[ad_1]

The U.S. Securities and Trade Fee (SEC) has expressed an absence of opposition to suspending the Terraform co-founder Do Kwon’s crypto fraud trial and, as a substitute, is open to ready till he’s extradited.

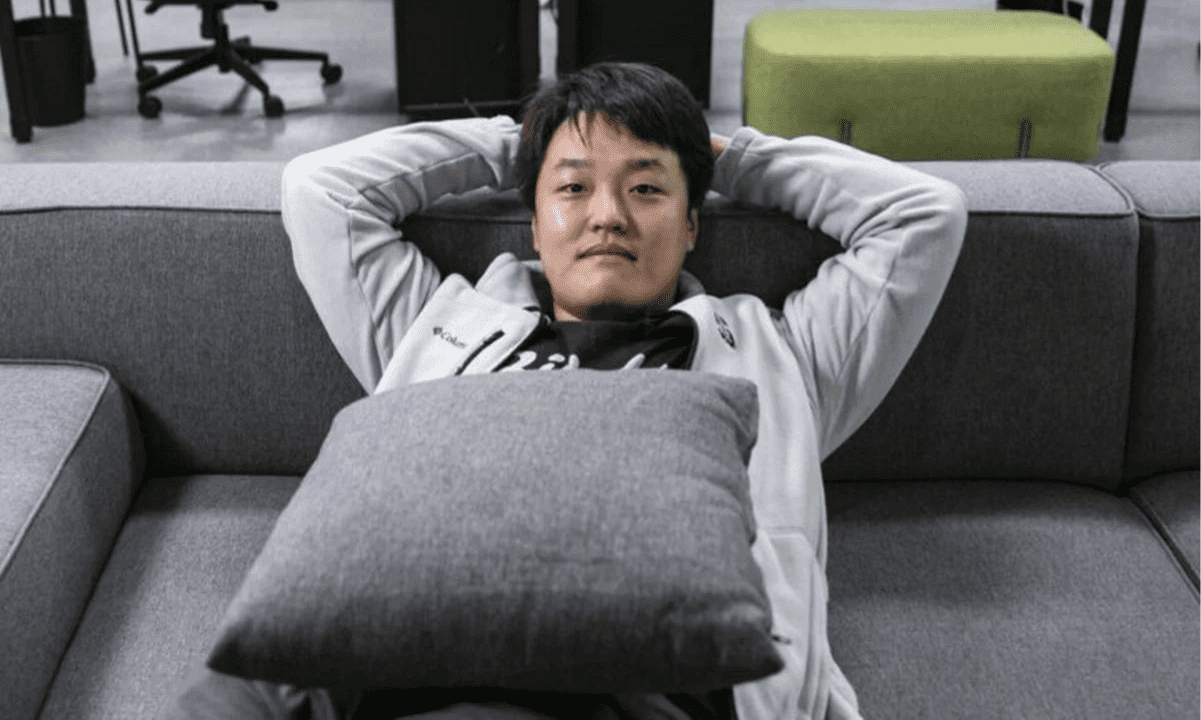

Two courtroom filings had been submitted by federal prosecutors, outlining the case in opposition to Kwon and Terraform Labs in regards to the $40 billion collapse of TerraLuna (LUNC) and TerraUSD (UST) in Might 2022.

SEC Consents to Delay in Terraform Case

The SEC has consented to a “modest adjournment” of the Terraform case till April 15, permitting for ongoing extradition proceedings for Kwon in Montenegro.

In a letter to Choose Jed Rakoff on January 11, Kwon’s authorized staff requested a delay within the January trial till he may take part in his protection in individual. They cited the slower-than-expected progress of the extradition proceedings, initiated after Kwon’s detention in Montenegro.

Whereas the SEC agreed to postpone the trial probably, it opposed separating Kwon’s case from Terraform’s. Each had been named defendants when the company filed fees in February 2023, alleging their involvement in a “multi-billion greenback crypto asset securities fraud” associated to the previously TerraUSD (UST) and LUNA tokens.

The SEC argued that it might unnecessarily require witnesses, together with company whistleblowers and retail buyers with restricted monetary means, to testify twice about similar details in several trials.

Do Kwon’s Troubles Are Far From Over

The previous tech billionaire has reportedly filed one other attraction to overturn a Montenegro Excessive Courtroom ruling that upheld extradition requests from his native South Korea and america, the place he faces fees.

His attorneys argue that the Excessive Courtroom’s choice disregarded a bilateral extradition treaty with the U.S. and the European Conference on Extradition. Regardless of profitable an attraction in opposition to extradition requests in November, the Excessive Courtroom in Podgorica, the place he was arrested, reinstated its ruling in December.

Kwon and Terraform had been accused of deceiving customers and buyers in regards to the stability of UST, an algorithmic stablecoin pegged to the U.S. greenback. The failure of UST to take care of its promised $1 worth resulted in a collapse inside Terra’s ecosystem. This crash had main results, resulting in bankruptcies and marking the start of the crypto winter of 2022.

In a latest ruling, Choose Jed Rakoff decided that Terraform and Kwon violated U.S. legislation by not registering TerraUSD and Luna. Kwon additionally faces associated legal fees within the U.S. and an extradition request from South Korea.

Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).

[ad_2]

Source link