[ad_1]

Obtain free Cryptocurrencies updates

We’ll ship you a myFT Day by day Digest e-mail rounding up the most recent Cryptocurrencies information each morning.

Hi there and welcome to the most recent version of the FT Cryptofinance publication. This week, we’re looking at Coinbase’s different regulatory troubles.

Coinbase is in a authorized quagmire.

This week it filed its response to the Securities and Change Fee, which this month alleged the US-listed group had been working an unregistered securities trade and providing unlisted securities. It’s a case that guarantees to define the American crypto industry. It’s a hefty 177-page read.

However one other severe authorized concern bought misplaced amid the SEC headlines at the beginning of the month. Alabama state securities regulators additionally filed an order that gave Coinbase simply 28 days to show it isn’t promoting unregistered securities in its state. After that it faces a cease-and-desist order.

It was filed on June 6 and was the results of a multi-state activity power that comprised California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington and Wisconsin. Come July 4, time is up.

Collectively, the states have locked on to Coinbase’s staking rewards programme, a typical approach to supply traders a return on their property. Customers lock their crypto of their pockets — on an trade equivalent to Coinbase — for a set interval however give permission for that third celebration to stake their crypto on different crypto tasks that supply curiosity or a yield.

One of the vital well-liked methods is to place the staked asset to work serving to to safe a big public blockchain, equivalent to ethereum. The boundaries to staking blockchains are fairly excessive and customers usually want to carry a whole lot of a specific cryptocurrency first. A pooled stake is one approach to do it.

Relying on the coin and the chance concerned, staking can earn an annual yield of between 4 and 17 per cent. The issue is that Alabama and others regard staking as an unregistered safety.

Coinbase disagrees. It “firmly believes that our staking providers on no account represent securities beneath any state or federal regulation, and we intend to defend this essential a part of the cryptoeconomy”.

Coinbase has to struggle every case state by state. It’s in lively discussions with 5 states that issued stop and desist orders, including that extensions have been given to the corporate, in accordance with an individual acquainted with the matter.

Different states which have began proceedings have solely set Coinbase deadlines to point out trigger as to why its staking providers will not be securities and nobody state is transferring to enforcement subsequent week, the particular person added.

Nevertheless it underscores that there’s rather a lot at stake for Coinbase with staking. There are greater than 3.5mn US Coinbase clients with a staking reward programme account. Within the first quarter, turnover from the service was $74mn, about 10 per cent of whole group income.

It additionally types a part of the corporate’s broader “subscription and providers” income, which chief government Brian Armstrong sees as a gradual stream of revenue to protect in opposition to the unreliability of charges from buying and selling volumes.

“In a world the place Coinbase doesn’t supply staking, it is not going to be aggressive in opposition to those that do,” mentioned Ilan Solot, co-head of digital property at London-based monetary providers group Marex.

However this concern goes past solely an issue for Coinbase.

Staking clients’ tokens is on the coronary heart of the safety of networks equivalent to ethereum. The blockchain is verified by so-called validators chosen at random. These validators — both people or corporations equivalent to Coinbase — stake tokens as a type of collateral in opposition to dangerous actors and are paid for it.

If one of many larger, extra dependable and clear validators runs into hassle with its staking product and has to withdraw, that may change the steadiness of financial energy.

It may focus the system in favour of fewer richer members as a result of the extra cash a miner owns, the extra mining energy it has. Or the hole may be crammed by dangerous actors, doubtlessly corrupting it.

“Each centralised entity that runs into hassle with their staking programme is doubtlessly chipping away on the safety of the community . . . it might develop into much less centralised,” Solot added.

What’s your tackle Coinbase’s run-in with American state regulators? As at all times, e-mail me your ideas at scott.chipolina@ft.com.

Go to the FT Wilshire Digital Asset Index for round the clock updates on the crypto market, that includes information on worth, circulating worth and different key market metrics impacting trade’s most generally traded cash, together with bitcoin and ether.

Weekly highlights:

-

Whereas with reference to state regulators, Nevada asked a court docket to nominate a receiver for Prime Belief, one of many few “crypto-friendly” US monetary establishments with some regulatory approvals to function within the conventional US banking and funds system. The state alleges that the custodian used buyer funds to purchase cryptocurrencies after dropping entry to digital wallets containing tens of hundreds of thousands of {dollars} in property.

-

The Nationwide Bureau for Counter Terror Financing of Israel announced this week it thwarted an operation involving digital property used to finance terror, headed by Hizbollah and the Iranian Quds Power. “This isn’t a simple activity, which turns into much more complicated when digital currencies are concerned,” mentioned Israel’s defence minister Yoav Gallant.

-

Within the newest blow to Binance’s banking woes, Reuters reported that on-line funds service supplier Paysafe mentioned it will stop providing assist to Binance clients throughout the European Financial Space. The platform is now working with Binance to “terminate this service over the subsequent few months”. Earlier this 12 months Paysafe mentioned it will wind down providers to Binance’s UK clients.

Soundbite of the week: Coinbase hits again on the SEC

As talked about, Coinbase’s response to the SEC was hefty and units up a head-on authorized conflict between it and the principle US markets regulator. One notable level is that Coinbase is arguing it violates the US Structure. It’s going to run and run.

“Even have been the SEC appropriate that the property and providers it identifies are inside the scope of its current regulatory authority, this motion should be dismissed on the impartial grounds that it violates Coinbase’s due course of rights and constitutes a rare abuse of course of.”

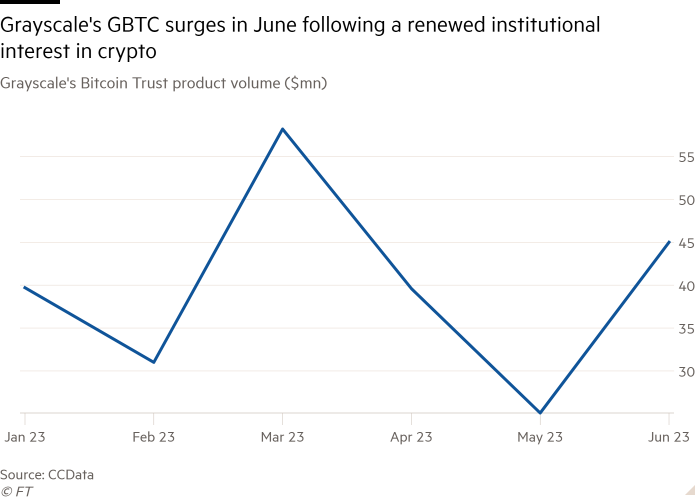

Knowledge mining: Grayscale surges amid institutional pleasure

Grayscale, supervisor of the world’s largest crypto fund, has had a very good month.

The low cost of the $13.5bn Grayscale Bitcoin Belief (GBTC) to its internet asset worth has narrowed sharply to a nine-month low of 29 per cent after BlackRock filed to checklist a crypto ETF. The market worth is now $19.55 versus an NAV of $27.65, in accordance with Bloomberg information.

If the world’s largest asset supervisor succeeds, it may open the door to a flood of publicly traded spot bitcoin ETFs on the earth’s largest funding market.

Grayscale is suing the SEC for its refusal to permit it to transform GBTC into an ETF. If that modified the low cost would most likely disappear. Amid the thrill quantity in GBTC has surged virtually 80 per cent in June.

Cryptofinance is edited by Philip Stafford. Please ship any ideas and suggestions to cryptofinance@ft.com.

[ad_2]

Source link