[ad_1]

Based mostly on his historic prediction of 2015 and 2019, PlanB stays assured that the Bitcoin value might rally to $500K throughout the mega bull run of 2025.

After a powerful begin to the yr 2024 final week, Bitcoin has been dealing with some promoting strain however has managed to carry above $43,500 ranges. Nevertheless, this hasn’t stopped Bitcoin analysts from making bullish predictions for the crypto. PlanB, the creator of the stock-to-flow mannequin lately made a daring prediction for Bitcoin after the Bitcoin halving. Together with the spot Bitcoin ETF approval, the Bitcoin halving could possibly be one other main catalyst to propel the BTC value to new highs.

PlanB, a outstanding determine within the cryptocurrency area, lately shared reflections on the trajectory of Bitcoin (BTC) and public sentiment through the years. Recalling the yr 2015 when the acquisition of the primary BTC was made at $400, PlanB highlighted that in that point, many dismissed Bitcoin as a dying asset.

Quick ahead to 2019, when BTC reached $4,000, PlanB authored the Inventory-to-Circulate (S2F) article, boldly predicting a future worth of $55,000 for Bitcoin. Regardless of the skepticism confronted at the moment, PlanB’s forecast proved correct as BTC soared to new heights.

Within the present panorama with BTC priced at $40,000, PlanB emphasizes the importance of the Inventory-to-Circulate mannequin, projecting a staggering $532,000 valuation after the 2024 halving occasion. Well-liked crypto analyst Michael van de Poppe acknowledged that the goal doesn’t look unattainable contemplating institutional cash flowing into BTC.

The place’s Bitcoin Value Heading Subsequent?

We’re simply two days away from the approval of the spot Bitcoin and Bitcoin bulls are sustaining a powerful watch. As per a report from Bloomberg, the US Securities and Alternate Fee (SEC) will conduct a vote on the 19b-4 types throughout the subsequent few days. The candidates for the Alternate-Traded Fund (ETF) are more likely to submit Kind S-1 by 8 am on Monday, January 8, 2024.

Earlier analyses by Bloomberg indicated that the probability of the ETF rejection decreased to five%, contemplating current conferences between SEC officers and representatives from companies in search of approval. The report famous, “If the SEC grants each units of required approvals, the ETFs might start buying and selling as early as the following enterprise day.”

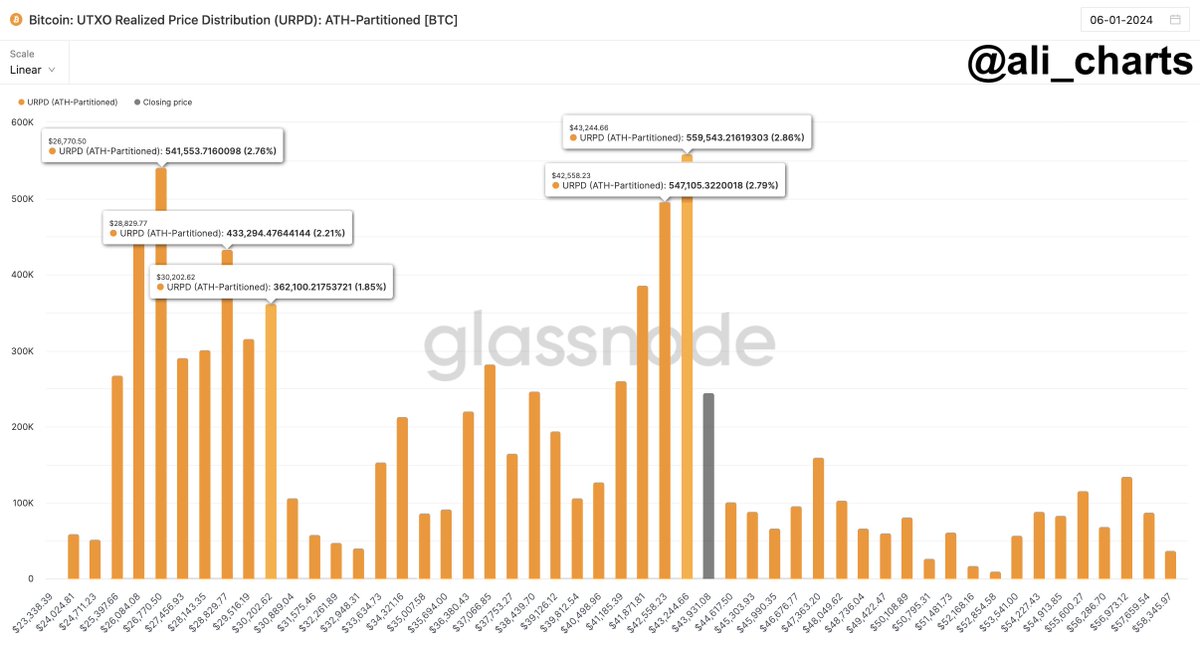

Cryptocurrency analyst Ali Martinez has observed a considerable assist wall within the Bitcoin (BTC) market, with roughly 1.11 million BTC bought within the value vary of $42,560 to $43,245. Notably, the consumers haven’t bought their BTC, establishing a sturdy basis for the digital asset.

Martinez means that if Bitcoin manages to keep up its place above this assist degree, the upward motion stays intact with restricted resistance. Nevertheless, a failure to carry the vary between $42,560 and $43,245 might doubtlessly result in a downward pattern, with the following essential space of curiosity mendacity between $26,770 and $30,220.

-

Picture: Ali charts

- Amidst the escalating ETF pleasure, Milkybull Crypto, a well-regarded analyst within the crypto area, anticipates vital impacts on the value of Bitcoin (BTC). In accordance with their projections, the fervor surrounding ETFs might propel BTC to $80,000 in 2024 and a staggering $200,000 by 2025. Moreover, Milkybull Crypto posits that these developments may also carry optimistic results for Ethereum (ETH) and numerous different altcoins available in the market.

[ad_2]

Source link