[ad_1]

- The value of the token and TVL elevated after the group agreed to the proposal.

- Customers would be capable of entry the Nakamoto Testnet by the twenty fifth of March.

After a very long time of ready, the Stacks [STX] group has agreed to the deployment of the Nakamoto Improve. In accordance with the voting outcomes, no STX holders voted towards the proposal.

Nonetheless, Stacks additionally allowed non-STX holders to take part through which 99.98% clicked ‘sure’ to the approval.

Apparently, the worth of STX jumped moments after the end result went public. At press time, AMCrypto noticed that STX’s worth had elevated by 17.34% within the final 24 hours. This efficiency was higher than Bitcoin’s [BTC], regardless of being a Layer-2 on the community.

Does this imply no exploit?

Stacks proposed the Nakamoto Improve as a approach to deliver enchancment to the community. One of many potential enhancements contains quicker transactions in Bitcoin block time. One other one is to lower the Most Extractable Worth (MEV) linked with Bitcoin transactions.

The MEV is the utmost potential revenue {that a} miner or validator can derive by manipulating transactions. Subsequently, the improve, when applied, may scale back these occurrences. Additionally, validators and miner can get their customary rewards with out points.

Nonetheless, STX worth was not the one metric affected by the event. In accordance with AMBCrypto’s evaluation, progress additionally unfold to its Complete Worth Locked (TVL).

At press time, DeFiLlama information showed that the TVL had climbed to an all-time excessive of $156.52 million. The extra the TVL will increase, the safer and helpful the community is perceived to be.

Metrics concur with the course

The rise within the metric additionally meant that market contributors belief that Stacks would produce extra yields. Coincidentally, Stacks’ co-creator Muneeb Ali posted on X concerning the potential impact of the improve on the ecosystem.

Ali, in his submit, defined that Stacks customers can earn extra BTC yield. He additionally talked about the expansion in community utilization would create a “optimistic financial loop.”

The event has additionally brought about dialogue on a number of social platforms. Primarily based on our perusal, we discovered that contributors have began evaluating to Ethereum [ETH] and Solana [SOL].

This was as a result of a few of the transaction velocity, safety, and decentralization provided by Nakamoto may make Stacks’ adoption climb.

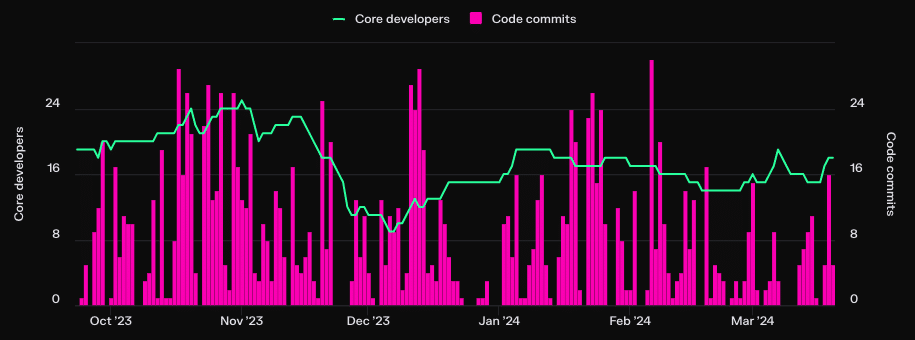

Within the meantime, Token Terminal revealed that core builders and code commits on Stacks have been growing.

Is your portfolio inexperienced? Test the Stacks Profit Calculator

The surge in these metrics implies that builders are bullish on the L2. It additionally means that the venture may ship out new options quickly.

In addition to that, Stacks gave a timeline for the completion of the improve. In accordance with the venture, the Testnet will probably be reside on the twenty fifth of March. It additionally talked about that it might activate the Mainnet between the fifteenth and twenty ninth of Could.

[ad_2]

Source link