[ad_1]

On-chain information reveals the Ethereum each day energetic addresses indicator has not too long ago registered its second-highest spike.

Ethereum Every day Lively Addresses Has Noticed A Sharp Spike Just lately

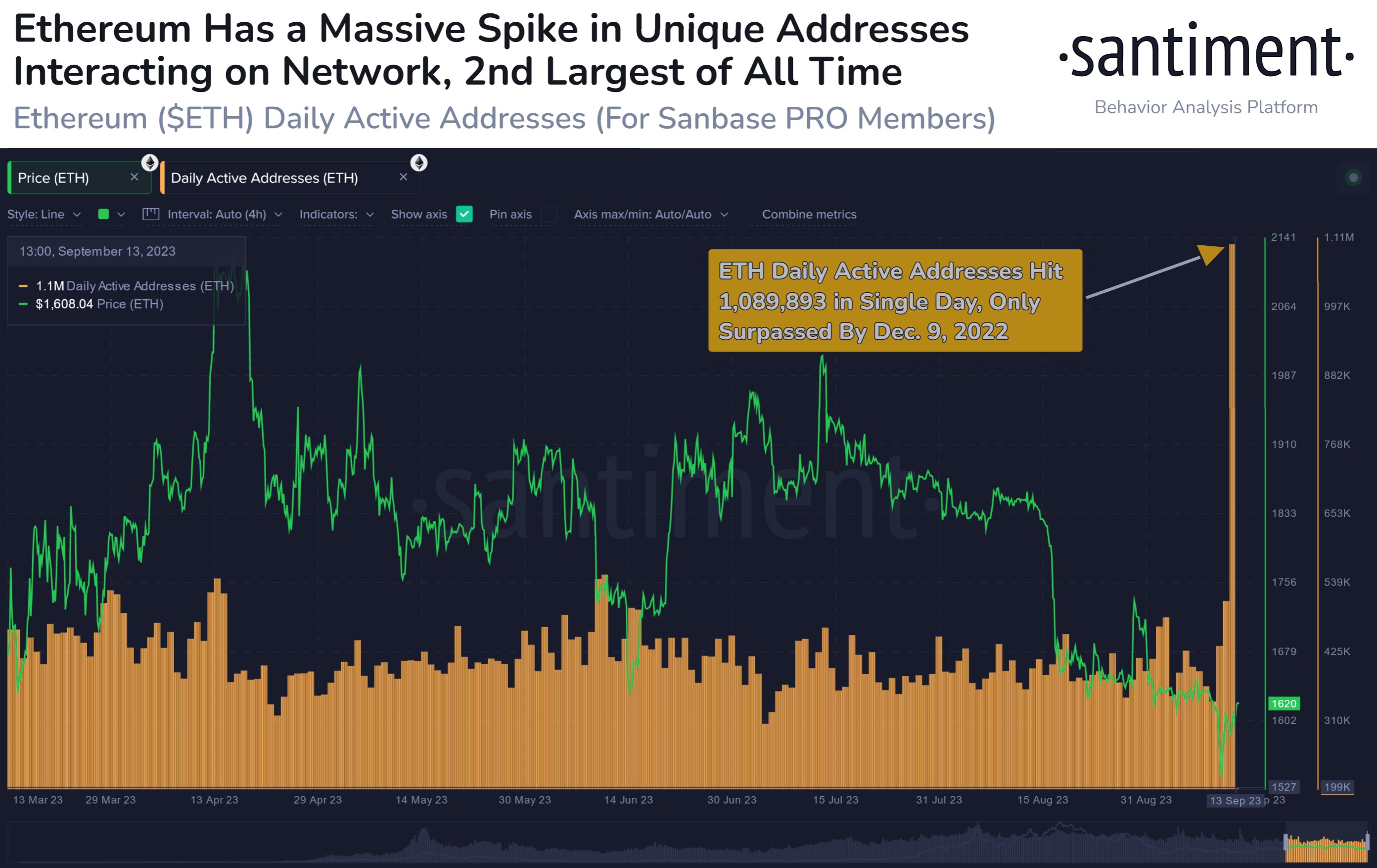

In accordance with information from the on-chain analytics agency Santiment, the energetic addresses metric solely achieved a better worth in December 2022. The “daily active addresses” indicator measures the each day complete variety of distinctive Ethereum blockchain addresses that work together ultimately.

This metric naturally accounts for each senders and receivers. Observe that “distinctive” implies that even when an tackle makes a number of transactions in a single day, its contribution in direction of the energetic addresses metric will stay only one unit.

The advantage of this restriction is that distinctive addresses will be thought-about analogous to distinctive customers, so the indicator’s worth can present hints concerning the quantity of visitors the ETH blockchain has acquired through the previous day.

When the metric has a excessive worth, many customers at the moment are interacting with the community. This could signify that the merchants are actively taken with making strikes on the asset.

Now, here’s a chart that reveals the development within the Ethereum each day energetic addresses over the previous few months:

Appears to be like like the worth of the metric has been fairly excessive in current days | Supply: Santiment on X

As displayed within the above graph, the Ethereum each day energetic addresses indicator has seen a worth of a couple of million through the previous day. This might indicate that greater than one million customers have simply made a transfer on the blockchain.

That is a particularly excessive worth and is, in reality, the second highest that the metric has noticed within the eight years or so of the cryptocurrency’s historical past. The all-time excessive of the indicator (that’s, the one time the indicator had been greater) was registered on December 9, 2022.

Apparently, again then, Ethereum had been within the post-FTX crash lows, and because it has turned out, that interval was the bear market backside for the asset. It’s doable that the sudden reignition of curiosity within the coin was what helped it hit the underside and equipment up for the rally that will begin in January 2023.

Throughout the previous few months, the indicator’s worth has remained comparatively low as traders have held low curiosity within the asset. With this newest spike, although, issues have modified in a flash.

Suppose the instance of the December energetic addresses spike is something to go by. In that case, Ethereum might be able to flip itself round off the again of this newest elevation in person exercise.

ETH Value

Ethereum has continued to point out total flat motion through the previous week as ETH continues to be buying and selling round $1,600.

ETH has bounced shortly from its lows | Supply: ETHUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link