[ad_1]

In a complete analysis of worldwide market dynamics, Bloomberg Intelligence analyst and Chartered Market Technician (CMT) Jamie Coutts has opined on the shifting sands of monetary asset volatility. With bonds probably falling out of favor and Bitcoin cementing its place as a debasement hedge, conventional portfolio fashions could also be on the verge of a renaissance.

Main Portfolio Shift In the direction of Bitcoin?

Coutts tweeted, “It seems to be like we’re about to see a considerable uptick in volatility throughout all markets, given the place yields, USD, & world M2 are heading. Regardless of what lies forward, there was a giant shift within the volatility profiles of worldwide property vs. Bitcoin over the previous years.”

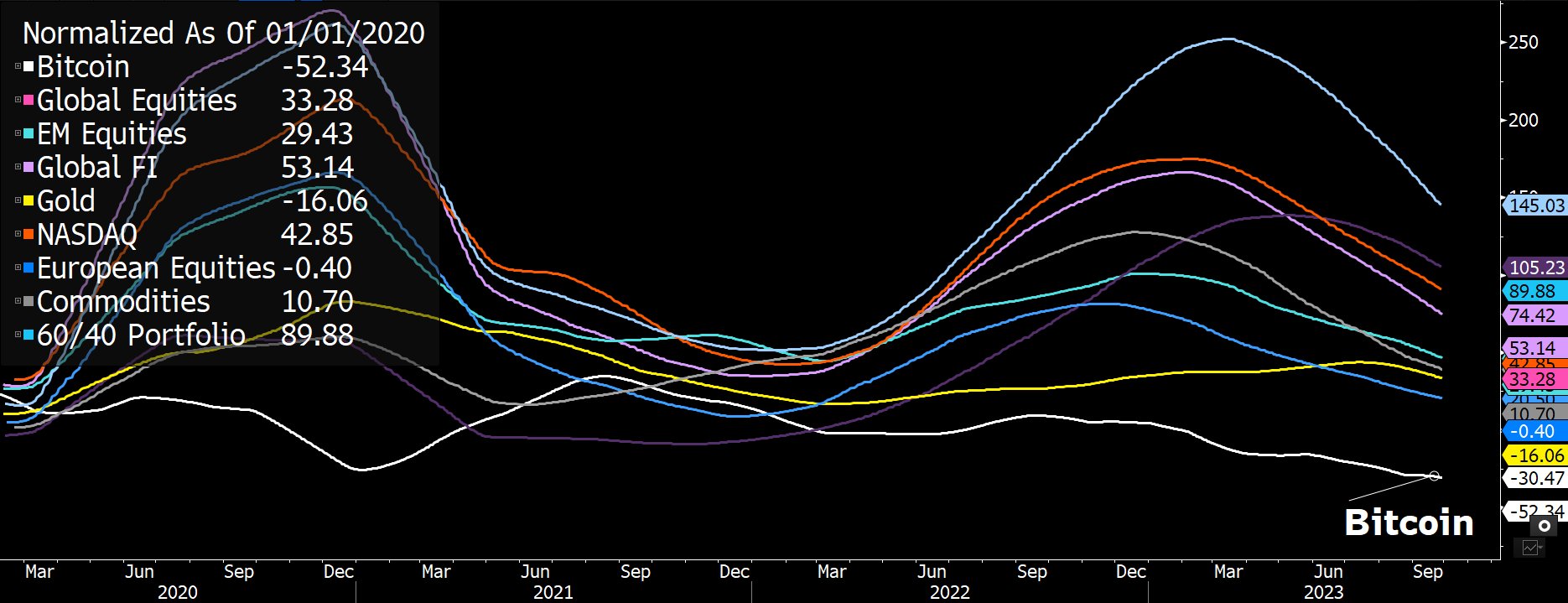

A comparative evaluation by Coutts highlighted that since 2020, the volatility profiles of Bitcoin and Gold have declined, whereas most different property have seen a rise in volatility.

His breakdown signifies that the standard 60/40 portfolio volatility is up by 90%, NASDAQ’s volatility has surged by 53%, and world fairness volatility rose by 33%; in the meantime, solely Bitcoin’s volatility decreased by 52% in addition to Gold’s volatility, which went down by 6%

