[ad_1]

- Latest Bitcoin surge results in $285 million in liquidations, affecting brief orders.

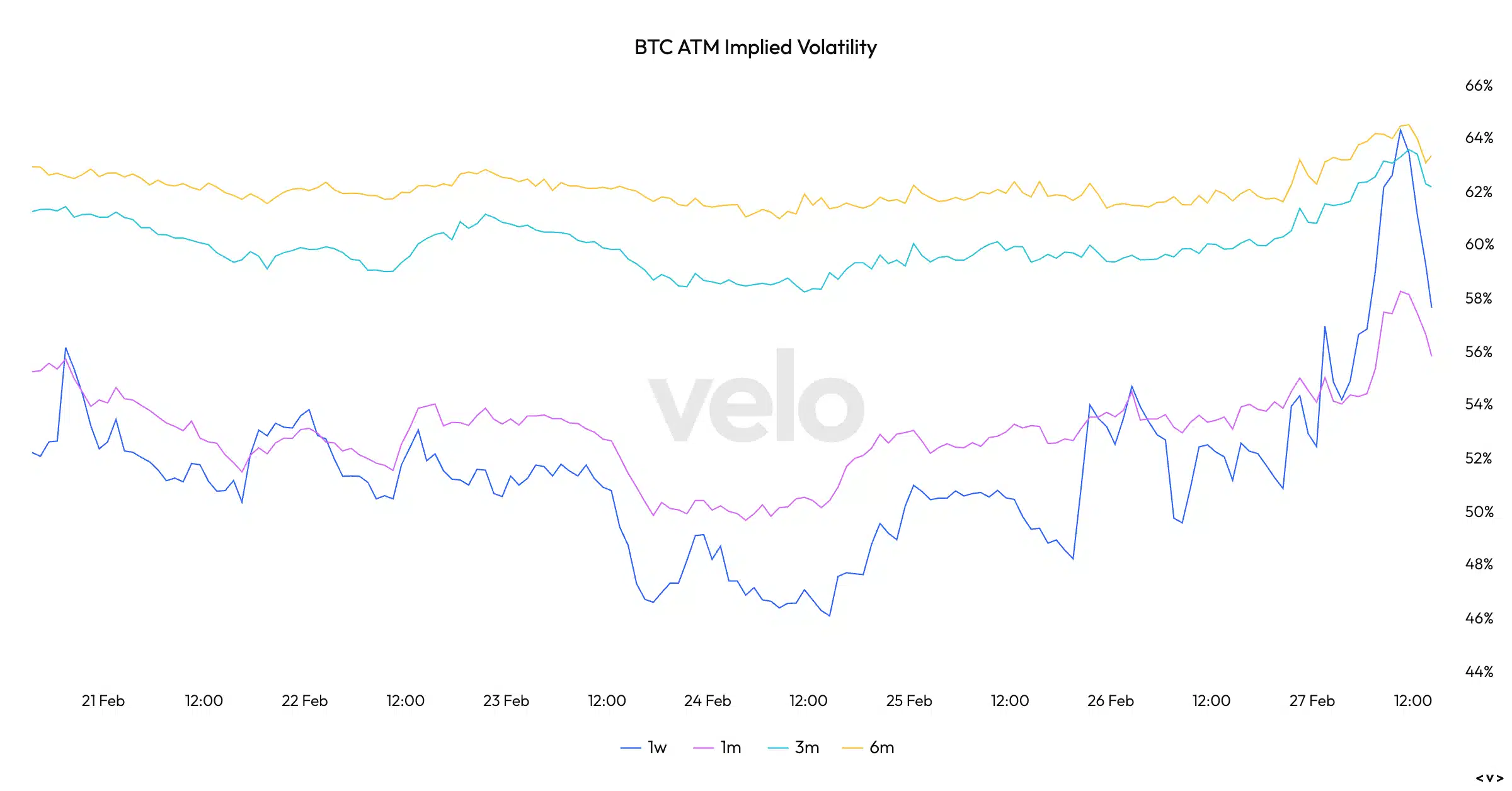

- Put-to-call ratio declines and implied volatility declines.

Bitcoin [BTC] not too long ago broke free from its stagnant state across the $51,000 vary, experiencing a major surge that left each buyers and bears grappling with the aftermath.

Liquidations on the rise

In response to AMBCrypto’s evaluation of Coinglass’ information, up to now 24 hours, the surge prompted $285 million in liquidations, with brief orders taking a considerable hit at $211 million.

