[ad_1]

Matt Dines, the Chief Funding Officer at Construct Asset Administration, has identified a classical ‘Cup and Deal with’ sample within the Bitcoin (BTC) value chart, which he believes might sign an impending rally to $75,000. This technical formation is commonly thought of a powerful bullish sign and is carefully watched by market analysts and merchants.

Bitcoin Worth Validates Cup And Deal with Sample

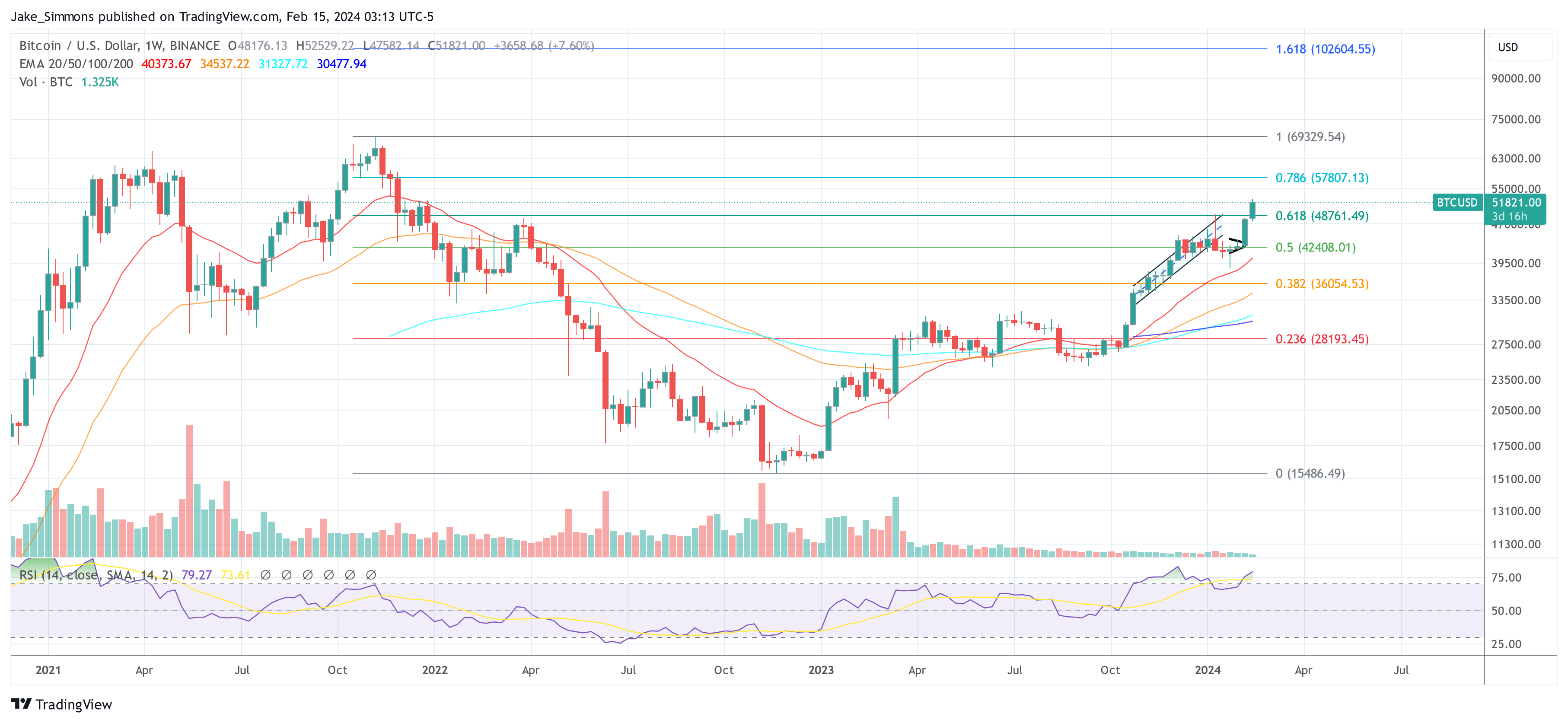

The ‘Cup’ a part of the sample, resembling a bowl or rounding backside, started forming in March 2022 when the value plunged under $48,000 and entered one of many longest Bitcoin bear markets. The sample reached its lowest level at roughly $17,600, signifying a powerful help stage for Bitcoin.

The left facet of the sample reveals a rounded backside resembling a “cup.” It types when the value initially declines, then consolidates, and at last begins to rise once more. Since hitting this backside, Bitcoin’s value has made a gentle restoration, mimicking the fitting facet of the cup, indicating a bullish reversal of the earlier downtrend.

“The saucer or the ‘cup’ signifies a consolidation interval, a pause within the downward development, earlier than the value begins to rise again as much as the take a look at resistance ranges,” Dines defined. The restoration to the preliminary resistance line completes the ‘cup’ portion of the sample. The Bitcoin value accomplished this step in early January this yr.

The next ‘Deal with’ is represented by a reasonable retracement following the restoration, which types a small dip or pullback from the height. This deal with is recognized by a slight downward trajectory and is taken into account the ultimate consolidation earlier than a breakout.

BTC’s value drop to $38,600 on the finish of January marked the underside of the pullback. With the breakout above $48,000, the Bitcoin value validated the cup and deal with sample.

Setting A BTC Worth Goal

Dines additionally addressed the position of the vertical projection from the underside of the deal with, clarifying its foundation: “It’s completely arbitrary and within the eye of the beholder. However longer reply, merchants are eyeing charts for formations.”

The vertical goal line, or the ‘stick’ on the fitting, is projected from the underside of the deal with. The peak of the cup — from the low at round $17,600 to the resistance line at $48,000— units the stage for the value goal.

Dines added, “A number of merchants will use the peak of the bowl (from the low of the bowl to the highest on the resistance line) to set their value goal. Simply add that peak to the underside of the deal with … that’s an honest guesstimate for the place we’d see the longs who entered on the breakthrough to set their value goal.”

Primarily based on the chart, the peak from the cup’s low to the resistance stage is roughly $31,973, marking the rise in Bitcoin’s value from its lowest level to the present stage when the chart was produced. Projecting this peak from the deal with’s formation suggests a goal within the neighborhood of $75,000.

Dines additional provides that the collective conduct of market members will certainly information the value motion: ” A number of these longs would set a retrace at ~$75k as they shut out their W. If sufficient members put this commerce on it’ll set the dominant value motion … they win out and it’ll flip the chart into actuality. I do know it sounds ridiculous, however in the true world that is how markets really uncover value.”

At press time, BTC traded at $51,821.

Featured picture created with DALLE, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal threat.

[ad_2]

Source link