account function appears remarkably resilient in that cash customers can change price tags and regulate psychological fashions to the ever-shifting nominal costs. Accounts from Zimbabwe, Lebanon or South America point out that cash customers can maintain “considering” in a foreign money unit (maintain performing financial calculation) though the speedy modifications in each day worth makes it tougher to do that properly.

Each hyperinflation and excessive inflation are extreme headwinds on financial output and a wasteful use of human efforts, however cash’s “metric role” would not instantly go away. The medium of change function, which economists have lengthy held to be the foundational monetary role from which the opposite features stem, appears to be probably the most resilient. You possibly can transact, sizzling potato-style, even with hyperinflating cash.

Learn Extra >> What is Money?

What occurs: The few winners and lots of losers

The pure response of Germans and Austrians and Hungarians, wrote Adam Fergusson in his traditional account of the hyperinflations within the Twenties When Money Dies, was “to imagine not a lot that their cash was falling in worth as that the products which it purchased had been changing into dearer in absolute phrases.” When costs rose, “folks demanded not a steady buying energy for the marks that they had, however extra marks to purchase what they wanted.”

Hundred years later — a special time in several lands with a special cash — the identical doubts undergo folks’s minds. Inflation, of its hyper-variety or those we’re residing by way of within the 2020s, muddies folks’s capacity to make financial choices. It will get tougher to understand how a lot one thing “prices,” if a enterprise is making an actual revenue or if a family is including to or depleting its financial savings.

The Economist’s account of the results of Turkey’s inflation final 12 months summarized the economy-wide penalties of inflation operating amok. Beneath excessive (or hyper-)inflation, time horizons shrink and decision-making collapses to day-to-day money administration. Like all inflations there are arbitrary redistributions of wealth:

- The financial value of excessive inflation is the unpredictability of the value system, the volatility of costs themselves. Should you assume bitcoin’s change price to the USD is “unstable,” you haven’t seen fundamental costs in hyperinflating nations — wages, belongings, grocery shops, rents. It undermines customers’ capacity to plan or make financial decisions. Manufacturing will get delayed, funding choices postponed and the financial system squeezed since spending choices are introduced ahead to the current.

- In an identical vein, worth indicators don’t work as properly anymore. It’s tougher to see by way of the nominal costs to the actual financial components of provide and demand — just like the automobile window into the financial system immediately changing into foggy. Haggling over actual costs makes transaction prices shoot up, which profit no one; partially substituting the failing cash for international foreign money provides a second layer of (usually black-market) change charges to juggle.

- It’s unfair. These greatest positioned to play the inflation recreation, to shelter their wealth by way of property, onerous belongings or foreign exchange, can defend themselves. It causes a rift between those that can entry international foreign money or onerous belongings, and those that can not.

Whereas most individuals’s financial lives are disrupted by (hyper)inflation and in combination everybody loses, some folks profit alongside the way in which.

- The obvious losers are these holding money or money balances, since these are right away value much less.

- Probably the most direct beneficiaries are debtors, whose debt will get inflated away; insofar as they’ll have their incomes maintain tempo with the quick rises in costs, the actual financial burden of the debt disappears. The flipside of that’s the creditor, who loses buying energy when their fixed-value asset deflates into nothingness.

Do governments profit from excessive or hyperinflation?

There’s a number of nuance as to whether governments profit from excessive inflation. The federal government itself normally advantages, since seigniorage accrues to the issuer of the foreign money. However common tax assortment doesn’t occur immediately and so taxes on previous incomes could also be paid later in much less beneficial, inflated cash. Apart from, a poorer actual financial system normally makes for much less financial assets {that a} authorities can tax.

One other means governments profit is that their bills are normally capped in nominal phrases whereas tax receipts rise in proportion to costs and incomes.

As a big debtor, a authorities all else equal, has a better time nominally servicing its debt — certainly, giant authorities money owed and monetary obligations are main causes to hyperinflate the foreign money within the first place. Alternatively, worldwide collectors shortly catch on and refuse to lend to a hyperinflating authorities, or demand that they borrow in international foreign money and at further rates of interest.

Some institutional options matter too. To take two current examples from the U.S.: Social Safety indexation and the lack of earnings from the Fed. Whereas the debt that will get inflated away includes a authorities’s pension obligation to retirees, there could also be listed compensation when costs rise. In December 2022, Social Safety funds had been adjusted upwards by 8.7% to account for the inflation captured in CPI during the last 12 months. In additional excessive circumstances of inflation or hyperinflation, such compensation is perhaps delayed, or much less steady governmental establishments could lack such options altogether, which might end in cuts in monetary welfare for the aged.

Equally, when the Fed hiked charges aggressively throughout 2022, it uncovered itself to accounting losses. For the foreseeable future it has due to this fact suspended its $100 billion in annual remittances to the Treasury. Whereas a drop within the 6 trillion federal outlay bucket, it nonetheless exhibits how prior cash printing could cause a lack of fiscal earnings sooner or later.

When a financial authority has misplaced sufficient credibility (the cash customers hand over a quickly deteriorating cash for exactly something) it doesn’t a lot matter how one strikes the small levers left beneath the financial authority’s management. Hyperinflation, due to this fact, could be seen as a excessive inflation the place the financial authorities have misplaced management.

Backside line:

Hyperinflations occur when the nation-state backers of a foreign money exit of enterprise — as within the Balkan states and former Soviet Bloc nations within the early Nineties. In addition they occur from excessive mismanagement, from the Weimar Republic within the Twenties to the South American episodes within the Nineteen Eighties and Nineties, or Venezuela and Zimbabwe extra lately.

Do not forget that the German hyperinflation occurred between 1922 and 1923, after wartime inflation (1914-1918) and postwar reparations debacle had steadily degraded the nation’s funds and industrial capability. Very like as we speak’s financial struggles, there was loads of blame to go round however the level stays: it takes a very long time for a thriving and financial steady empire to devolve into the jaws of hyperinflationary chaos.

Each foreign money regime ends, steadily then immediately. Maybe issues transfer sooner as we speak, however recognizing a USD hyperinflation on the horizon (like Balaji did in March 2023) is perhaps too early but. Whereas we’d not have reached the “immediately” half but, we are able to’t make sure that the “steadily” hasn’t already begun.

America in 2023 options lots of the components usually concerned in hyperinflations: home turmoil, runaway fiscal deficits, a central financial institution unable to imbue credibility or handle its worth stabilization objectives, grave doubts in regards to the banks’ solvency.

The historical past of hyperinflation is huge however largely confined to the trendy age of fiat. If it’s any information for the longer term, a descent into hyperinflation occurs far more slowly and takes loads longer than just a few months.

[ad_2]

Source link