[ad_1]

Information from Glassnode reveals that Bitcoin long-term holders have nonetheless been promoting their cash at a loss in latest days.

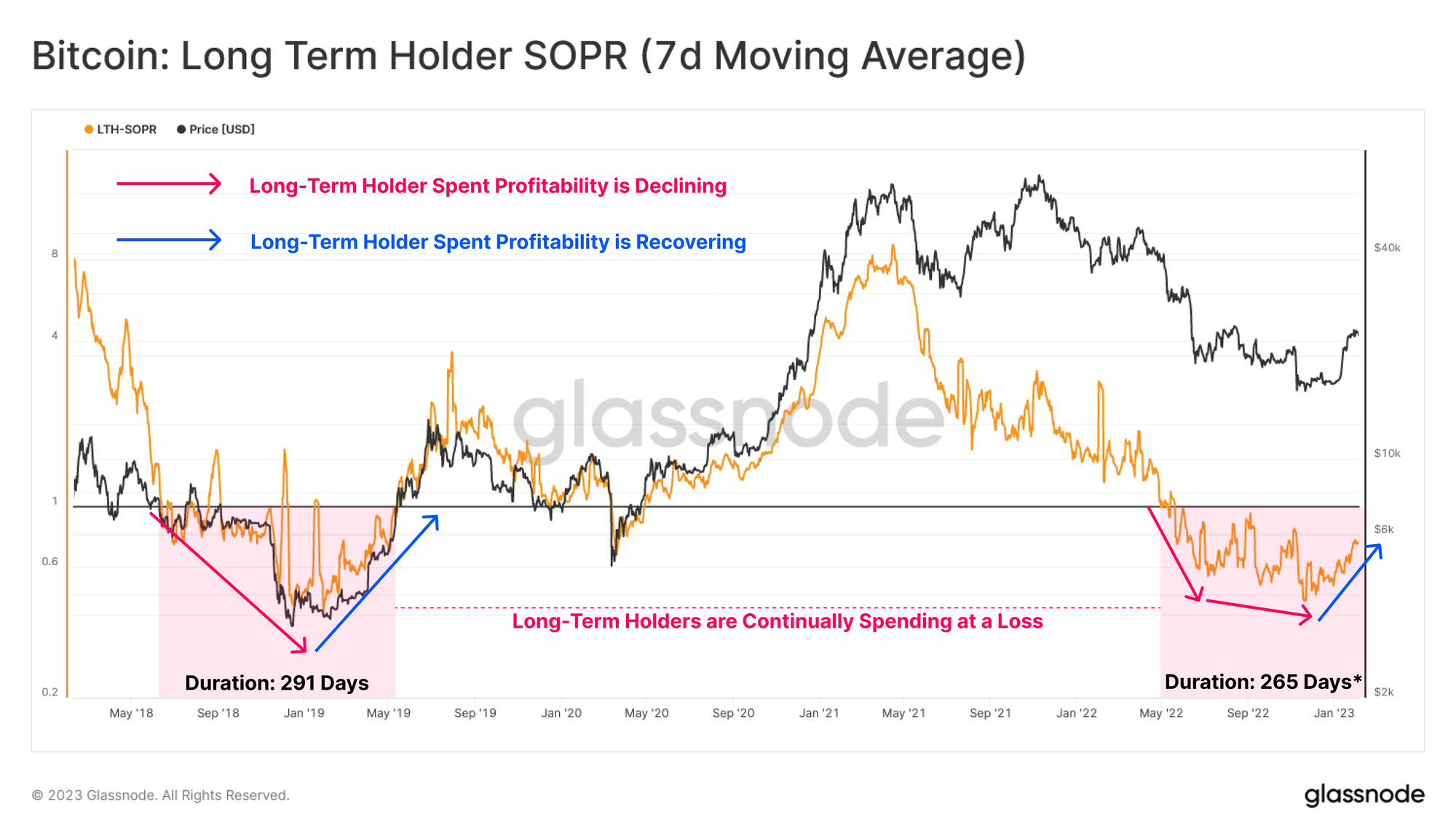

Bitcoin Lengthy-Time period Holder SOPR Continues To Be At Values Beneath 1

In keeping with the most recent weekly report from Glassnode, bitcoin traders have been realizing losses for 9 months now. The related indicator right here is the “Spent Output Profit Ratio” (SOPR), which tells us whether or not the common holder within the Bitcoin market is promoting their cash at a revenue or loss proper now.

When the worth of this metric is larger than 1, it means the traders as a complete are harvesting some income by way of their promoting at the moment. Alternatively, values beneath the brink indicate the general market has been taking part in loss realization.

Naturally, the SOPR being precisely equal to 1 suggests the traders have been simply breaking even on their funding, as the entire quantity of income realized are equal to losses realized at this worth.

One of many two primary segments within the Bitcoin market is made up of the “long-term holders” (LTHs), who’re traders which have been holding onto their cash since greater than 155 days in the past, with out having moved or bought them. The counterpart cohort is the “short-term holder” (STH) group.

Now, here’s a chart that reveals the pattern within the Bitcoin SOPR particularly for these LTHs over the previous couple of years:

The worth of the metric appears to have been climbing in latest days | Supply: Glassnode's The Week Onchain - Week 6, 2023

As displayed within the above graph, the Bitcoin LTH SOPR had dropped beneath the 1 mark following the LUNA collapse final 12 months and has stayed there since then. Because of this these traders have been promoting at losses all through the bear market.

The chart has additionally highlighted the pattern that the metric adopted throughout the 2018-2019 bear market. It appears to be like just like the LTH SOPR additionally dropped beneath the break-even mark again then as effectively.

Typically, the traders who purchase throughout bull markets and proceed to carry till a bear market units in (thus probably maturing into changing into LTHs) enter into massive losses as bull runs naturally supply comparatively excessive acquisition costs.

A few of these holders inevitably capitulate as costs go decrease throughout bearish durations and their losses grow to be deeper. It’s due to this motive that the LTH SOPR sinks beneath 1 in such occasions.

Within the 2018-2019 bear market, the Bitcoin LTHs continued to promote at losses for 291 days, earlier than a rally just like now pulled them again into income. To this point within the present cycle, the indicator has spent 265 days on this zone, which isn’t too removed from the time spent there within the final cycle.

From the chart, it’s seen that the LTH SOPR appears to have been catching some uptrend not too long ago (though it’s nonetheless clearly beneath 1 proper now), which means that the most recent rally could also be slowly serving to them recuperate.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $22,900, up 1% within the final week.

BTC has declined in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link