[ad_1]

Bitcoin and the broader crypto market have come underneath main promoting stress amid information of the FTX creditor liquidation.

On Monday, September 11, the world’s largest cryptocurrency Bitcoin (BTC) confronted a serious value correction with its value taking a dip underneath $25K. Nonetheless, the BTC value has recovered since and is at present buying and selling at $25,807 ranges.

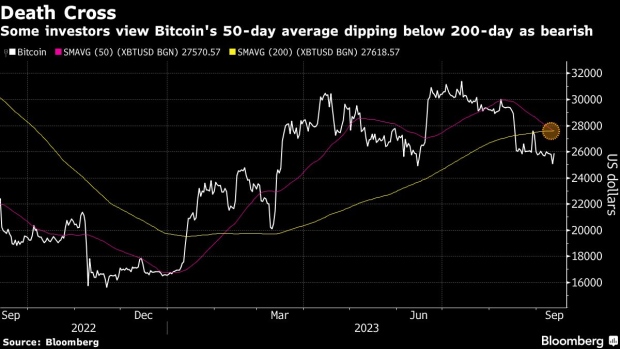

On the technical charts, the BTC value has fashioned a dying cross sample with its 50-day short-term transferring common having breached its 200-day short-term transferring common. This implies robust bearish formations on the technical charts with additional chance of value correction.

-

Picture: Bloomberg

- Then again, the liquidity within the crypto market has been on a gentle decline throughout this steady promoting stress. On the identical time, the on-chain and the off-chain volumes are additionally about to succeed in the historic lows.

FTX Creditor Liquidation

Together with Bitcoin, the altcoins have confronted a extreme value crash with Ethereum falling all the way in which to $1,540 ranges falling underneath essential assist ranges. Equally, Ethereum competitor Solana has been dealing with big promoting stress and has been buying and selling at $18.00.

FTX’s directors have efficiently reclaimed roughly $7 billion value of property, $3.4 billion of that are in cryptocurrency. A courtroom listening to scheduled for Wednesday will consider a proposal to provoke token gross sales as a way to repay collectors, as outlined in current submissions.

An accompanying presentation reveals that FTX possesses roughly $1.2 billion in SOL, the native token of the Solana community, alongside holdings of $560 million in Bitcoin, the biggest cryptocurrency, and $192 million in Ether, the second-ranked cryptocurrency. This has left the market feeling unsure and anxious concerning the impending FTX creditor liquidation.

FTX is within the means of contemplating the appointment of the asset administration division of Galaxy Digital Holdings Ltd., owned by billionaire Michael Novogratz, to help in managing the numerous pool of tokens held by the distressed change. In keeping with a submitting made in August, the weekly restrict for cryptocurrency divestments varies, spanning from $50 million to a possible most of $200 million.

Different cryptocurrencies, sometimes called altcoins, are experiencing a interval of underperformance, with Solana’s SOL main the decline with a drop of over 8%. Different notable altcoins, together with Toncoin’s TON and layer 2 Arbitrum’s ARB, have additionally skilled important declines of an identical magnitude. Moreover, Ripple’s XRP has confronted a 5% loss in worth throughout this era.

Bhushan is a FinTech fanatic and holds a superb aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in direction of the brand new rising Blockchain Expertise and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and typically discover his culinary abilities.

Subscribe to our telegram channel.

Join

[ad_2]

Source link