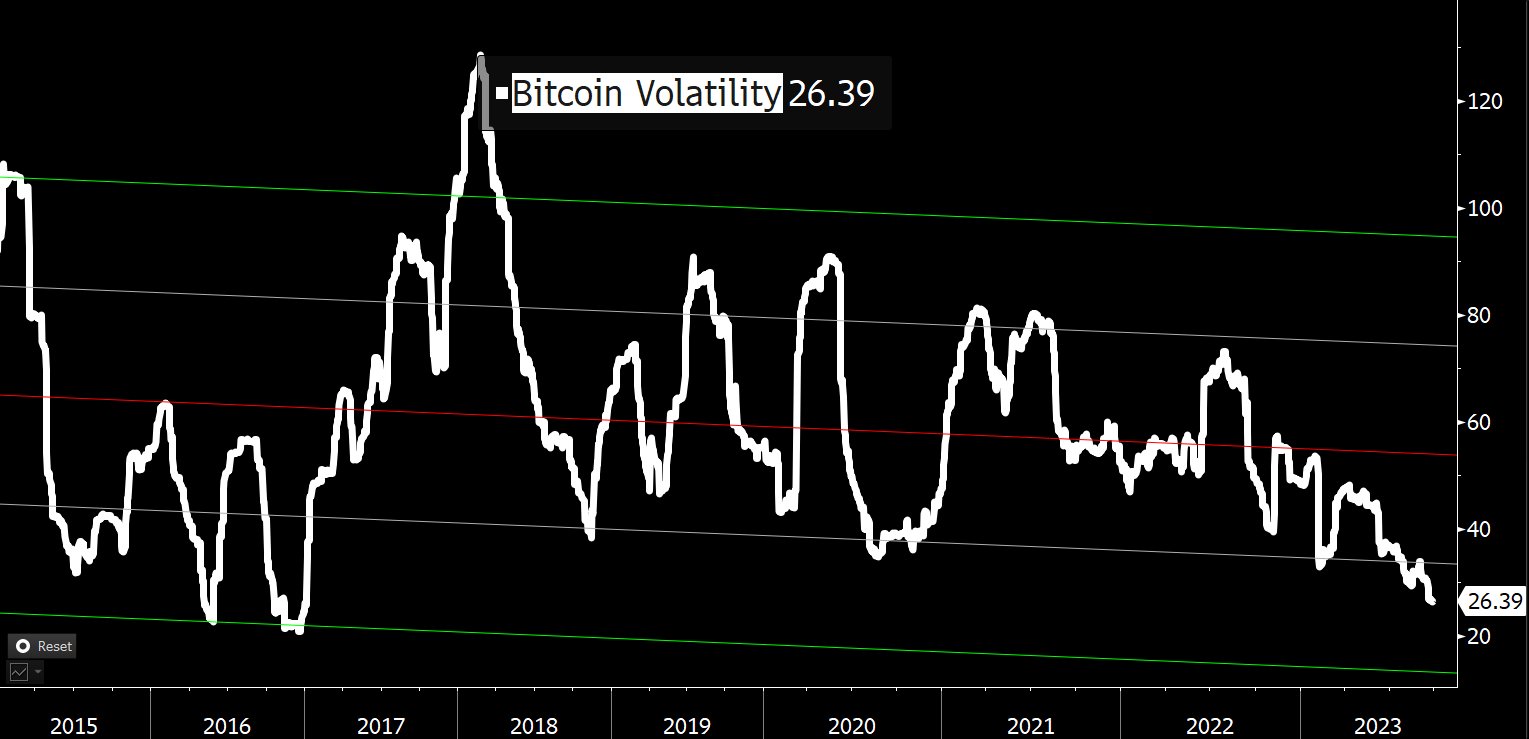

Coutts additional elaborated that following the “hyper-volatile” part of Bitcoin throughout 2011-14, the cryptocurrency’s volatility has been on a downward trajectory. From a peak above 120 in early 2018, this metric presently stands at 26.39.

Nevertheless, Coutts maintains skepticism over Bitcoin’s short-term prospects given the deteriorating macro setting: “Provided that BTC volatility is close to the underside of the vary plus a deteriorating macro setting: US greenback (DXY) is up, 10Y Treasury Yield is up, World M2 cash provide is up. It’s troublesome to see how BTC (& all danger property) can maintain up with this setup.”

BTC Vs. World Asset Lessons

On the intense facet, from an asset allocation perspective, Coutts considers the actual query to be whether or not “Bitcoin can add worth as a danger diversifier & enhance risk-adjusted returns.” Evaluating the risk-adjusted returns utilizing the Sortino ratio over the last bear market, Bitcoin’s efficiency just isn’t the perfect.

Within the 2022 bear market, Bitcoin’s Sortino ratio is -1.78, positioning BTC above world equities, the NASDAQ 100, and the standard 60:40 portfolio. Nevertheless, it trails the S&P 500 (-1.46), European Equities (-1.01), Gold (+0.1), Silver (+0.28), and commodities (+1.25).

Elaborating on the cyclical habits of Bitcoin, Coutts added, “The issue with BTC is the comparatively quick historical past makes inferences troublesome and 1 yr durations are definitely not vital. The perfect we are able to go on is a number of cycles. It’s clear that holding over the total cycle has been a successful technique.”

Evaluating the Sortino ratio over the previous three Bitcoin cycles (2013-2022), Coutts discovered Bitcoin to steer with a rating of two.46, outperforming the NASDAQ 100 (+1.37), S&P 500 (+1.25), and world equities (+1.05).

BTC: High Wager Towards Cash Printing

On this situation, Debasement issues additional improve Bitcoin’s proposition. Coutts emphasised this saying, “And if allocators need to outpace financial debasement, over most timeframes, bonds should not the place to be.” He recognized Bitcoin because the foremost selection for portfolio reallocation in opposition to financial debasement.

Citing the huge distinction between asset returns regarding cash provide development (M2) over the previous 10 years, he highlighted Bitcoin’s dominance with a staggering ratio of +8,598, adopted by NASDAQ (+109), S&P 500 (+25) and world equities (-7.5).

In a concluding assertion, Coutts postulated, “Within the years forward it’s conceivable that allocators start to shift in the direction of higher debasement hedges. BTC is an apparent selection.” Furthermore, he means that Bitcoin may supplant bonds by securing a minimum of 1% of the standard 60/40 portfolio.

At press time, BTC traded at $26,433.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link