[ad_1]

Ethereum has plunged under $1,700 through the previous day. Right here’s the on-chain indicator which will have signaled this dip prematurely.

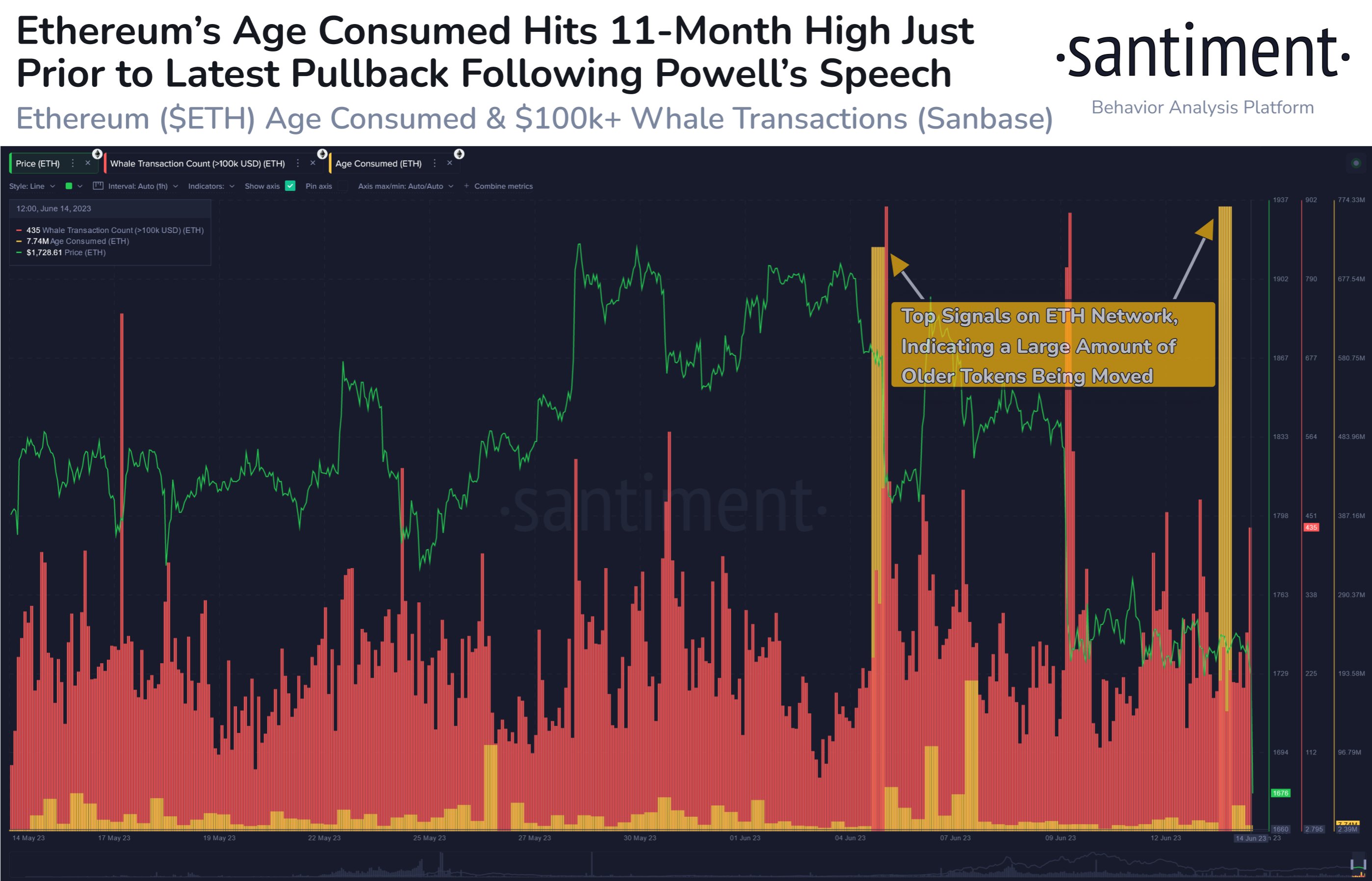

Ethereum Age Consumed Metric Noticed A Spike Earlier than The Worth Decline

In line with information from the on-chain analytics agency Santiment, institutional traders look to have been anticipating the transfer to happen. The indicator of curiosity right here is the “ETH age consumed,” which first finds the entire variety of cash transferring on the Ethereum blockchain. Then it multiplies this worth by the times these cash had been dormant earlier than their motion.

So, on this approach, the metric retains observe of what number of cash are being offered/moved every day and makes use of their age as a weighting issue. Because of this many elderly cash are moved to the community each time this indicator’s worth is excessive.

Naturally, low values of the metric, then again, would suggest that there aren’t many cash transferring on the chain proper now or some cash with a low common age are being transferred.

Now, here’s a chart that exhibits the pattern within the Ethereum age consumed over the previous month:

Seems to be like the worth of the metric has been fairly excessive in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the Ethereum age consumed metric had lately registered a really giant spike. This is able to recommend the potential motion of many dormant cash on the chain throughout this surge.

Usually, when such giant spikes within the indicator are noticed, it’s an indication of promoting from the long-term holders (LTHs). The LTH cohort consists of all of the traders holding onto their cash since greater than 155 days in the past.

These holders are the skilled palms out there who don’t simply promote even when the market is distressed. Due to this cause, their actions could be one thing to be careful for, as after they do lastly promote, it’s normally not a optimistic signal for the worth.

The chart exhibits that the LTHs had additionally proven a big transfer earlier within the month. Shortly after these traders turned energetic, the cryptocurrency worth plunged.

This time, the spike within the Ethereum age consumed additionally appears to have preceded a worth decline, because the cryptocurrency’s worth has now dropped under the $1,700 stage.

This newest worth plunge has come after the information that the US Federal Reserve isn’t raising interest rates this time, however extra hikes can be coming later within the 12 months to battle inflation.

Santiment means that the spike within the age consumed metric earlier than the worth decline may suggest that the establishments already anticipated the transfer, therefore why they shifted their cash early.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,600, down 11% within the final week.

ETH has taken a plunge lately | Supply: ETHUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link