A staggering complete of 74,800 people confronted liquidation, with the most important single order, price $4.81 million, occurring on Binance for BTCUSDT.

On one hand, the liquidation of brief orders might contribute to upward strain on Bitcoin’s value, doubtlessly making a extra favorable atmosphere for lengthy positions.

Conversely, the sheer quantity of liquidations displays a market shakeup, indicating potential volatility and uncertainty within the brief time period.

Taking a look at dealer conduct

Moreover, Bitcoin’s put-to-call ratio witnessed a decline throughout this era. This shift implies a lower in bearish sentiment, because the ratio signifies the proportion of bearish (put) choices to bullish (name) choices.

A decrease put-to-call ratio suggests a extra optimistic market sentiment, doubtlessly contributing to the optimistic momentum of Bitcoin’s value.

Moreover, Bitcoin’s Implied Volatility, a measure of market expectations for future value fluctuations, additionally skilled a lower. Whereas a decline in volatility can sign a extra secure market, it might additionally point out decreased speculative curiosity.

What are holders as much as?

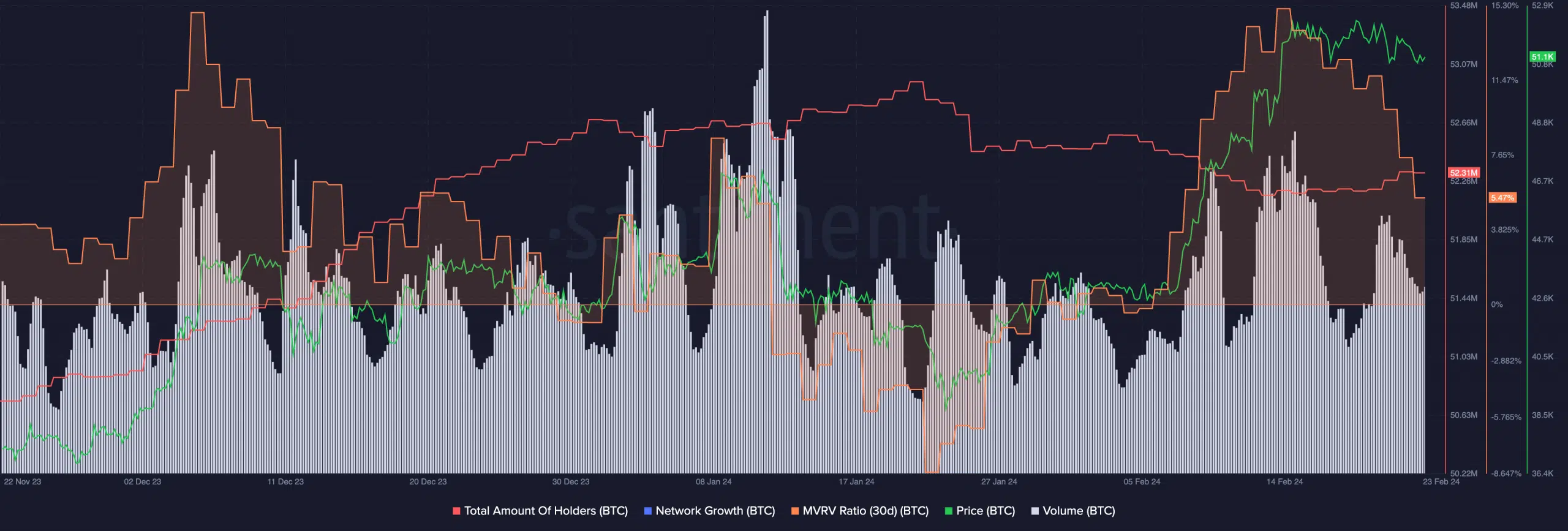

Analyzing MVRV ratios supplied extra insights into the promoting strain on BTC holders. The decline in MVRV ratio suggests profit-taking amongst holders regardless of the surge in value.

Revenue-taking signifies confidence amongst holders. Nonetheless, it may also introduce promoting strain, doubtlessly resulting in short-term corrections.

Surprisingly, regardless of the surge in BTC’s value, the overall variety of holders didn’t surge to earlier ranges. This commentary means that the current uptick in value could also be attributed to older holders accumulating, relatively than an inflow of latest contributors.

At press time, BTC was buying and selling at $56,308.79 and its value had grown by 9.66% within the final 24 hours.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The amount at which it was buying and selling at had additionally grown by 235.73% throughout the identical interval and had reached a complete of $48,941,296,302.

If the optimism round BTC continues, its value might goal $60,000 quickly.

[ad_2]

Source link